Use of Knowledge Qualifiers for Representations and Warranties

What's Market

SEPTEMBER 26, 2022

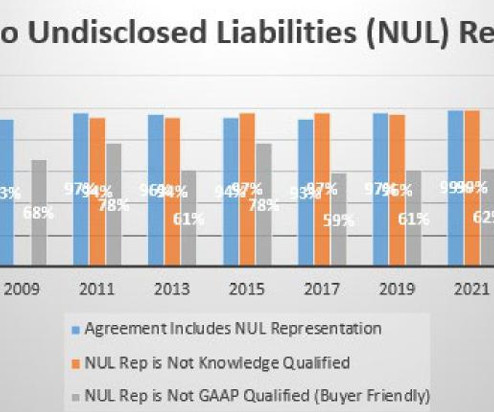

Specifically, including constructive knowledge has steadily increased over the nine ABA studies— from 52% of reviewed deals in the 2005 ABA study to 81% in the most recent 2021 study (down slightly from 86% in the 2019 study). The parties must still negotiate the scope of the seller's knowledge.

Let's personalize your content