Bank of Japan Raises Interest Rates for Second Time Since 2007

The New York Times: Banking

JULY 30, 2024

The closely watched move by the Bank of Japan could bolster the country’s beleaguered currency.

The New York Times: Banking

JULY 30, 2024

The closely watched move by the Bank of Japan could bolster the country’s beleaguered currency.

How2Exit

MARCH 5, 2023

Ali Taraftar left Canada in 2007 to go to the United States and met a couple of investment bankers who put together a firm to do debt restructuring and mortgage modifications. Concept 3: Debt Restructuring Can Save Businesses The current economic climate has put many businesses in a precarious situation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Peak Frameworks

MAY 2, 2024

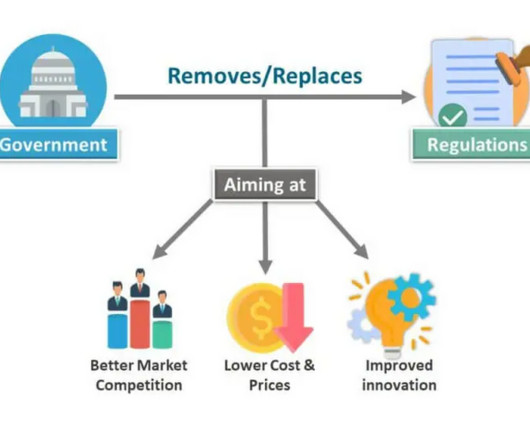

However, it's also spotlighted the need for a balanced approach to regulation, as evidenced by the financial crisis of 2007-2008 , which underscored the potential dangers of overly lax regulatory frameworks. Innovation in financial services: Freed from stringent regulations, institutions can develop new products and services.

Focus Investment Banking

JUNE 13, 2023

A big part of oncology is buying and billing chemotherapy, and we're able to improve their economics there substantially with national buying power,” Patton told OBR. Founded in 2007, publicly-traded TOI provides care to about 1.8 In addition to OneOncology, other major oncology platforms include the following: Genesis Care.

Wall Street Mojo

JANUARY 15, 2024

However, if economic winds shift unfavorably, leading to mortgage defaults, Michael could face losses. The credit default swap (CDS) market, a key component in CDOs, experienced a staggering fourfold expansion in just two years, reaching its peak at US $58 trillion in 2007, as reported by the Bank for International Settlements.

Sica Fletcher

JUNE 20, 2024

As the charts below indicate, what used to make up approximately 10% of the total buyer space now takes up a whopping 75% of the market: Private Equity in Insurance, 2007 vs. 2024 The growth of private equity in the insurance M&A market can be attributed to equal parts reaction to it and reflection of it. Increased Buyer Demand.

What's Market

AUGUST 15, 2022

Market Trends: What You Need to Know As shown in the American Bar Association's Private Target Mergers and Acquisitions Deal Point Studies: The use of separate escrows for purchase price adjustments has been increasing on a fairly steady basis since 2007 (with a slight dip in 2021 from a 2019 high).

Let's personalize your content