Japan Raises Interest Rates to Highest Level Since 2008

The New York Times: Banking

JANUARY 23, 2025

After a long period of stagnation, the return of inflation and wage growth is giving the Bank of Japan room to raise interest rates.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

JANUARY 23, 2025

After a long period of stagnation, the return of inflation and wage growth is giving the Bank of Japan room to raise interest rates.

Peak Frameworks

SEPTEMBER 12, 2023

Economics is a vast discipline, but at its core, economics examines how entities manage their scarce resources. Economics not only shapes how we view the world, but also guides how businesses, governments, and individuals allocate resources. Adam Smith's Perspective on Economics Who was Adam Smith?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Peak Frameworks

JUNE 21, 2023

It is a valuable tool, providing insight into how changes in external factors, like price or income, can influence economic behaviors and outcomes. A practical example can be observed in the aftermath of the 2008 financial crisis. For instance, during periods of economic prosperity, income elasticity for luxury cars tends to be high.

The Guardian: Mergers & Acquisitions

MARCH 19, 2023

Banks race to finish takeover to calm fears of new global financial crisis Millions paid in bonuses to UK SVB staff days after £1 rescue Bank runs, bailouts, rescues: are the ghosts of 2008 rising again?

The Harvard Law School Forum

MAY 2, 2023

Persistently high inflation, coupled with the fastest Fed tightening cycle seen since 1988, contributed to making 2022 the worst performing year for the S&P 500 Index since 2008, thrashing growth and technology stocks in particular. [1] 1] Geopolitical concerns added to poor investor sentiment approaching the new year. [2]

Peak Frameworks

JULY 19, 2023

Monetary policy refers to the actions undertaken by a nation's central bank to control the money supply and achieve sustainable economic growth. Its importance lies in its profound impact on economic factors like inflation, employment , and economic stability. Conversely, high-interest rates tend to dampen these activities.

Peak Frameworks

JUNE 5, 2023

It forms the core of economic forecasting and is central to all aspects of financial decision-making. This is a period of economic growth, characterized by increased production, rising employment, and heightened consumer confidence. This is the point where economic activity has reached its maximum output.

Peak Frameworks

SEPTEMBER 12, 2023

The Solow Growth Model is an economic framework that attempts to explain long-term economic growth. The model, named after Nobel laureate Robert Solow, is indispensable for understanding investment decisions and the dynamics of economic growth. Take, for instance, the aftermath of the 2008 financial crisis.

How2Exit

APRIL 8, 2024

Located in Taipei City, Taiwan since 2008, Wells started his journey as an English teacher before venturing into the digital business space. His diversified business portfolio includes marketing agencies, WordPress plugins, online courses, e-commerce businesses, and online content.

Wall Street Mojo

JANUARY 17, 2024

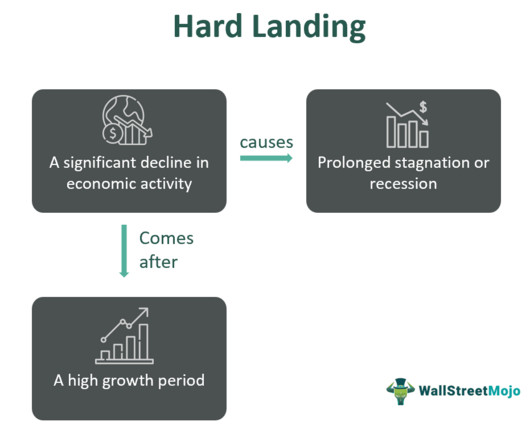

Hard Landing Meaning Hard landing refers to a significant economic downturn or slowdown following a period of fast or rapid growth. Nations must prevent it to avoid a significant drop in economic growth. Moreover, it may lead to prolonged economic stagnation and even recession.

Peak Frameworks

AUGUST 24, 2023

Gross Domestic Product (GDP) , often heard in financial news and economic discussions, is a crucial barometer of a nation's economic health. It serves as a comprehensive scorecard of a nation's economic health. It's estimated quarterly and annually by the Bureau of Economic Analysis (BEA) in the United States.

Peak Frameworks

OCTOBER 17, 2023

Headwinds in finance are conditions or events that can impede economic growth or reduce the profitability of an investment. For instance, an economic downturn can lead to job losses, which in turn can result in decreased consumer spending, which then affects retail, real estate, and other sectors. How do Headwinds Work?

Peak Frameworks

JULY 20, 2023

A stock market crash is typically triggered by a combination of economic factors and investor psychology. Economic Factors Influencing Market Downturns Macroeconomic indicators, such as GDP, inflation, and interest rates , play a significant role in shaping market conditions.

Peak Frameworks

SEPTEMBER 12, 2023

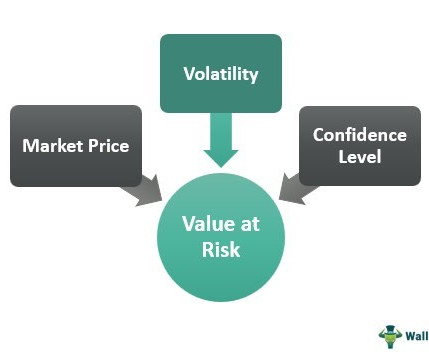

Example: During the 2008 Financial Crisis, many financial models based on parametric VaR underpredicted potential losses, causing significant challenges. Monte Carlo Simulation: Generates a vast number of potential economic scenarios using random value generation.

Peak Frameworks

SEPTEMBER 10, 2023

A free market economy is an economic system where decisions regarding investment, production, and distribution are guided by the price signals created by the forces of supply and demand. However, cases like the 2008 financial crisis remind us of the necessary balance between regulation and freedom.

Peak Frameworks

JANUARY 15, 2024

Laurier is well known for its business, economics, social work, and data science programs. Laurier is home to the Lazaridis School of Business and Economics , a highly-ranked Canadian business school with program offerings for undergraduate and graduate students. We have created a U.S.

How2Exit

OCTOBER 2, 2023

Corey experienced this firsthand during the economic downturn of 2008 and the recent challenges faced by his business. While the current economic climate presents challenges, Corey remains confident in the resilience of his business and its ability to bounce back.

Peak Frameworks

SEPTEMBER 18, 2023

The theory behind a Giffen Good contradicts standard economic theory of demand. Implications in Modern Economics Understanding Giffen Goods is essential for today's finance professionals, especially in unpredictable economic climates. They serve as an exception, a wrinkle in the fabric of standard economic theory.

Peak Frameworks

SEPTEMBER 28, 2023

Claremont is also home to the Robert Day School of Economics and Finance, which offers educational programs for graduate students. Our investment banking target school list is a complete rank of 60 schools and analyzed >60k LinkedIn profiles of professionals who worked in investment banking between 2008 and 2023.

Peak Frameworks

AUGUST 29, 2023

UChicago has a world-famous economics program and is often regarded as a thought leader in the space, with Milton Friedman and George Stigler as notable alum. Our investment banking target school list is a complete rank of 60 schools and analyzed >60k LinkedIn profiles of professionals who worked in investment banking between 2008 and 2023.

Peak Frameworks

SEPTEMBER 19, 2023

For instance, someone with a deep understanding of equity research who is also proficient in data analytics and global economic trends embodies the T-shape model. No longer can an investment banker function in isolation without understanding global economic trends, technological advancements, or geopolitical shifts.

Peak Frameworks

OCTOBER 3, 2023

Finance hopefuls often take other majors such as economics, statistics, or engineering. Our investment banking target school list is a complete rank of 60 schools and analyzed >60k LinkedIn profiles of professionals who worked in investment banking between 2008 and 2023. We filtered the data to examine U.S.

Peak Frameworks

AUGUST 29, 2023

Cornell is home to 3 business schools: the Dyson School of Applied Economics and Management, the Nolan School of Hotel Administration, and the Johnson Graduate School of Management. Cornell ranks #5 by total hires, which is a testament to its dedicated student body and presence across the top investment banks.

Peak Frameworks

AUGUST 29, 2023

Yale's investment banking hopefuls may study economics, statistics, or liberal arts in lieu of this. Our investment banking target school list is a complete rank of 60 schools and analyzed >60k LinkedIn profiles of professionals who worked in investment banking between 2008 and 2023. Yale is one of the most storied schools in the U.S.,

Peak Frameworks

AUGUST 10, 2023

Instead, undergraduates often pursue investment banking and finance while obtaining degrees in economics, engineering, and other fields. Our investment banking target school list is a complete rank of 60 schools and analyzed >60k LinkedIn profiles of professionals who worked in investment banking between 2008 and 2023.

Peak Frameworks

SEPTEMBER 18, 2023

During this time, world leaders recognized the need for a new monetary order to ensure stability and prevent future economic crises. This trust is what makes modern crises like the fall of Lehman Brothers in 2008 so globally impactful, as they threatened the stability of a currency now integral to global trade.

OfficeHours

AUGUST 25, 2023

The growth of private credit can be traced back to the Great Financial Crisis of 2008-2009. Economics is generated by the fees, principal, and interest payments made by the borrower rather than the commitment fees earned by the banks.

Peak Frameworks

SEPTEMBER 19, 2023

For instance, during the 2008 Financial Crisis, many investors fled from riskier money market instruments to the safety of T-Bills, driving their yields almost to zero. Economic Data Various economic indicators, such as GDP growth , unemployment rates, and manufacturing output, can influence T-Bill prices. Treasury yield curve.

Peak Frameworks

OCTOBER 4, 2023

Amherst College does not have a business school, so finance hopefuls often pursuing degrees in subjects such as economics or statistics. Our investment banking target school list is a complete rank of 60 schools and analyzed >60k LinkedIn profiles of professionals who worked in investment banking between 2008 and 2023.

Peak Frameworks

OCTOBER 19, 2023

For instance, if we consider the European Central Bank's policy decisions after the 2008 financial crisis, one can see the practical application of the Fisher Equation. By leveraging the Fisher Equation, the Fed ensured that real interest rates promoted economic growth without letting inflation run too hot.

Peak Frameworks

SEPTEMBER 19, 2023

Example: In the aftermath of the 2008 financial crisis, many homeowners in the U.S. Lenders look at how broader economic conditions might affect the borrower's capacity to repay. Example: The COVID-19 pandemic brought unforeseen economic challenges. A lower ratio is often seen as a sign of strong capacity.

Peak Frameworks

AUGUST 16, 2023

Business students at Brown often choose a major in economics, statistics or engineering. Our investment banking target school list is a complete rank of 60 schools and analyzed >60k LinkedIn profiles of professionals who worked in investment banking between 2008 and 2023. We filtered the data to examine U.S.

Peak Frameworks

OCTOBER 30, 2023

The Income Elasticity of Demand helps explain why there is a surge in luxury car sales during an economic boom and why budget-friendly stores attract consumers during recessions. Europeans, for example, continue to consume roughly the same amount of staple foods irrespective of mild economic fluctuations. cities post-2010?

Peak Frameworks

OCTOBER 30, 2023

Following the 2008 financial crisis, regulations have intensified , pushing banks to allocate more resources to ensure compliance. Dodd-Frank Wall Street Reform and Consumer Protection Act: Introduced after the 2008 crisis, this U.S. The subprime mortgage crisis that led to the 2008 financial crash is a prime example.

The M&A Lawyer

SEPTEMBER 23, 2015

29 2008) , and. The court noted that, as of the date of the opinion (2008), Delaware courts had never found a material adverse effect to have occurred in the context of a merger agreement. However, three Delaware cases stand out as particularly important. They are: IBP, Inc. Tyson Foods, Inc. , 2d 14 (Del. Huntsman Corp. , 19, 2013).

Peak Frameworks

SEPTEMBER 12, 2023

This inefficiency can be visualized in terms of deadweight loss , which represents the lost economic value due to market imperfections. Example: Mispricing of assets during the 2008 financial crisis , where the true risks associated with mortgage-backed securities were not apparent, led to misguided investments.

Peak Frameworks

AUGUST 29, 2023

Harvard does not offer a strict business degree, so Harvard's investment banking hopefuls often major in a field such as economics, statistics, or the liberal arts. We observe that many investment bankers and private equity professionals plan their careers in order to go to HBS or GSB. We filtered the data to examine U.S.

Peak Frameworks

MAY 23, 2023

Economic, political, and social factors can have significant impacts on the process. For instance, the 2008 financial crisis prompted companies worldwide to rethink their strategic plans, with a focus on risk management and liquidity.

Peak Frameworks

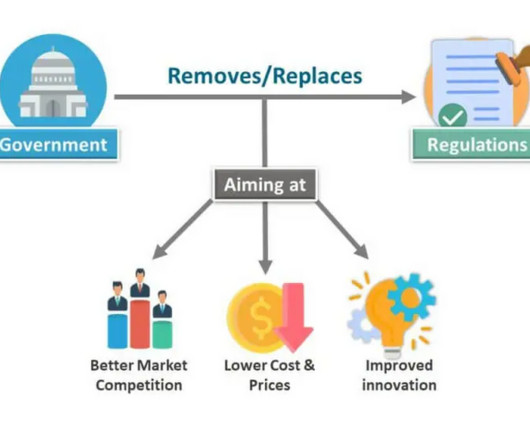

MAY 2, 2024

However, it's also spotlighted the need for a balanced approach to regulation, as evidenced by the financial crisis of 2007-2008 , which underscored the potential dangers of overly lax regulatory frameworks.

Peak Frameworks

JULY 19, 2023

The gig economy is an economic phenomenon characterized by temporary and flexible jobs. Economic trends have also played a role. The aftermath of the 2008 financial crisis left many people unemployed or underemployed, leading to the search for alternative income sources. a driver or deliveryperson for Doordash).

Sica Fletcher

JULY 1, 2020

No one really knows how the pandemic will play out from a medical, economic, political, and societal perspective. We are now in a global recession with record unemployment and numerous businesses shut down or dramatically altered. We face a future of uncertainty. We will try to decipher the answer to this question in this article.

Wizenius

JUNE 28, 2023

Macroeconomic Factors: The global economic landscape can significantly impact growth rates. For instance: - During the global financial crisis of 2008, several industries experienced a substantial downturn due to reduced consumer spending and tightened credit conditions.

Peak Frameworks

JUNE 21, 2023

The 2008 financial crisis is a stark example. It involves companies making voluntary commitments to contribute to social, environmental, or economic well-being. The Importance of Business Ethics in the Finance Sector Unethical practices in the finance sector can lead to disastrous outcomes, severely impacting economies and livelihoods.

Peak Frameworks

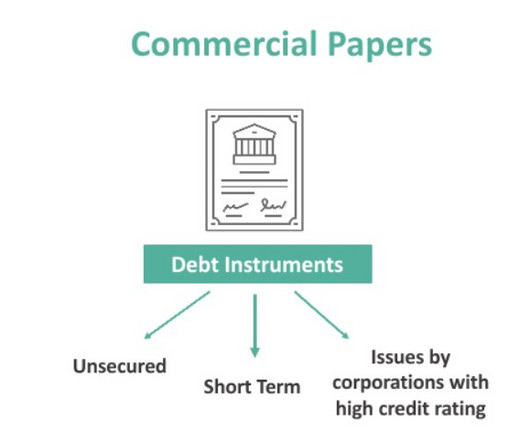

OCTOBER 17, 2023

Case in point, the collapse of Lehman Brothers in 2008 sent shockwaves through the commercial paper market. However, this doesn't mean they are risk-free, as the events of 2008 illustrated. Interest Rate Risk: Fluctuating interest rates can impact the attractiveness and pricing of existing commercial paper.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content