These bond funds withstood the 2008 and 2020 recessions. What investors can learn from them

CNBC: Investing

NOVEMBER 7, 2023

Recession fears are looming, but a few intermediate core bond funds have a track record of success.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

NOVEMBER 7, 2023

Recession fears are looming, but a few intermediate core bond funds have a track record of success.

The TRADE

FEBRUARY 26, 2024

Euronext has launched daily options on the CAC 40 index, allowing investors to execute short-term trading strategies and gain exposure to the main index of Euronext Paris. The new offering builds upon Euronext’s launch of daily options on the AEX index in 2008.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Banking & Finance

APRIL 23, 2024

Euro at highest to yen since 2008, markets nervy over Toyko stepping in By Brigid Riley and Alun John TOKYO/LONDON (Reuters) -The yen hit multi-year lows against the dollar and the euro on Tuesday, keeping investors on heightened intervention watch ahead of this week’s Bank of Japan meeting, while dovish policy maker comments left sterling […] (..)

The TRADE

JANUARY 22, 2025

It will succeed only if the task force has input from a wide range of investors, industry participants, academics, and other interested parties, said Peirce. Bush as a commissioner of the SEC on 29 July 2002, where he served until August 2008. This undertaking will take time, patience, and much hard work.

Peak Frameworks

AUGUST 15, 2023

The Fear and Greed Index is a valuable gauge that attempts to quantify what many think cannot be measured – the emotional state of investors in the stock market. The Fear and Greed Index gauges the primary emotions driving investors: fear and greed.

OfficeHours

AUGUST 25, 2023

The growth of private credit can be traced back to the Great Financial Crisis of 2008-2009. This means that banks commit to providing debt financing for a transaction, and then they syndicate this debt out to a variety of investors and pocket a fee for this service (say, 2-3% on average). This has a number of implications.

Chesapeake Corporate Advisors

OCTOBER 16, 2024

“CCA’s deep expertise in the government contracting sector proved invaluable as we guided Vetegrity though this important milestone in the company’s growth journey.” About Vetegrity Founded in 2008, Vetegrity, provides engineering support to the Defense Department and the Intelligence Community. The post Vetegrity, LLC.

How2Exit

MAY 23, 2023

Then, in 2008, the world experienced a massive financial crisis and Wall Street experienced tremendous dislocation. This platform is based on data and technology which allows them to narrow down the 65,000 institutional investors on their platform to the best candidates. In 2000, Richard's partner left and he left for Bear Stearns.

The Harvard Law School Forum

MAY 2, 2023

Persistently high inflation, coupled with the fastest Fed tightening cycle seen since 1988, contributed to making 2022 the worst performing year for the S&P 500 Index since 2008, thrashing growth and technology stocks in particular. [1] 1] Geopolitical concerns added to poor investor sentiment approaching the new year. [2]

How2Exit

APRIL 8, 2024

Located in Taipei City, Taiwan since 2008, Wells started his journey as an English teacher before venturing into the digital business space. rn rn rn Going public as a company involves facing market dynamics and investor behaviors that may not align with pre-IPO expectations.

The TRADE

NOVEMBER 20, 2024

He re-joined Janus Henderson in 2008 and, as they say, the rest is history. Royal has been global head of equity trading for Janus Henderson Investors since 2017 and despite his now-lofty title as global head he continues to trade both US securities and foreign exchange for the firm.

Mergers and Inquisitions

MARCH 13, 2023

history and the largest bank to collapse since 2008. Why bank regulations , including those passed after the 2008 financial crisis, failed to prevent this. Yes, it does, and the LCR was created in the aftermath of the 2008 financial crisis specifically to prevent bank runs. It’s the second-biggest bank failure in U.S.

Accenture Capital Markets

JANUARY 22, 2024

The first green bond was issued by the World Bank in November 2008 and since then, they’ve become a well-established feature of the global financial landscape. Investor appetite for such investments is rapidly increasing, as banks, asset managers and large corporates all seek ways to invest in sustainability.

Growth Business

MAY 31, 2023

Despite the first quarter of 2023 seeing a drop in deals to 41, down from 95 in the same quarter in 2022, the UK remains the biggest angel investor market in Europe. An angel investor is an individual investor with, usually, a high net worth. See also: What metrics do start-up investors look for?

The Harvard Law School Forum

JUNE 27, 2023

bank failure since the 2008 financial crisis; JPMorgan Chase later agreed to buy the majority of its assets. [2] 5] Despite the instability, investors were granted some breathing room in May as inflation continued to recede from its June 2022 peak. [6] 1] On May 1, regulators seized First Republic, which had reported $232.9

Mergers and Inquisitions

OCTOBER 4, 2023

In short, the media portrayed this event as a populist uprising against Wall Street, as retail investors on Reddit joined forces to bid up GameStop’s stock price while hedge fund Melvin Capital was heavily short the stock. The GameStop short squeeze “changed the industry” forever because hedge funds could no longer ignore retail investors.

Peak Frameworks

AUGUST 15, 2023

An investment portfolio is a basket of various types of financial assets owned by an investor. Therefore, the process of portfolio management involves balancing these two factors based on an investor's financial goals and risk tolerance. Risk Tolerance : This determines the level of risk an investor is willing to take.

Peak Frameworks

JULY 20, 2023

A stock market crash is an event that can have a significant impact on investors and financial markets. A stock market crash is typically triggered by a combination of economic factors and investor psychology. When the bubble burst in 2008, it triggered a severe financial crisis.

Peak Frameworks

JUNE 5, 2023

The Impact on Financial Markets During an expansion, equities typically perform well as corporate earnings increase and investor sentiment improves. For example, the Great Recession of 2008–2009 saw significant drops in GDP, widespread unemployment, and a substantial decrease in consumer spending.

Peak Frameworks

SEPTEMBER 11, 2023

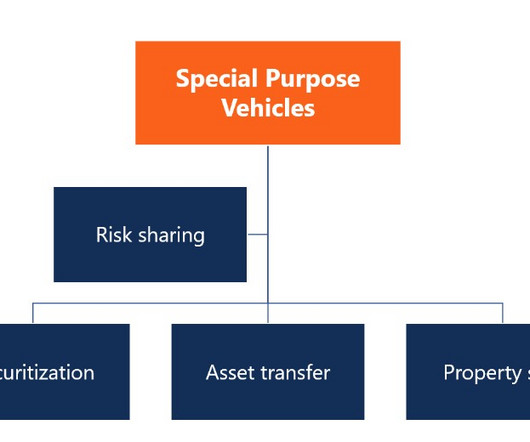

The proceeds from these sales are then used by Company B to issue securities that are sold to investors. This separation allows Company A to achieve various financial objectives while protecting investors in Company B's securities if Company A faces financial distress.

Peak Frameworks

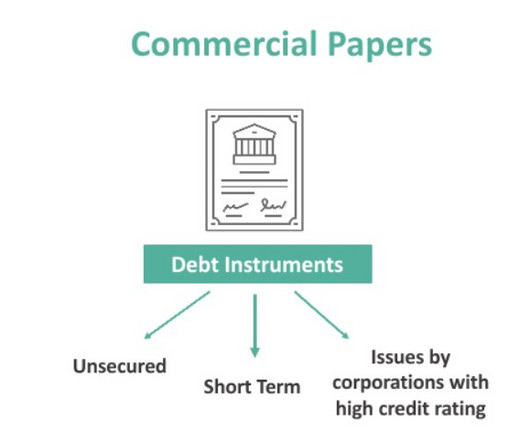

OCTOBER 17, 2023

The choice between the two usually hinges on market conditions and investor preference. For instance, in an environment with anticipated rising interest rates, investors might lean towards interest-bearing commercial paper to lock in current rates. However, this doesn't mean they are risk-free, as the events of 2008 illustrated.

Wall Street Mojo

JANUARY 15, 2024

Collateralized debt obligation (CDO) is a Structured product used by banks to unburden themselves of risk, and this is done by pooling all debt assets (including loans, corporate bonds, and mortgages) to form an investable instrument (slices/trances) which are then sold to investors ready to assume the underlying risk. read more it may cause.

Peak Frameworks

OCTOBER 17, 2023

Impact on Sentiment Beyond tangible effects, headwinds can influence investor and consumer sentiment. Prolonged geopolitical uncertainties, for example, can make investors more risk-averse, pulling money out of stocks and into safer assets, leading to a bearish market.

Peak Frameworks

MAY 24, 2023

These complex instruments enable investors to hedge risks, speculate on future price movements, and exploit arbitrage opportunities. This mechanism allows businesses and investors to manage risk by securing a certain price level, thus protecting against adverse price movements. To mitigate these risks, regulatory bodies like the U.S.

Peak Frameworks

SEPTEMBER 19, 2023

For seasoned investors , novice financial enthusiasts, and even the government, these instruments hold unique significance. Investors, wary of the uncertainties in European debt markets, turned to U.S. Debt Ceiling Crisis , T-Bills experienced an unusual yield spike as investors momentarily questioned U.S. government.

Peak Frameworks

SEPTEMBER 12, 2023

While it might not result in immediate physical harm, its aftermath can decimate companies, tarnish reputations, and shake investors' confidence. Following closely, Bernie Madoff's Ponzi scheme in 2008 shocked the world, costing investors billions and forever marring the landscape of trust in the investment world.

Growth Business

SEPTEMBER 28, 2023

It doesn’t serve investors well and it doesn’t serve founders well either. Back in 2008, he was playing golf with Peter Dubens, founder of private equity firm Oakley Capital, who offered him a job looking after investments considered too small for private equity money. “A A VCT seemed a good way to set up a fund.

Peak Frameworks

OCTOBER 30, 2023

Volatile markets often lead to more trading activity as investors look to buy low and sell high. Asset Management and Private Banking While most of us are familiar with regular banking services, there's a high-end segment dedicated to the uber-rich and institutional investors. Take UBS's Wealth Management division.

The TRADE

DECEMBER 8, 2023

SVB was the catalyst for a bank run that led to the collapse of FRB and Signature Bank as the latest iteration of March madness led to market volatility, credit contraction and negative investor sentiment, which very much defined the first half of the year.

The Harvard Law School Forum

JUNE 27, 2023

bank failure since the 2008 financial crisis; JPMorgan Chase later agreed to buy the majority of its assets. [2] 5] Despite the instability, investors were granted some breathing room in May as inflation continued to recede from its June 2022 peak. [6] 1] On May 1, regulators seized First Republic, which had reported $232.9

Peak Frameworks

JULY 19, 2023

The aftermath of the 2008 financial crisis left many people unemployed or underemployed, leading to the search for alternative income sources. Businesses, entrepreneurs, and investors can also seize opportunities in this burgeoning market. For businesses and investors, there are other challenges.

Mergers and Inquisitions

MARCH 22, 2023

it’s starting to feel a lot like 2008. Investors panicked and bid down the prices of other AT1 bonds in Europe, which prompted EU regulators to step in and state that this “ would not happen to other banks.” Investors and large depositors looked at the market and said, “OK, banks are in trouble. And the answer was “U.S.

Peak Frameworks

JUNE 21, 2023

The 2008 financial crisis is a stark example. Moreover, ethical business practices foster trust with clients, investors, and stakeholders , playing a vital role in building and maintaining a company's reputation. Such actions, severely penalized by regulatory bodies like the SEC, undermine market integrity and investor confidence.

Peak Frameworks

SEPTEMBER 10, 2023

, Short Selling is an investment strategy where investors sell borrowed shares, anticipating the price will drop and they can buy them back at a lower cost, making a profit from the difference. For instance, let's recall the Volkswagen Short Squeeze of 2008. On the other hand, collective market sentiment plays a critical role.

Peak Frameworks

SEPTEMBER 11, 2023

This principle was starkly highlighted in the 2010 Goldman Sachs case, where the firm was accused of misleading investors. The Dodd-Frank Act was a response to the lack of transparency that led to the 2008 financial crisis, echoing Kant's principle of respect for autonomy and transparency.

Peak Frameworks

AUGUST 15, 2023

If you recall the 2008 financial crisis, Lehman Brothers' shareholders felt the brunt of their ownership when the company went bankrupt, losing nearly all of their investment. When Twitter went public in 2013, thousands of individual investors became shareholders in the company.

Mergers and Inquisitions

MARCH 13, 2024

Others would counter that growth equity’s rapid ascent was mostly due to the easy money that persisted between 2008 and 2021. There’s usually a long list of previous VC investors as well. Debt financing is much more common, and the GE firm is often the first institutional investor. Many hedge funds also joined the party.

Software Equity Group

MARCH 13, 2023

Despite the macroeconomic uncertainty, buyers and investors are still willing to pay a premium for mission-critical, recession-resistant companies. In previous economic downturns, such as 2008, private SaaS company valuations took a hit as public strategics were forced to cut back.

Wall Street Mojo

JANUARY 17, 2024

Benefits Risks What Is In It For An Investor In The Swap? Usually, financial institutions with very high credit worthiness are the ones that offer the swap market to clients who may be investors or other financial institutions. A huge tool for fixed-income investors. Interest Rate Swap Explained Types How To Calculate?

Peak Frameworks

AUGUST 15, 2023

Consider the infamous internal emails during the 2008 financial crisis, which were filled with slang and inappropriate language, harming the image of the professionals involved and their companies. When Airbnb first pitched to investors, its presentation was simple yet compelling, effectively showcasing its unique value proposition.

InvestmentBank.com

NOVEMBER 1, 2020

Investors don’t care what you paid for your PP&E even if it has been depreciated in a reasonable matter. The true value–especially in today’s businesses–is not typically in the hard assets, but said assets are able to produce in a cash-on-cash return for investors.

Peak Frameworks

SEPTEMBER 12, 2023

For instance, tech-driven stock market surges, like Tesla's meteoric rise , are often driven not just by hard financial data, but by investor sentiment, psychology, and collective behavior. Understanding the underpinnings of individual decisions can shed light on market anomalies and opportunities.

Peak Frameworks

SEPTEMBER 10, 2023

million tons of CO2 from 2008-2020 through energy efficiency measures. to disclose financially material sustainability information to investors. Air and Water Pollution: Beverage giant Coca-Cola has implemented significant water management initiatives to reduce its global water footprint. Energy Efficiency: Unilever saved 1.5

Peak Frameworks

JUNE 27, 2023

Take, for instance, Jamie Dimon , the CEO of JPMorgan Chase, who successfully navigated the company through the 2008 financial crisis. His consistent display of honesty and adherence to ethical business practices has not only built investor confidence but has significantly contributed to the longevity and success of his company.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content