What Barclays’ history tells us about its current predicament

Financial Times - Banking

FEBRUARY 15, 2024

The bank’s underperforming share price can be traced back to disastrous decisions made during and after the 2008 crisis

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Times - Banking

FEBRUARY 15, 2024

The bank’s underperforming share price can be traced back to disastrous decisions made during and after the 2008 crisis

Global Banking & Finance

NOVEMBER 11, 2024

billion) worth of its own shares from Britain’s government, the bank said on Monday, as it continues its exit from state ownership following its bailout in the 2008 financial crisis. LONDON (Reuters) – NatWest has bought back 1 billion pounds ($1.29

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Guardian: Mergers & Acquisitions

MARCH 19, 2023

Banks race to finish takeover to calm fears of new global financial crisis Millions paid in bonuses to UK SVB staff days after £1 rescue Bank runs, bailouts, rescues: are the ghosts of 2008 rising again? Continue reading.

The TRADE

MAY 16, 2024

He joins Bankhaus Metzler after 16 years with DWS Group, having originally joined back in 2008 as a senior equity trader covering Europe and emerging markets. I am more than delighted to share that I will start a new job as equity sales trader at Bankhaus Metzler,” Cotar said in his update.

Bronte Capital

OCTOBER 23, 2022

Greensill is a story straight from the 2008 playbook. It is the same illusion is familiar from the 2008 playbook. I work on the assumption that in financial markets everyone has an incentive to sell me their b t - from crappy mining projects to shares in Valeant or Enron. But it actually happened in 2016 to 2020.

How2Exit

OCTOBER 2, 2023

rn rn Summary: Corey Veverka shares his journey of buying the business where he worked and provides insights into the process of acquiring a business. He emphasizes the importance of building a team of professionals to guide the acquisition process and shares his experience with refinancing the SBA loan.

Peak Frameworks

AUGUST 15, 2023

A shareholder is an individual, company, or institution that owns at least one share of a company's stock. By owning a share, they own a slice of the corporation, entitling them to a claim on a part of the company's assets and earnings. Their stake in the company directly corresponds to the number of shares they own.

How2Exit

APRIL 8, 2024

Located in Taipei City, Taiwan since 2008, Wells started his journey as an English teacher before venturing into the digital business space. rn As the discussion progresses, Wells shares his reflections on being the CEO of a public company post-IPO, the unexpected realities, and the learning curve that has come with the territory.

The Harvard Law School Forum

JUNE 27, 2023

bank failure since the 2008 financial crisis; JPMorgan Chase later agreed to buy the majority of its assets. [2] 2] In the weeks following the First Republic Bank collapse, PacWest Bancorp, with shares down 66.2% 9] With share prices of financial institutions under pressure, shareholder activists began circling the sector.

Accenture Capital Markets

JANUARY 22, 2024

The first green bond was issued by the World Bank in November 2008 and since then, they’ve become a well-established feature of the global financial landscape. Also, since DLT is a “shared state” model, authorized parties can access the embedded data directly.

Peak Frameworks

SEPTEMBER 10, 2023

, Short Selling is an investment strategy where investors sell borrowed shares, anticipating the price will drop and they can buy them back at a lower cost, making a profit from the difference. When short sellers begin buying back shares to cover their positions, a cascading effect ensues.

How2Exit

OCTOBER 9, 2023

On the show, he shares his story of how he got into the industry, starting with a corporate job in institutional banking working with high net worth clients to help them invest. Simon shared examples of clients who prioritized the well-being of their employees and the continuity of their businesses when making decisions about selling.

Peak Frameworks

OCTOBER 30, 2023

Following the 2008 financial crisis, regulations have intensified , pushing banks to allocate more resources to ensure compliance. Dodd-Frank Wall Street Reform and Consumer Protection Act: Introduced after the 2008 crisis, this U.S. The subprime mortgage crisis that led to the 2008 financial crash is a prime example.

Francine Way

MAY 14, 2017

Said differently, equity holders trade a fixed claim and payment for a share of the company’s upside performance, while debt holders trade the upside for a priority claim and payment which minimize their downside risks. Each source of capital varies in riskiness and cost, but debt will always be cheaper than equity in the same investment.

Mergers and Inquisitions

OCTOBER 4, 2023

This led to a “ short squeeze ,” where Melvin had to cover its shorts by buying shares, further pushing up the price. The Big Short did an excellent job explaining the 2008 financial crisis with a few key scenes, and Dumb Money could have done something similar – maybe during the Congressional hearings toward the end.

Mergers and Inquisitions

MARCH 22, 2023

it’s starting to feel a lot like 2008. per share when it was trading above $8.00 With the retreat of both CS and UBS, these firms’ market shares in Europe and Asia will continue to grow. In 2008, some banks rescinded internships and full-time jobs, so it’s safest to assume that will happen again. a year ago?

The Harvard Law School Forum

JUNE 27, 2023

bank failure since the 2008 financial crisis; JPMorgan Chase later agreed to buy the majority of its assets. [2] 2] In the weeks following the First Republic Bank collapse, PacWest Bancorp, with shares down 66.2% 9] With share prices of financial institutions under pressure, shareholder activists began circling the sector.

Wizenius

JUNE 28, 2023

For instance: - During the global financial crisis of 2008, several industries experienced a substantial downturn due to reduced consumer spending and tightened credit conditions. As a result, growth rate assumptions need to consider the company's ability to maintain or increase its market share. -

Peak Frameworks

SEPTEMBER 12, 2023

Following closely, Bernie Madoff's Ponzi scheme in 2008 shocked the world, costing investors billions and forever marring the landscape of trust in the investment world. During the 2008 financial crisis, for instance, many banks approved "liar loans," where borrowers provided fake income statements.

Peak Frameworks

AUGUST 15, 2023

As an investment banker , for instance, Jamie Dimon might underscore his expertise in risk management that helped JPMorgan Chase weather the 2008 financial crisis far better than most competitors. Bill Gates often shares how his early fascination with software programming set him on the path to co-founding Microsoft.

Transactional Delights

NOVEMBER 3, 2020

In 2008, Selectica amended its NOL pill [4] to include a 4.99% trigger. And, like Selectica, HBP has a potential suitor (Mill Road) who is interested in acquiring HBP shares. share (later revised to $4/share). share for the Company is too low and undervalues HBP’s growth potential!

Peak Frameworks

OCTOBER 17, 2023

During the 2008 global financial crisis , many sectors, from real estate to banking, experienced significant challenges. For instance, after the aforementioned 2008 crisis, the financial sector faced increased regulations via mechanisms like the Dodd-Frank Act. Businesses slow to adapt can lose market share or become obsolete.

Peak Frameworks

OCTOBER 17, 2023

Why it's Crucial: A well-structured document is easier to review, reference, and share. Steps to Finalize: Share the draft with the meeting's chairperson or organizer for review. Choose the Right Medium: Email, shared drives, or specialized software – pick what suits your organization. Separate discussions by agenda items.

Peak Frameworks

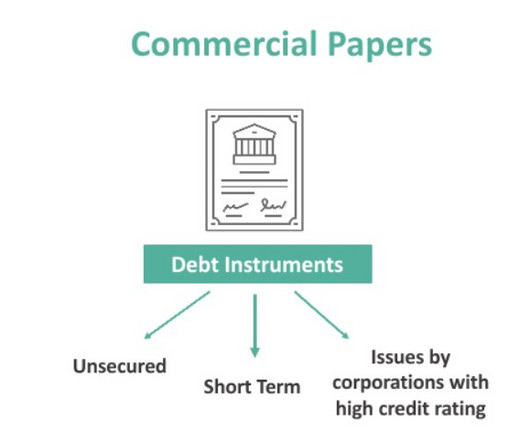

OCTOBER 17, 2023

Potential Risks However, like any financial instrument, commercial paper has its share of risks: Default Risk: Being unsecured, there's always the risk of the issuer defaulting. Case in point, the collapse of Lehman Brothers in 2008 sent shockwaves through the commercial paper market.

Peak Frameworks

AUGUST 15, 2023

Stock Price Breadth : The volume of shares trading in stocks on the rise versus those declining. For example, during the 2008 financial crisis , the Fear and Greed Index tanked to extreme fear levels. Stock Price Strength : The number of stocks hitting 52-week highs versus those hitting lows. Put and Call Options : The Put/Call ratio.

Cleary M&A and Corporate Governance Watch

OCTOBER 2, 2023

8-02 (2008), [link]. In line with efforts to avoid deterring M&A activity, as expressed by DOJ officials in the past, Marshall specifically indicated that the DOJ “…will not treat as a recidivist any company with a proven track record of compliance that acquires a company with a history of compliance problems….” [4] Alcon PTE Ltd.

Growth Business

SEPTEMBER 28, 2023

VCTs themselves are prohibited from owning more than half a company’s shares. Back in 2008, he was playing golf with Peter Dubens, founder of private equity firm Oakley Capital, who offered him a job looking after investments considered too small for private equity money. million investment, but 36 per cent of Hackney Gelato (£3.2

Wall Street Mojo

JANUARY 15, 2024

CDOs are considered highly astute financial instruments Financial Instruments Financial instruments are certain contracts or documents that act as financial assets such as debentures and bonds, receivables, cash deposits, bank balances, swaps, cap, futures, shares, bills of exchange, forwards, FRA or forward rate agreement, etc.

Mergers and Inquisitions

MARCH 13, 2024

Others would counter that growth equity’s rapid ascent was mostly due to the easy money that persisted between 2008 and 2021. the Founders sell some shares to take money off the table, but “the company” doesn’t get any of that cash). Debt financing is much more common, and the GE firm is often the first institutional investor.

Mergers and Inquisitions

MAY 17, 2023

Ever since the 2008 financial crisis, there has been massive hype about both private equity and technology. Many of these deals also include both secondary purchases (existing shares) and primary purchases (new shares issued, which boost the cash balance).

The TRADE

OCTOBER 18, 2024

Additionally, multi-manager hedge funds have continued to win the lion’s share of the new capital coming into the industry as they have been rewarded for their ability to mitigate risk while still delivering positive alpha to their investors. Data from Convergence tracking the top 25 prime brokers showed their market share grew from 83.3%

Razorpay

MAY 11, 2023

The concept of LLP was introduced in 2008 through the Limited Liability Partnership(LLP) Act. • All partners of limited liability partnerships share the profits of business just as partners of regular firms. They are, however, free to decide the ratio in which they will share profits. What is Liability?

Cooley M&A

OCTOBER 29, 2020

starting in the early 2000s and ending around the start of the 2008-2009 financial crisis, and the second (SPAC 2.0) as it relates to both warrants and the sponsors’ promote shares, with such deviations generally resulting in less dilution to the target’s shareholders. Increased Frequency and Size. A distinct feature of SPAC 3.0

How2Exit

MAY 23, 2023

Then, in 2008, the world experienced a massive financial crisis and Wall Street experienced tremendous dislocation. Ron Concept 1: Adapt To Uncertain Times. In today's world, uncertainty is a constant. It can be difficult to navigate the ever-changing landscape of the business world, but it is possible to adapt to uncertain times.

Peak Frameworks

SEPTEMBER 11, 2023

By aligning strategy, structure, systems, skills, staff, style, and shared values, OD aims to create a harmonious and high-performing organizational culture. Case in point: JP Morgan Chase utilized an OD strategy to manage the tumultuous transition during the 2008 financial crisis, demonstrating the potential of OD in the face of adversity.

Peak Frameworks

AUGUST 15, 2023

In contrast, in societies like the US, with a low PDI, a more democratic and egalitarian approach is encouraged, with a focus on equal power distribution and shared decision-making. A prime example is the aftermath of the 2008 financial crisis.

Growth Business

MARCH 26, 2025

For leadership, that means creating an environment where speaking truth to power is permissible; a culture where people feel they can share ideas, debate, and discuss without things getting personal. NatWest faced countless revelations of its employees poor decision-making following the 2008 financial crash. The result?

Tyton Partners

JULY 27, 2023

It becomes something that catches you by the windows of opportunities, because moments like 2020 or moments like 2008 when a Black president is elected to office in the U.S. Look what we did in 2008. Fast forward to 2016 when you have a new administration, and you must pivot with this moment. And when you look back, you say, “Wow!

Focus Investment Banking

JUNE 21, 2024

The CEO of Crash Champions shared what he learned while growing his business from a regional MSO to a national brand. 11, 2001, terrorist attacks and the Great Recession of 2008. He said he once took out a total of $100,000 in cash advances on multiple credit cards.

Cooley M&A

MARCH 23, 2020

Advance preparation with management and the board’s outside financial and legal advisors can enable a board to respond swiftly to activist attacks calling for a return of cash via liquidation or a quick sale and unsolicited opportunistic proposals. [1]

Cooley M&A

SEPTEMBER 25, 2020

Snow Phipps points the court to its decision and remedy in the Hexion / Huntsman dispute that arose in connection with the 2008-2009 financial crisis. [6] 29, 2008). [7] Contributors. 6] Hexion Specialty Chemicals, Inc. Huntsman Corp. , 3841-VCL (Del.

Software Equity Group

MARCH 7, 2024

Steven Forth, CEO and Co-Founder of Ibbaka, shares, “Karen has innovated the pricing space by clarifying the role that non-economic value plays, or as she says, ‘Community Value Drivers.’ It operates within a scalable cloud solution, offering collaboration tools, sharing features, and visually appealing data representations.

Software Equity Group

MARCH 7, 2024

Steven Forth, CEO and Co-Founder of Ibbaka, shares, “Karen has innovated the pricing space by clarifying the role that non-economic value plays, or as she says, ‘Community Value Drivers.’ It operates within a scalable cloud solution, offering collaboration tools, sharing features, and visually appealing data representations.

Software Equity Group

MARCH 7, 2024

Steven Forth, CEO and Co-Founder of Ibbaka, shares, “Karen has innovated the pricing space by clarifying the role that non-economic value plays, or as she says, ‘Community Value Drivers.’ It operates within a scalable cloud solution, offering collaboration tools, sharing features, and visually appealing data representations.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content