‘Vindicating’: An Analyst Who Lowered the U.S.’s Credit Rating in 2011 on Fitch’s Downgrade

The New York Times: Banking

AUGUST 5, 2023

Nikola Swan played a key role at S&P when the agency became the first to strip America of its top ranking in 2011.

The New York Times: Banking

AUGUST 5, 2023

Nikola Swan played a key role at S&P when the agency became the first to strip America of its top ranking in 2011.

The New York Times: Banking

AUGUST 5, 2023

Nikola Swan played a key role at S&P when the agency became the first to strip America of its top ranking in 2011.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Cleary M&A and Corporate Governance Watch

AUGUST 2, 2023

2] , [3] The rules build on the 2011 guidance issued by the SEC’s Division of Corporation Finance (“2011 Staff Guidance”) and the 2018 Commission Statement and Guidance on Public Company Cybersecurity Disclosures issued by the Commission itself (“2018 Interpretive Release”). [4] 11] Form S-3 Eligibility Not Affected.

Street of Walls

SEPTEMBER 10, 2012

Sandler O’Neill’s Weekly M&A Trends: The S&P 500 had its best week since early June The S&P 500 rose by 2.2% In 3Q12, the S&P 500 has risen by 5.6% billion of net outflows experienced in December 2011. s $2 billion offering of its shares in the A.I.A. in the week.

Mergers and Inquisitions

JANUARY 31, 2024

They might have separate teams for specific strategies or markets, but everything is run under a single Profit & Loss statement (P&L). There are very few real “requirements” besides the single PM / single P&L one above and the standard Limited Partner / General Partner structure that all hedge funds use.

Street of Walls

SEPTEMBER 4, 2012

Sandler O’Neill’s Weekly M&A Trends: The S&P 500 declined for the second consecutive week but ended positive for the month The S&P 500 declined by 0.3% In 3Q12, the S&P 500 has risen by 3.3% billion of net outflows experienced in December 2011. in the week.

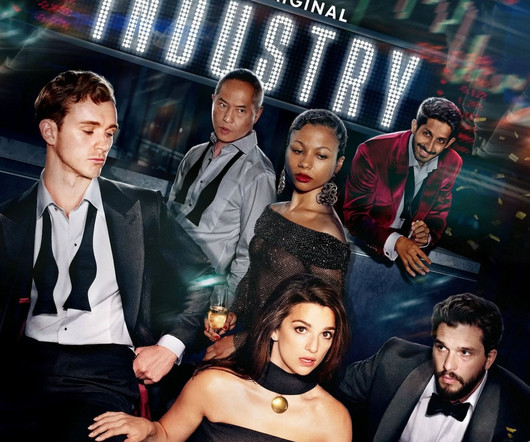

Mergers and Inquisitions

OCTOBER 2, 2024

One example is the trading fiasco I described above, but there are countless others: In one incident, a salesperson “tricks” a trader into executing a trade that would hurt the bank’s P&L solely to help a client – and a senior manager listens to the entire conversation and lets it go through. This would never happen in real life.

Let's personalize your content