2024 Insurance M&A Transactions: What To Expect

Sica Fletcher

JULY 31, 2024

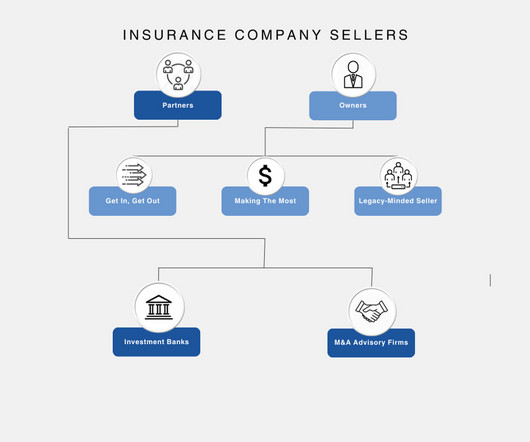

In addition to the high cost of debt interfering with their bottom line, they also have to contend with a buyer pool that’s larger than ever before , with 50+ buyers in the current pool where there used to be ~5. Sellers are remaining patient and working with M&A advisosr to identify areas of opportunity. Senior Attention.

Let's personalize your content