How To Value an Insurance Agency

Sica Fletcher

APRIL 30, 2024

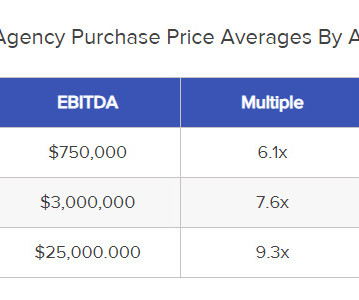

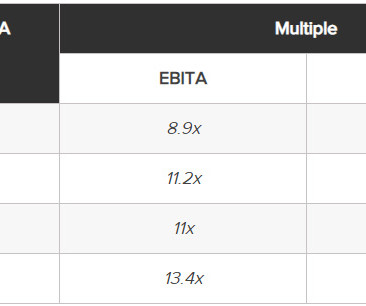

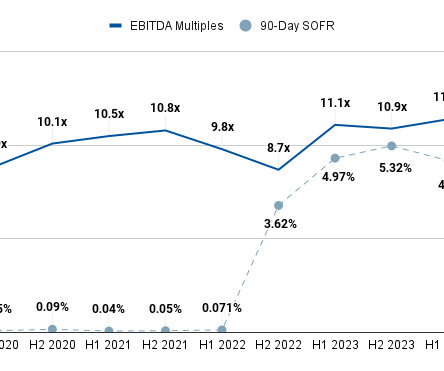

Preparing for an Insurance Agency Valuation Because the valuation process is really about determining the profitability of your insurance agency, any and all efforts should be made prior to the valuation to reduce costs and generate revenue. This figure is often averaged by calculating EBITDA over the course of several years.

Let's personalize your content