What To Remember When Selling an Insurance Brokerage

Sica Fletcher

JULY 1, 2024

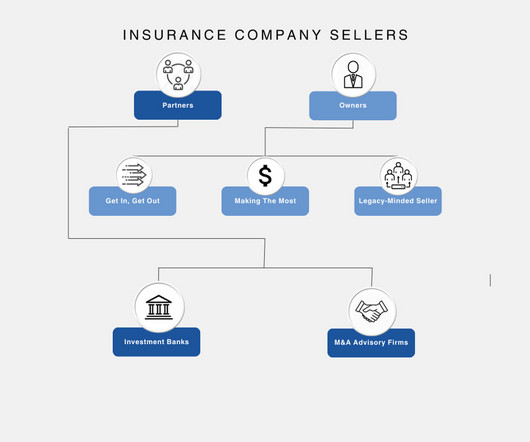

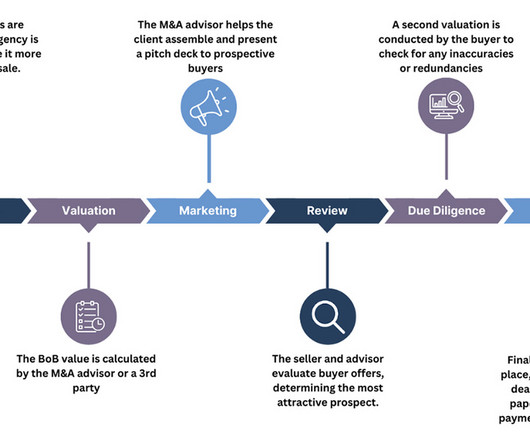

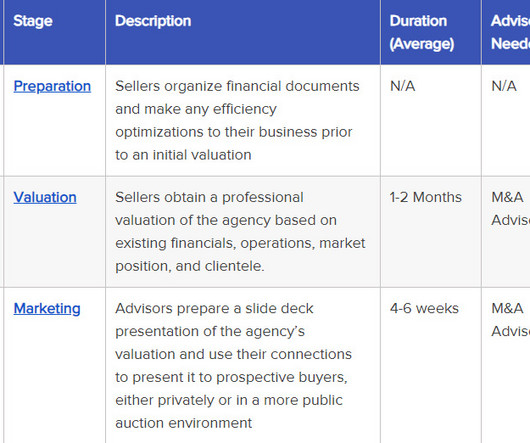

boost your profits, cut your bottom line), doing so with a brokerage requires paying special attention to the diversity of your policy portfolio. Selecting an Advisor Initial preparations when selling an insurance brokerage should absolutely include selecting an M&A advisory firm to represent you. Learn more at SicaFletcher.com.

Let's personalize your content