Insurance Broker Valuation Multiples: Q3 2024 Projections

Sica Fletcher

JUNE 11, 2024

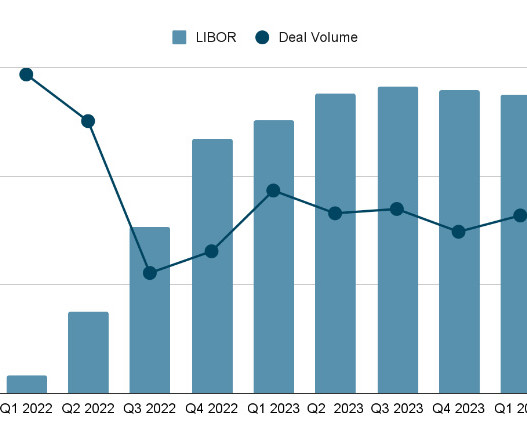

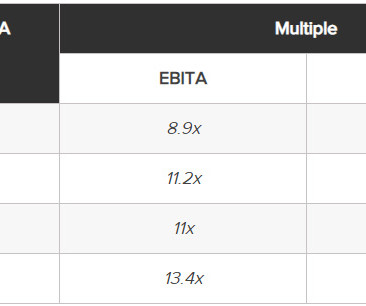

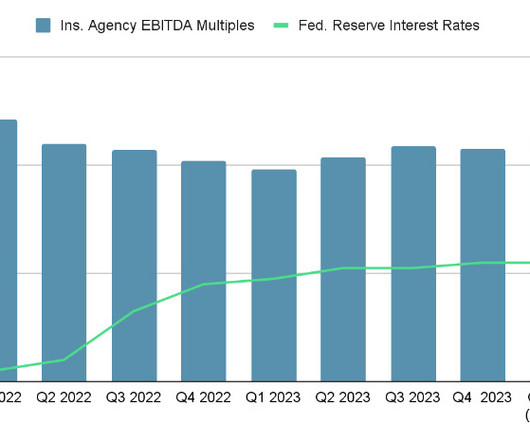

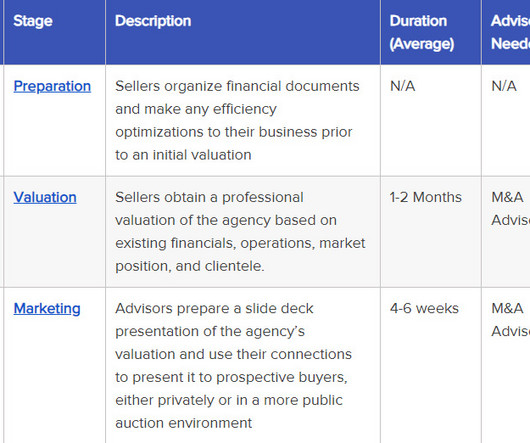

The following report contains our projections for Q3 2024 insurance broker valuation multiples. Insurance Broker Valuation Multiples: Q3 2024 Projections Using these numbers as a baseline, let’s examine the insurance industry more closely to identify influential factors behind its specific changes. Buyer perception has changed.

Let's personalize your content