Insurance M&A Deals in 2024

Sica Fletcher

APRIL 2, 2024

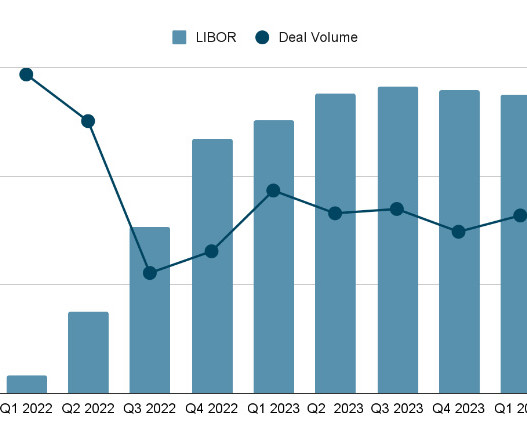

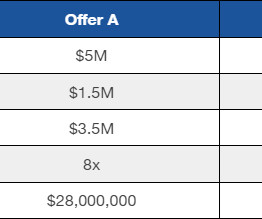

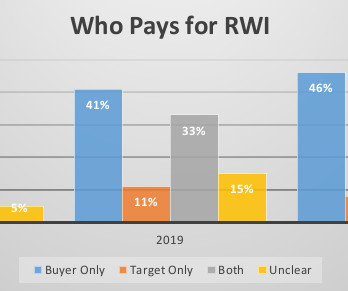

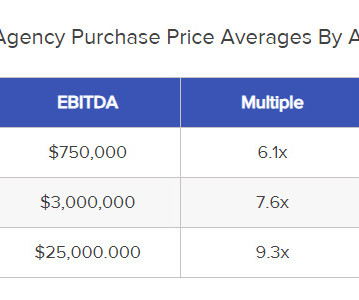

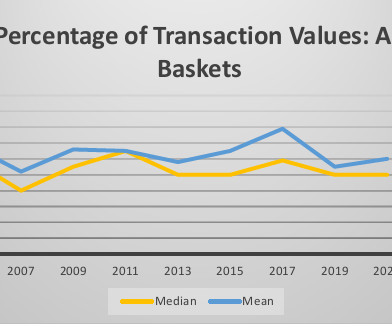

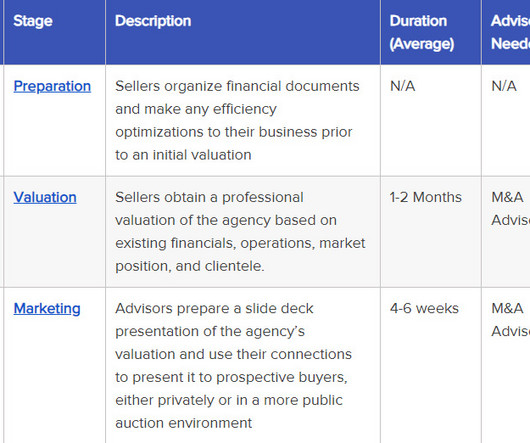

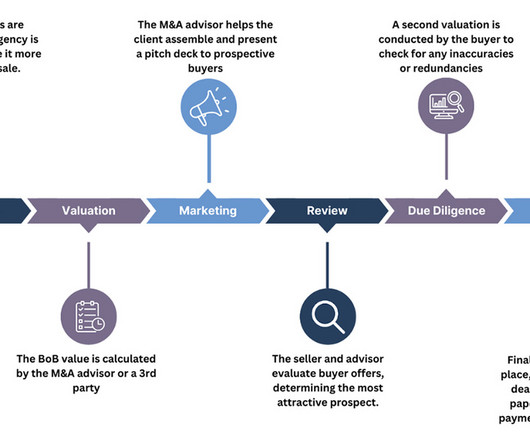

The following report examines the health and outlook for insurance M&A deals in 2024. We base this research on several key findings in our proprietary SF database, which observes and records data from the top ~400 insurance M&A buyers. Agency vs. Company: Which Is The Better Insurance M&A Deal?

Let's personalize your content