Should You Jump on the Private Equity Bandwagon?

Sica Fletcher

SEPTEMBER 25, 2019

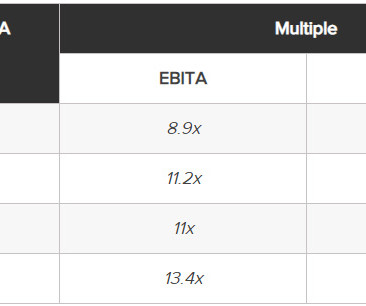

In recent posts, we outlined the background of and reasons for the dramatic upsurge of private equity investment in the insurance brokerage industry , how the combination of private equity and low interest rates have dramatically raised valuations , and how private equity sponsored agencies increasingly dominate the insurance agency business.

Let's personalize your content