Contingent Value Rights: Key Components & Trends

Deal Lawyers

MAY 24, 2023

Contingent Value Rights, or CVRs, are the public company analog of an earnout, and like earnouts are a tool for bridging valuation gaps between buyers and sellers.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Deal Lawyers

MAY 24, 2023

Contingent Value Rights, or CVRs, are the public company analog of an earnout, and like earnouts are a tool for bridging valuation gaps between buyers and sellers.

TechCrunch: M&A

JULY 12, 2023

In 2018, Jumbo raised a $3.5 Last year, Index Ventures also led a $17 million round in the company at a $77 million post-money valuation. In its most recent funding round , the company raised a $250 million Series F investment at a valuation of $5 billion. Coalition has raised hundreds of millions of dollars over the years.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Sica Fletcher

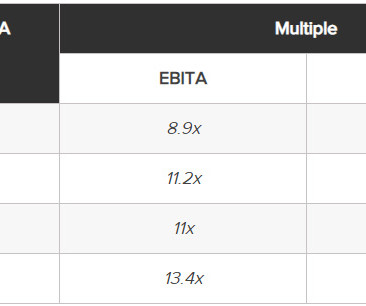

MARCH 12, 2024

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

TechCrunch: M&A

JUNE 27, 2023

billion valuation during the heady fundraising days of late 2021 (and $100 million earlier in 2021), today announced that it has acquired identity verification service Berbix for $70 million in cash and stock transactions. Founded in 2018, Berbix focuses on verifying users’ identities by checking scanned IDs in real time.

Cooley M&A

FEBRUARY 8, 2018

What’s on tap for 2018 M&A? A recap of 2017 trends and the Cooley outlook on this year’s dealmaking: Buying Innovation: Retention and Non-Competes. For both old-line companies and tech giants, innovation is the name of the game. Use of Earn-Outs in Life Sciences Deals.

Software Equity Group

FEBRUARY 28, 2023

Our report provides context for private companies to better understand factors influencing their valuations and evaluate how they can position themselves within a changing marketplace. This post will examine the current state of public SaaS company valuations and what it means for private companies. What is the SEG Index?

TechCrunch: M&A

MAY 8, 2023

After raising $100 million at a valuation of over $2 billion last year, the Australian ed-tech startup Go1 is making an acquisition and getting some investment to expand its reach and technology to serve the market of corporate online learning. Blinkist’s last valuation was $160 million in 2018 , when it raised $18.8

InvestmentBank.com

SEPTEMBER 18, 2019

Up from 65% in 2009 the percentage of adult Americans has increased to 76% in 2018 [1] with a projected market CAGR of 7.8% Major Players in the M&A Scene Amazon’s acquisition of PillPack is the largest acquisition of a DTC nutraceutical company on record with a $753 million price tag in 2018. until 2025 [2]. EBITDA multiple. .

Global Banking & Finance

NOVEMBER 13, 2024

(Reuters) -Payments firm Klarna began the process of going public for a second time in three years despite a sharp drop in its valuation, making it the largest Swedish company to float its shares in the U.S. since Spotify’s listing in 2018. The buy now, pay later (BNPL) company said on Tuesday it had confidentially […]

Shearman & Sterling

JANUARY 17, 2018

On January 10, 2018, Vice Chancellor Sam Glasscock III of the Delaware Court of Chancery declined to compel the production of attorney-client privileged documents under the Garner doctrine in the context of direct breach of fiduciary duty claims brought by former minority shareholders of R.L. Polk & Co. 9250-VCG (Jan.

The Harvard Law School Forum

JUNE 16, 2023

In recent months, the life sciences industry has seen the reemergence of contingent value rights, or CVRs, in public company acquisitions as a way to bridge a valuation gap between buyers and sellers. Executive Summary This study addresses CVRs, the public M&A analog to the earnout used in private deals, which can be price-driven (e.g.,

Shearman & Sterling

JANUARY 17, 2018

On January 10, 2018, Vice Chancellor Sam Glasscock III of the Delaware Court of Chancery declined to compel the production of attorney-client privileged documents under the Garner doctrine in the context of direct breach of fiduciary duty claims brought by former minority shareholders of R.L. Polk & Co. 9250-VCG (Jan.

OfficeHours

JULY 11, 2023

If you can really nail valuation questions but struggle with regulatory questions, make sure you can get all the valuation questions right to maximize your points there. The SIE was first introduced in 2018 as a mandatory exam for people seeking to be employed in the securities industry.

Shearman & Sterling

MARCH 6, 2018

On February 23, 2018, Vice Chancellor Sam Glasscock III of the Delaware Court of Chancery ruled, based on his own discounted cash flow ("DCF") analysis, that the fair value of AOL Inc. ("AOL") was below the deal price paid by Verizon Communications Inc. ("Verizon") to acquire it. In re: Appraisal of AOL Inc.,

Sica Fletcher

MARCH 8, 2024

Starting in H2 2022, the insurance M&A market has seen a notably difficult 18-month period, afflicted with high interest rates, lowered deal volumes, and lowered valuations. If they do, then we can expect to see valuations and, by extent, EBITDA multiples for insurance agencies rise.

InvestmentBank.com

OCTOBER 24, 2019

For the better part of the last decade, physician practices have seen a wave of consolidation by hospitals and private equity with 2018 being no exception [1]. toped 5,000 from 2015 to 2016 alone [22] , with the total number of hospital owned physician practices increasing to 80,000 by 2018 [15]. in 2018 to 12.5% of GDP or $2.5

OfficeHours

JULY 11, 2023

The SIE was first introduced in 2018 as a mandatory exam for people seeking to be employed in the securities industry. If you can really nail valuation questions but struggle with regulatory questions, make sure you can get all the valuation questions right to maximize your points there.

The Harvard Law School Forum

JUNE 16, 2023

In recent months, the life sciences industry has seen the reemergence of contingent value rights, or CVRs, in public company acquisitions as a way to bridge a valuation gap between buyers and sellers. Executive Summary This study addresses CVRs, the public M&A analog to the earnout used in private deals, which can be price-driven (e.g.,

The TRADE

JUNE 23, 2023

With respect to equity markets, AFME, EFAMA and BVI highlight that EU companies are continuing to take their initial public offerings (IPOs) outside of the EU or move their listings elsewhere to seek better valuations – emphasising that EU equity markets cannot continue to lag behind their peers. “In

Focus Investment Banking

JANUARY 18, 2024

And Navigant Consulting, a well-known publicly traded company, finished going private in 2019, after first selling its Disputes, Forensics and Legal Technology practice to Ankura in 2018, and then selling its remaining divisions to Guidehouse. If the stock market remains near all-time highs, it might just be too attractive to pass up.

Focus Investment Banking

MARCH 28, 2024

A typical ophthalmology PPM was founded in 2018 and has completed ten total acquisitions since (and thus, is now partnered with ten practices). Some PPMs have gotten very large, with partnerships across a broad geographic area and valuations likely north of $1B. The typical ophthalmology PPM is also regionally focused.

Sica Fletcher

JULY 1, 2020

This was the fourth year in a row fundraising surpassed half a trillion dollars, with 2017, 2018, and 2019 recording the highest amounts of capital raised in history. In 2019, there were about 5,100 PE-backed buyout deals announced, with an aggregate value of $393 billion, down from 6,500 deals announced in 2018 with a value of $493 billion.

Cooley M&A

OCTOBER 29, 2020

As reflected in Chart 1 , 102 SPAC IPOs have been announced this year as of September 18, 2020—almost double the number of SPAC IPOs in all of last year (and more than double the number of SPAC IPOs in 2018). Valuation Certainty. Competition / Variation. Another feature of SPAC 3.0 is the competition among SPACs for potential targets.

Sica Fletcher

SEPTEMBER 25, 2019

In recent posts, we outlined the background of and reasons for the dramatic upsurge of private equity investment in the insurance brokerage industry , how the combination of private equity and low interest rates have dramatically raised valuations , and how private equity sponsored agencies increasingly dominate the insurance agency business.

Growth Business

NOVEMBER 23, 2023

Despite investment in the first half of 2023 dropping to £4.6bn from 2022’s £10.8bn as a result of rising interest rates, high inflation, a decrease in valuations and geopolitical tensions globally, UK fintechs are still attracting more VC investment than all other EMEA fintechs combined, with a significant percentage coming from US investors.

Peak Frameworks

MAY 22, 2023

In 2018, General Electric reported $309 billion in non-current assets. Importance of Asset Valuation and Management Proper asset valuation and management are essential for businesses to maintain a healthy balance sheet and maximize their potential.

Software Equity Group

JANUARY 8, 2024

Having a clear understanding of the broader software industry is one of several key insights to a successful transaction and a better SaaS valuation. Users can access current information whenever and wherever they need it and can compare historical data since 2018.

Software Equity Group

JANUARY 8, 2024

Having a clear understanding of the broader software industry is one of several key insights to a successful transaction and a better SaaS valuation. Users can access current information whenever and wherever they need it and can compare historical data since 2018.

Sica Fletcher

DECEMBER 12, 2019

Let’s break down how this is paid: Valuation The valuation is invariably calculated as Pro Forma EBITDA multiplied by the EBITDA multiple. In 2018, we led the country with 79 transactions completed for the insurance agents and brokers, and in 2017, we led the country with 62 closed transactions.

Cooley M&A

OCTOBER 29, 2018

2018-0300-JTL (Del. Two days after the announcement of the execution of the merger agreement, Akorn notified Fresenius that it was experiencing dismal second quarter results (despite Akorn having reaffirmed its full-year guidance for 2018 at Fresenius’ request on the date that the parties signed the merger agreement).

Wall Street Mojo

JANUARY 15, 2024

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series) –>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle ( 25+ hours of video tutorials with step by step McDonald’s Financial Model ).

Wall Street Mojo

JANUARY 18, 2024

payable semi-annually maturing after 5 years with a principal face value of $1000 on 1st January 2018. Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements. The bonds mature on 31st Dec 2022.

Bronte Capital

MAY 21, 2021

There is the risk for the consolidated financial statements that the calculation of impairment loss allowances is not carried out in an appropriate manner or is based on inappropriate assumptions, an inappropriate database or inappropriate application of the valuation model and, as a result, the impairment loss is reported in an incorrect amount.

Cooley M&A

JANUARY 22, 2020

billion – almost double the value of deals announced in that same sector in 2018, despite the number of deals decreasing from 705 in 2018 to 519 in 2019. Changes in CFIUS Oversight.

Cleary M&A and Corporate Governance Watch

FEBRUARY 2, 2024

Musk himself even approved the projections of his grant that would be presented at the meetings, and the Compensation Committee did not include valuations for any other alternatives. 2018-0408-KSJM at *120 (Del. 2018-0408-KSJM at *129 (Del. 2018-0408-KSJM at *156 (Del. 30, 2023, 11:24 AM), [link]. [2] 2] Tornetta v.

The Deal

SEPTEMBER 22, 2023

Most of those are acquired by large IP houses,” Ivest co-founding partner Aston Loch said following the firm’s August purchase of CloudCo at a roughly $100 million enterprise valuation. The controlling Weiss family sold a 60% stake in American Greetings to Clayton, Dubilier & Rice LLC in 2018 but kept CloudCo. “In for decades.

Cooley M&A

MAY 5, 2020

In 2017, the Company began experiencing financial difficulty as it worked to update its flagship product, and in early 2018 it formed a special committee of its three independent directors to consider options for additional ways to raise capital. 2018-0542-AGB (Del. 281, 2018 (Del. Meenan Oil Co. 1985 WL 44705, at *3 (Del.

Mergers and Inquisitions

JANUARY 31, 2024

In-depth analysis that might take days or weeks, such as a financial model with 1,000 rows in Excel to assess a biopharma company’s valuation. Single-Manager Hedge Fund Performance The multi-manager hedge fund article described how MM funds grew faster than the overall industry between 2018 and 2023.

Growth Business

MAY 31, 2023

Founded: 2018 Members: 299 angels Number of deals in total: Between 2017 and 2022, it has facilitated angel deals worth £13.5m, across 120 funding rounds with more than 330 individual investments Interested in: Sector agnostic. Successful founders typically attract £70,000 to £350,000.

Cooley M&A

JULY 19, 2019

As a result of SEC cyber guidance from 2011 and 2018 , which specifies that cyber risks and cyber incidents could trigger general SEC reporting obligations, Marriott released a statement on its website to coincide with a filing of its 8-K. The breach was discovered in November 2018. Background on the ICO’s Proposed Marriott Fine.

Cooley M&A

DECEMBER 3, 2019

From 2008 to 2018, the total R&W policies bound per year in North America rose from 40 deals, providing $541 million of coverage to 1500+ R&W insurance transactions, providing aggregate coverage of $38.6 Aon estimates that over 45% of all private M&A transactions in North America had R&W insurance in 2018. [2].

Software Equity Group

JULY 9, 2024

“It could impact your valuation, which is why we want to ensure you’re thinking about this from the beginning.” Such contracts can materialize your company’s valuation in the eyes of a potential buyer. Along with this beneficial tax treatment comes very stringent rules regarding ownership structure.

Focus Investment Banking

APRIL 14, 2024

From 2018 to 2021, the total number of bakery workers declined nearly 12%, leaving operators struggling to replace highly experienced talent. Healthy competition for the top bakeries has increased valuations in recent years, with strong purchase price / cash flow (EBITDA) multiples.

Deal Law Wire

FEBRUARY 23, 2021

In May, we wrote about the increased focus on earn-out provisions during the pandemic as a method to mitigate the risk of a target’s post-closing under-performance and to bridge any valuation gap between the purchaser and seller. More recently, we discussed post-closing balance sheet adjustments as a separate tool to address the same risk.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content