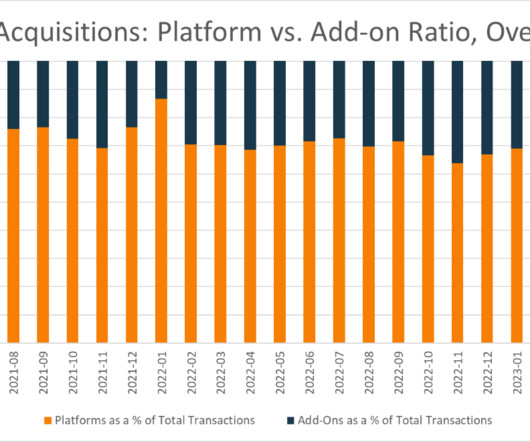

Use of Add-On Acquisitions in PE Is Likely to Continue

JD Supra: Mergers

MAY 30, 2024

Over the past several years, sponsors have increasingly relied on add-on acquisitions to increase the value of their portfolio company investments.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MAY 30, 2024

Over the past several years, sponsors have increasingly relied on add-on acquisitions to increase the value of their portfolio company investments.

JD Supra: Mergers

SEPTEMBER 16, 2024

In a much-anticipated ruling of 3 September 2024, the EU's highest court threw out the policy that the European Commission has been pursuing since 2021, by which it asserted jurisdiction to review so-called “killer acquisitions” falling below the review thresholds of both the Commission and all EU Member States.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

TechCrunch: M&A

JULY 17, 2023

While a new director joined the Board in 2020, he was ousted barely a year later in 2021 following some self-serving corporate governance maneuvers geared at maintaining the underperforming status quo and the mummified Board’s grip on power. Attempts to add a new independent director as recently as 2-3 years ago were met with pushback.

JD Supra: Mergers

DECEMBER 11, 2023

Today, a tale of two markets are seen in healthcare mergers and acquisition (M&A): the present (as reflected in the data about declining dealmaking) and the future (reflected in the increasingly positive outlook by dealmakers).

TechCrunch: M&A

SEPTEMBER 5, 2024

billion in 2021. Salesforce has acquired Own Company, a New Jersey-based provider of data management and protection solutions, for $1.9 billion in cash. Own is Salesforce’s biggest deal since buying Slack for $27.7 In a press […] © 2024 TechCrunch.

JD Supra: Mergers

MAY 23, 2023

In Short - SPAC Deals: Special purpose acquisition companies ("SPACs") boomed in 2020 as a means of taking early-stage private companies public.

TechCrunch: M&A

OCTOBER 12, 2023

billion valuation in May 2021 when it announced a $130 million Series C. Atlassian announced this morning that it is acquiring video messaging service Loom for $975 million, the same company that had a $1.53 That was when companies were still thinking about all work being cloud-based and the future looked oh so bright.

TechCrunch: M&A

AUGUST 15, 2024

Prytek had already been a big investor in TipRanks since 2017, most recently leading a $77 million round in the company in 2021. © 2024 TechCrunch. All rights reserved. For personal use only.

JD Supra: Mergers

AUGUST 16, 2024

8, 2024), the United States Court of Appeals for the Ninth Circuit affirmed the dismissal of a securities class action brought by investors who purchased shares of the special purpose acquisition company Churchill Capital Corporation IV (“CCIV”) in early 2021 before it merged with Atieva, Inc. d/b/a Lucid Motors (“Lucid”) in July 2021.

JD Supra: Mergers

NOVEMBER 10, 2023

European Commission Orders Unprecedented Unwinding Of Illumina’s Acquisition of GRAIL. s 2021 acquisition of GRAIL Inc., For the first time, the European Commission has ordered reversal of a consummated transaction, Illumina Inc.’s a company developing blood tests for cancer detection. By: WilmerHale

JD Supra: Mergers

JULY 12, 2023

Overview - The year 2022 started strong but proved to be a mixed year for M&A in what could be described as a return to earth after the record-setting year that was 2021. M&A market alone exceeded $2 trillion in 2021 – a staggering figure that crushed (by nearly 30%) the then-existing record established in 2015.

JD Supra: Mergers

OCTOBER 24, 2024

The mergers and acquisitions (M&A) landscape in 2024 showed signs of recovery following the slump experienced in 2023. Deal volumes increased, but the market remains considerably slower compared to the boom years of 2021 and 2022.

JD Supra: Mergers

JANUARY 28, 2025

2024 was a better year for mergers and acquisitions (M&A) in the UK and Europe than 2023, although overall growth in the market was slow. Deal numbers, by both absolute volume and aggregate deal value, remained far below the heights of 2021. By: Katten Muchin Rosenman LLP

JD Supra: Mergers

SEPTEMBER 11, 2024

According to the American Bar Association's Private Target Mergers and Acquisitions Deal Points Studies, financial statement representations are universally required from sellers in private company M&A deals, included in almost every transaction—99% covered by the most recent study in 2021.

JD Supra: Mergers

JANUARY 14, 2025

Renovus Capital Partners has announced the acquisition of Superior Health Holdings. Superior, formed in 2021 and based in Baton Rouge, Louisiana, is a provider of home health and hospice services throughout Louisiana. By: McGuireWoods LLP

TechCrunch: M&A

JULY 11, 2023

eBay announced today that it has closed its acquisition of Certilogo, a company that provides AI-powered apparel and fashion goods digital IDs and authentication. eBay’s acquisition indicates that it’s looking to boost secondhand fashion authentication on its marketplace. The financial terms of the deal were not disclosed.

JD Supra: Mergers

OCTOBER 23, 2024

A month prior, Sir Keir's government published its National Security and Investment Act 2021 (NSI Act) Report for the period 1 April 2023 to 31 March 2024 (Report) of scrutiny and intervention in proposed investments in or acquisitions of British companies or. By: Katten Muchin Rosenman LLP

JD Supra: Mergers

MAY 6, 2024

Regulatory changes and government antitrust scrutiny of merger and acquisition activity have led to increased attention to Hart-Scott-Rodino (HSR) Second Requests. In Fiscal Year 2022, merging parties filed 3,029 transactions eligible for Second Request with regulatory agencies—the second highest in almost 20 years, surpassed only by FY 2021.

How2Exit

DECEMBER 11, 2023

b' E167: Peterson Acquisitions: A Unique Approach to Buying and Selling Businesses with Devin Craig - Watch Here rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US.

TechCrunch: M&A

AUGUST 18, 2023

announced this morning its acquisition of Boxed.com and “other intellectual property portfolios and affiliates” in an all-cash transaction. MSG says it will continue to serve Boxed customers, vendors and brands following the acquisition. based regional distributor MSG Distributors, Inc. ”

TechCrunch: M&A

JULY 6, 2023

Prior to the acquisition, Paperspace raised $35 million from investors including Battery Ventures, Intel Capital, SineWave Ventures and Sorenson Capital. Erb sees the acquisition as a step toward a comprehensive offering of cloud CPU and GPU compute to rival other vendors in the public cloud market. .

TechCrunch: M&A

AUGUST 22, 2023

Sidus Space is taking another step toward full vertical integration with the acquisition of California-based Exo-Space , a startup that offers edge computing on orbit. The remainder of the acquisition is being paid via stock options and performance incentives, Sidus said in a statement. Since that time, Sidus has raised at least $5.2

TechCrunch: M&A

JUNE 26, 2023

It’s ThoughtSpot’s fourth acquisition following (most recently) the company’s purchases of SQL-based analytics firm SeekWell in March 2021 and data integration company Diyotta in May of that same year. Enabling all the deals is ThoughtSpot’s massive war chest, which totaled over $663 million as of August 2019.

JD Supra: Mergers

AUGUST 17, 2023

The deal market reached historic levels in recent years, with record-setting merger and acquisition activity in 2021. Markets have since cooled, with capital becoming harder to find. But any company preparing to sell within the next five years should consider the more common IP issues that arise during the legal due diligence process.

TechCrunch: M&A

JUNE 27, 2023

billion valuation during the heady fundraising days of late 2021 (and $100 million earlier in 2021), today announced that it has acquired identity verification service Berbix for $70 million in cash and stock transactions. This marks Socure’s first acquisition. Berbix previously raised a total of $11.6

TechCrunch: M&A

JUNE 13, 2023

Sincere roadmap With the addition of Timehop in its roster combined with the VidHug (now Memento) acquisition in 2021 , Punchbowl wanted to create a brand to encapsulate its work around creating memories. Hence its rebranding to Sincere.

TechCrunch: M&A

JUNE 27, 2023

Founded by the team behind Vera Security , BluBracket raised a $12 million Series A round led by Evolution Equity partners in 2021. The two companies did not disclose the price of the acquisition. Infrastructure automation company HashiCorp today announced that it has acquired code security startup BluBracket.

TechCrunch: M&A

JUNE 26, 2023

The deal marks Ramp’s first acquisition since it bought Buyer , a “negotiation-as-a-service” platform that claimed to save its clients money on big-ticket purchases such as annual software contracts, in August of 2021 and second since its 2019 inception. One salesperson is joining the Ramp team as well (Wang left Cohere in 2021).

Private Equity Info

NOVEMBER 14, 2023

Private equity firms are shifting towards smaller M&A deals, with add-ons becoming the dominant investment strategy.

Deal Lawyers

APRIL 18, 2025

The claim involved the acquisition of Codecademy by Skillsoft in November 2021, shortly after Skillsoft went public via de-SPAC. This Sidley Enhanced Scrutiny blog discusses the Delaware Chancerys recent rare pre-discovery dismissal of an entire fairness claim in In re Skillsoft Stockholders Litigation (Del. stake in […]

TechCrunch: M&A

MAY 31, 2023

Financial terms of the deal, which marks Stripe’s first acquisition since it bought card reader provider BBPOS in January of 2022, were not disclosed. Okay had seven employees prior to the acquisition. billion at a $50 billion valuation after being valued at $95 billion in March of 2021.

The Harvard Law School Forum

JANUARY 7, 2023

After a record-shattering year for M&A in 2021, a crescendo that built over a decade, powered by unique pandemic conditions, 2022 was, statistically, a reversion to the mean. trillion in 2021 and an average of $4.3 Acquisitions of U.S. Worldwide M&A volume was $3.6 trillion in 2022, as against $6.2 companies by non-U.S.

JD Supra: Mergers

JUNE 20, 2023

billion in 2021, there were only 18 with a total volume of EUR 5.3 Even KKR and Vodafone’s acquisition of Vantage Towers, a radio tower infrastructure company, By: White & Case LLP The number of takeovers and the total offer volume have both fallen significantly. billion in the first 11 months of 2022.

The New York Times: Mergers, Acquisitions and Dive

SEPTEMBER 29, 2024

The automaker, created by a 2021 merger, is dealing with labor unrest, slumping sales and a revolt from its dealers.

Sica Fletcher

FEBRUARY 2, 2022

And What We Anticipate in 2022 2021 is finally behind us, and, as the old curse goes, we still appear to be living in interesting times. 2021 was not an easy year, and now that it's behind us we can't help but wonder what 2022 has in store. Will we see transaction multiples at last year’s levels? Or will the multiples decrease?

The TRADE

FEBRUARY 29, 2024

However, post-trade saw a double digit increase of 17.4%, driven in large part by the acquisition-minded strategy of the exchange over the last few years. David Schwimmer, chief executive of LSEG, asserted that 2023 had been a strong year for the business, with every target set out at the time of the Refinitiv acquisition having been met.

JD Supra: Mergers

AUGUST 8, 2023

Since mid-2022, the macro acquisition environment has faced the challenges of inflation and increasing interest rates, among a variety of other headwinds. Global deal flow is down from its 2021 peak.

JD Supra: Mergers

JULY 27, 2023

On July 19, 2023, the Department of Justice (DOJ) and the Federal Trade Commission (FTC) issued a draft version of new Merger Guidelines (Merger Guidelines), which would replace the 2010 Horizontal Merger Guidelines and the 2020 Vertical Merger Guidelines (the latter were rescinded by the FTC in September 2021). By: Bracewell LLP

The New York Times: Mergers, Acquisitions and Dive

FEBRUARY 21, 2024

The digital-media company, which has plunged in value, is selling the unit to Ntwrk at a significant discount from its 2021 purchase price.

TechCrunch: M&A

AUGUST 2, 2023

The companies said that the acquisition will include tech assets, customer relationships (that is, customers using the tools) and engineering, product and go-to-market talent. Coming off of a huge couple of years of business during the pandemic, in 2021, it was valued at nearly $7.7

TechCrunch: M&A

JUNE 26, 2023

Today, IBM made a big acquisition doubling down on the hybrid concept: it will pay $4.6 IBM said in its announcement that the acquisition is expected to close in the second half of 2023, pending regulatory and other approvals. Apptio is currently owned by PE firm Vista Equity Partners, which paid $1.94

The New York Times: Mergers, Acquisitions and Dive

JANUARY 15, 2024

Smith bought the newspaper and its sister publications in a private deal with Alden Global Capital, their owner since 2021.

PE Hub

JUNE 23, 2023

Under GPP, Valenz completed eight tuck-in acquisitions, including Kozani Health in 2021. The post Rise of self insurance fueled growth at Valenz before sale to Kelso appeared first on PE Hub.

Quest: Mergers & Acquisitions

DECEMBER 9, 2020

Thanks for sticking with me as I dive into the details of my eight predictions for 2021 ! On to the second half, starting with a subject that regular readers know is near and dear to my heart: mergers and acquisitions. billion acquisition of CardWorks. The outlook for M&A activity for 2021 is quite promising.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content