Growth Equity: The Child Prodigy of Private Equity and Venture Capital, or an Artifact of Easy Money?

Mergers and Inquisitions

MARCH 13, 2024

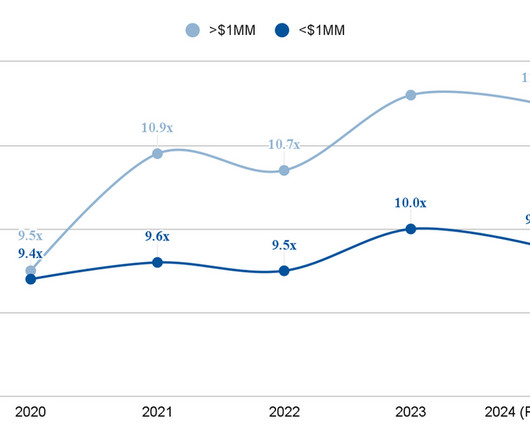

Some argue that GE offers the best of both worlds: the opportunity to fund innovation and growth – as in venture capital – plus the ability to limit downside risk and invest in proven companies – as in private equity. The Top Growth Equity Firms Why Did Growth Equity Get So Popular? Many hedge funds also joined the party.

Let's personalize your content