The S&P 500 is headed for a big first-half gain. Three key stocks have more than doubled

CNBC: Investing

JUNE 28, 2023

The S&P 500 is up nearly 14% year to date, putting it on track for its best first-half performance since 2021.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

JUNE 28, 2023

The S&P 500 is up nearly 14% year to date, putting it on track for its best first-half performance since 2021.

CNBC: Investing

OCTOBER 16, 2023

Pros on CNBC discussed Lululemon as the athletic clothing company climbed to its highest price since 2021.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

NOVEMBER 10, 2023

The broad index finished Thursday down, ending its longest win streak since 2021.

The TRADE

JANUARY 22, 2025

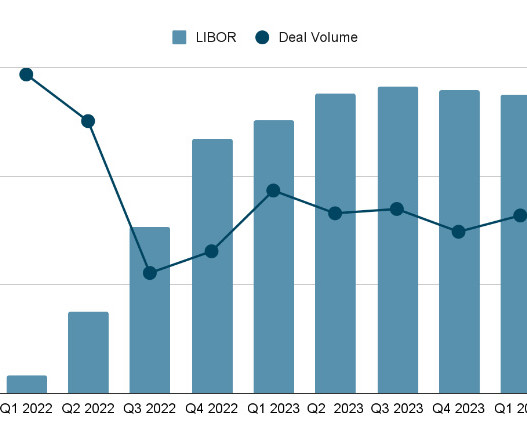

I was there through 2015, then Bank of America, before I joined Conversant Capital in early 2021. When Mike called me about the opportunity to join Conversant, he emphasised the firm’s long-term, buy-and-hold strategy, akin to private equity. There’s been a reopening in capital markets. It’s been busy.

The Deal

JUNE 22, 2023

Reed and Michael P. Chief legal officer Joshua S. Goldman Sachs Bank USA and JPMorgan Chase Bank NA are providing Nasdaq with bridge financing for the deal. Lam and Veblen counseled Nasdaq on its $2.75 billion purchase of Verafin Inc. Lam has done several other deals for Nasdaq, including its purchases of Solovis Inc. billion in 2016.

The Harvard Law School Forum

MAY 2, 2023

stock market in 2022 experienced increased volatility relative to 2021. Persistently high inflation, coupled with the fastest Fed tightening cycle seen since 1988, contributed to making 2022 the worst performing year for the S&P 500 Index since 2008, thrashing growth and technology stocks in particular. [1]

Focus Investment Banking

JULY 2, 2024

This was despite a generally favorable market that pushed the S&P 500 up 3.6% However, the sector still lagged both the S&P 500 and NASDAQ by a wide margin over the past year. The S&P 500 is up 26.3% and the NASDAQ up 4.0%. over this time frame, while the NASDAQ gained 29.4%.

Growth Business

MAY 23, 2023

London’s firms attracted $10.2bn of investment funds last year, only a 5 per cent drop from 2021’s figure – and there are still plenty of fintech roles available. Apply here.

Software Equity Group

MARCH 13, 2023

On the surface, things looked rough: the Dow Jones, S&P 500, and the NASDAQ all finished the year with significant losses, with tech stocks hit particularly hard. After the unprecedented market highs of 2020 into 2021, it’s natural for founders in this environment to wonder if they’ve missed the boat. 4Q22’s multiple of 5.6x

Mergers and Inquisitions

JANUARY 3, 2024

My portfolio did “OK” (up 10% for the year), but it greatly underperformed the S&P 500 , which was up 24%. On the other hand, I was only down 9% in 2022 vs. a 19% drop for the S&P, so both the index and my portfolio are now back to “early 2022” numbers.

Razorpay

JUNE 18, 2023

Traditional banking, which has been the go-to for hundreds of years now, has not been able to keep up with today’s tech-savvy customers. Tasks that typically require a visit to a physical branch, like depositing a cheque, can be done on the go from a user’s mobile phone or laptop. New-age banking is new.

The Deal

JULY 19, 2023

Cox, Andrew P. Denbury chief administrative officer and general counsel James S. Denbury joined The Deal’s Watch List and Crosshairs of possible activist targets in June 2021, given its potential appeal to supermajors such as Exxon or Chevron Corp. Also in 2021, ESG activist Engine No. McDonough at TPH&Co.

How2Exit

OCTOBER 10, 2023

-Ron rn rn rn About The Guest(s): Juan Braschi is the CEO of Boopos, a company that helps talented buyers acquire businesses and provides flexible financing for buying e-commerce and software-as-a-service (SaaS) businesses. Juan has a background in finance and technology, and he has experience in investment banking and private equity.

InvestmentBank.com

JANUARY 14, 2021

WiMi Hologram Cloud (NASDAQ: WIMI ) was the first IPO after the S&P 500, NASDAQ, NYSE and Dow Jones Industrial Average reached their respective 52-week lows on March 20, 2020, but this proved only the beginning of IPOs in the Covid-era portion of 2020 [14]. Retrieved January 3, 2021, from [link] [2] Cook, J. Kaplan, S.

Focus Investment Banking

SEPTEMBER 4, 2024

which in 2021 was acquired by a group of investors led by BayPine LP. and has been since 2021. According to S&P Global, the monetary value of dry powder reached $2.59 Incidentally, S&P Global estimates that Leonard Green & Partners alone was sitting on $15.3 based dealership in 2020.

Sica Fletcher

APRIL 2, 2024

Granted, these numbers are not quite at pre-pandemic levels yet (although they are close), and they are nowhere near the M&A boom of 2021. Founders Michael Fletcher and Al Sica are two of the industry's leading dealmakers who have advised on over $16 billion in insurance agency and brokerage transactions since 2014.

Focus Investment Banking

JANUARY 18, 2024

The S&P 500 has recently traded near 4800, close to its record at the end of 2021. As 2024 starts, the U.S. stock markets are at or near their all-time highs. It has taken two years to return to those levels, after 2022 and 2023 were burdened with interest rate hikes and fears of a recession.

How2Exit

MARCH 23, 2023

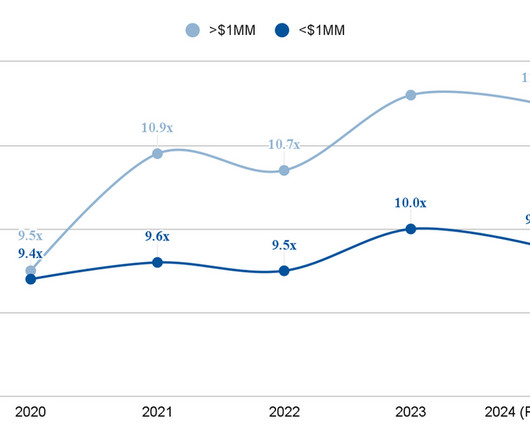

By 2021, the median deal size had increased to $1.8 For example, if the seller owns an e-commerce business with a majority of its sales coming from FBA, they may have a subscription to Jungle Scout or Helium 10 which can be added back to the P&L. This is especially true if the business is being sold to a third-party.

Sica Fletcher

JULY 23, 2024

Possible Changes in Tax Law May Drive Transactions H2 2021 specifically saw a small surge in deal volume because of expected increases to the laws surrounding capital gains taxes. Consult data sources like S&P Global data to get an idea of a firm’s activity within the industry. Are you meeting the firm’s principals?

The TRADE

OCTOBER 9, 2024

She joined Ninety One in 2021 from Royal London Asset Management where she had been head of dealing for three years. Markets are constantly challenging and that’s the key aspect to our role.” But sometimes you want to go to the road less trodden, and that’s when you make use of local brokers,” he says. “My

Sica Fletcher

MAY 29, 2024

Both are already rising as of Q2 2024 , with annual numbers expected to exceed those of last year, despite falling short of the highs of 2021. Founders Michael Fletcher and Al Sica are two of the industry's leading dealmakers who have advised on over $16 billion in insurance agency and brokerage transactions since 2014.

FineMark

OCTOBER 17, 2023

Equities and the S&P 500 At the onset of each new year, like clockwork, we’re asked for our near-term view. benchmark equity index, the S&P 500. Consequently, by the end of July 2023, the S&P was up more than 20% for the year. This year was no different.

Sica Fletcher

JUNE 20, 2024

PE firms rely on leveraged buyouts (LBOs) for the lion's share of their deals, which often involve using the acquired company’s assets as collateral to insure the loan used to purchase it. Deal Volume Has Lowered Deal volume has never quite recovered from the near-record numbers posted in 2021.

Transactional Delights

FEBRUARY 14, 2021

“ Generally Accepted ESG Reporting Principles ” – Samuel Liss argues that there needs to be more standardization from some regulatory third-party, but it won’t be easy as “ E&S is difficult to tightly define, and cross-currents influencing the definition will intensify. and $2,000 in Canada”. That’s one to watch.

The TRADE

JANUARY 18, 2024

He explains: “If somebody’s entering a huge notional-sized order into the marketplace, they might not want to put that on-screen. When you look on-screen, the size and price you see in the screens isn’t necessarily the full market, it’s what the market makers are comfortable quoting electronically.

Mergers and Inquisitions

DECEMBER 4, 2024

SPAC IPOs for esports companies were “hot” for a short period in 2021, but they seem to have died off by now. My high-level summary would be: 1) Focus on Revenue Multiples – Many teams are not run efficiently and have low/negative cash flows and earnings, so revenue multiples are more common than EBITDA , P/E, or other valuation multiples.

FineMark

JANUARY 17, 2024

This strong push in November and December ended the long stretch of losses that fixed-income investors have endured since 2021. The equity market also noted the Fed’s comments as investors piled back into equities and the S&P 500 finished the year up more than 26%. in the rising rate period and 11.8%

InvestmentBank.com

MAY 26, 2021

Though to a significantly lesser degree than in the early months of COVID, look into the rest of 2021 and beyond features continued uncertainty in the debt market. COVID-19’s impact on M&A activity varied across industries, with some reaping the benefits and others not being so lucky. So where do we go from here?

Mergers and Inquisitions

APRIL 10, 2024

This happened for a few reasons: 1) Soaring Valuations – Many sources say that sports team valuations “outperformed” the S&P 500 over the past 20 years, which is a polite way of saying that many teams are now valued at extremely high multiples. When the fans are passionate, there are infinite ways to milk the brand’s value.

Cooley M&A

JANUARY 20, 2022

Although the COVID-19 pandemic that defined 2020 continued to shape much of the life sciences industry in 2021, the way that it did was markedly different. 2] Examples of this strategy coming to bear in 2021 included Thermo Fisher Scientific’s acquisition of PPD for $17.4 on transactions over 2019’s mega?mergers. driven assets.

Cooley M&A

FEBRUARY 1, 2024

2023’s much-discussed downturn in mergers & acquisitions – with global M&A volume and value down 6% and 17%, respectively, from 2022 – was largely driven by the slowdown in the tech sector, with global tech M&A volumes down 51% year over year, while other sectors saw marked increases. [1] billion leading the pack.

The TRADE

APRIL 14, 2025

S&P Global and CME Group today have signed a definitive agreement to sell post-trade solutions provider OSTTRA to investment funds managed by KKR. billion and is set to be divided evenly between S&P Global and CME Group as each hold a 50% interest. The post CME and S&P offload OSTTRA in $3.1

The TRADE

APRIL 15, 2025

New addition Biagini joins from S&P Global where he most recently served as head of data, valuations and risk analytics. Lefferts has been with LSEG since 2021, currently serving as group head of sales and account management and has been a member of the executive committee since 2023.

Focus Investment Banking

JANUARY 14, 2025

This significantly underperformed the returns of both the S&P 500 (up 2.1%) and the NASDAQ (up 6.2%) over the corresponding time frame.When viewed over the past 12-months, the TBSI is down 3.1%. The S&P 500 is up 23.3% Once again, this compares unfavorably to the broader indices. revenue and 10.5x

Cooley M&A

JANUARY 30, 2025

In 2024, the rate of CEO turnover following an activist campaign rose to approximately 20% of CEOs of activist targets having left their roles in the past two years (as compared to the 12% market-average CEO turnover for the S&P 500 index). Assembling a response team of seasoned advisors. [1]

Growth Business

FEBRUARY 5, 2025

But there’s a lot to unpack. Recommended Provider (2021-2024). How many Mbps do you really need? And does it make any difference if you have a static or dynamic IP address? Box router. It has been a Which? Available speeds and packages depend on business location. Pricing (excl. VAT): Superfast Fibre Broadband 27.95/month

Focus Investment Banking

MARCH 17, 2025

David Dart: Well, well, there’s a couple of really important elements that we’re driving here at Caliber Number one, our technician apprentice program. So that’s a really critically important talent development function that we have. Cole Strandberg: Let’s do both. I think that’s insanely important.

InvestmentBank.com

MAY 18, 2021

Government funded programs include Medicare, Medicaid, Children’s Health Insurance Program, and the Veterans Health Administration. Over the last year, the biotech industry has seen considerable growth compared to the S&P 500. Lee & Robert S. SPDR S&P Biotech ETF (XBI), Yahoo!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content