Cooley’s 2022 Life Sciences M&A Year in Review

Cooley M&A

JANUARY 25, 2023

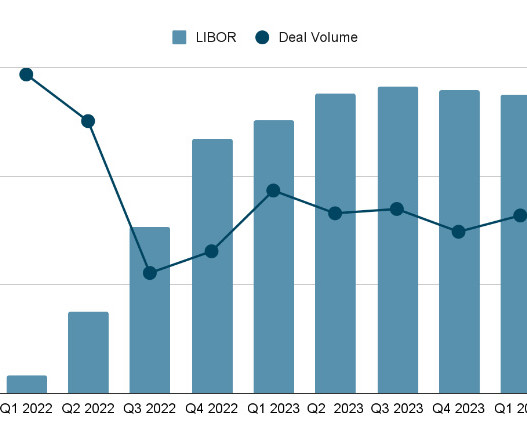

Although 2022 saw a general decline in M&A activity in the life sciences industry compared to 2021’s frenetic pace (when deal volume was up 52% from 2020 ), life sciences deal flow in 2022 on balance remained strong despite the headwinds. Let’s dig in. Let’s dig in.

Let's personalize your content