The 5 Influences Shaping Software M&A Valuations in 2024

Software Equity Group

MAY 8, 2024

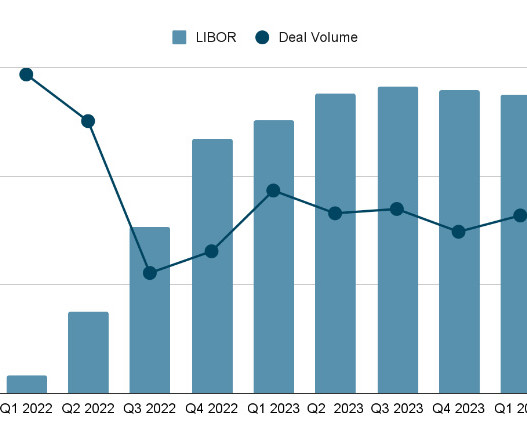

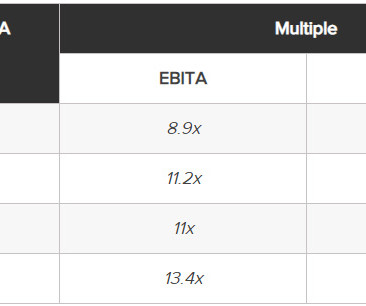

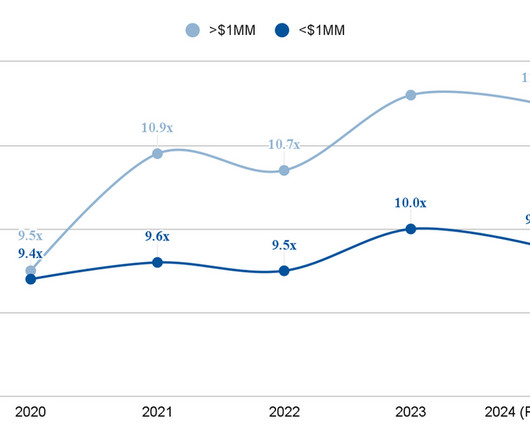

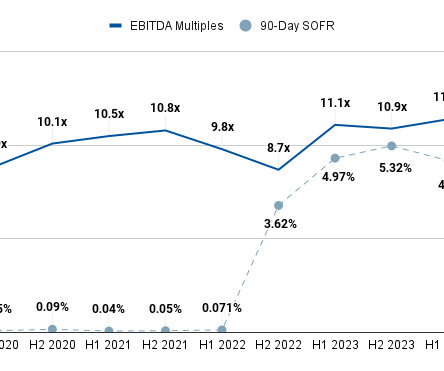

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. But what are the key influences shaping valuation multiples in today’s M&A deals? The most active verticals in 2023 were Healthcare, Financial Services, and Real Estate.

Let's personalize your content