Global software M&A volume rebounds

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

Solganick & Co.

SEPTEMBER 30, 2022

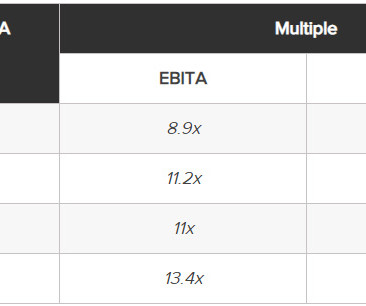

September 30, 2022 – Manhattan Beach, CA and Dallas, TX – Solganick & Co. has published its latest Healthcare IT M&A Update for Q2 2022. You can download the full report here: Solganick HCIT Q2 2022 M&A transactions have remained active in the healthcare IT sector in Q2 2022. Consumer Health 3.7x

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Software Equity Group

FEBRUARY 28, 2023

Our report provides context for private companies to better understand factors influencing their valuations and evaluate how they can position themselves within a changing marketplace. It is no secret that 2022 was a rough year for the stock market. At the end of 2022, EV/Revenue multiples were still 15% higher than in 2018.

Sica Fletcher

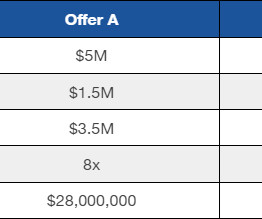

JUNE 11, 2024

The following report contains our projections for Q3 2024 insurance broker valuation multiples. Insurance Broker Valuation Multiples: Q3 2024 Projections Using these numbers as a baseline, let’s examine the insurance industry more closely to identify influential factors behind its specific changes. as of H1 2024.

Chesapeake Corporate Advisors

JANUARY 13, 2023

2022 was a strong year for CCA, following a record-breaking 2021. In the video below, CCA Managing Partner, Charlie Maskell, Director, Tim Brasel, and Managing Director, Mike Zuidema break down the CCA team, investment banking, and corporate advisory highlights from 2022.

Sica Fletcher

MARCH 12, 2024

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

Focus Investment Banking

JUNE 12, 2023

Thriving US Middle Market Fundraising and Resilient Private Equity Regarding Global M&A Private Equity Trends, looking at the positive news, the US middle-market fundraising landscape remained stable throughout 2022, with 156 funds closing at an aggregate value of $133.5 trillion as of June 30, 2022.

FineMark

JANUARY 20, 2023

These periods are now known as “Minsky Moments.” 2022: One for the Record Books These days, words such as “unprecedented” or “extraordinary” seem overused in our daily vernacular, however, they do feel appropriate when describing 2022. Seventy years of peace in Europe were shattered as Russia invaded Ukraine in February 2022.

Software Equity Group

DECEMBER 18, 2023

Given geopolitical instability, high interest rates, and the perception that B2B SaaS valuation multiples are declining, it is no great surprise that many founders interested in pursuing a transaction are considering delaying a liquidity event. Continue reading to learn more about what is driving today’s B2B SaaS valuation multiples.

TechCrunch: M&A

JULY 27, 2023

Uplift had raised nearly $700 million in equity and debt, securing $123 million at a reported $195 million valuation in its Series C round alone. Klarna , once Europe’s most valuable VC-backed company, suffered an 85% valuation cut, from $45.6 billion in July 2022 following an $800 million round. billion to just $6.7

Software Equity Group

MAY 7, 2024

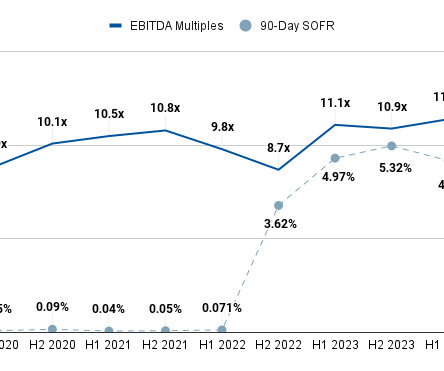

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. In 2022 and 2023, the Fed raised interest rates repeatedly to counteract high inflation.

Software Equity Group

MAY 8, 2024

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. In 2022 and 2023, the Fed raised interest rates repeatedly to counteract high inflation.

Software Equity Group

DECEMBER 21, 2023

Software Equity Group closely monitors M&A activity, historical trends, and insights from the investor and strategic buyer community to paint a more complete picture of what’s happening. Here’s a closer look at what the future looks like for the SaaS M&A market and its valuation multiples.

Growth Business

MARCH 1, 2024

By Dom Walbanke on Growth Business - Your gateway to entrepreneurial success Raising private equity funds is seen as the holy grail for businesses who want to grow quickly, simply because the strength of capital opens the door for rapid growth.

The Harvard Law School Forum

SEPTEMBER 22, 2022

Posted by Gregory Pryor and Michael Deyong, White & Case LLP, on Wednesday, September 21, 2022 Editor's Note: Gregory Pryor and Michael Deyong are partners at White & Case LLP. As predicted in our previous M&A report, 2022 has not lived up to the runaway performance of 2021. more…).

Lake Country Advisors

JULY 5, 2022

Various sectors from different industries have experienced consistent growth in 2022, thanks to the professional services of reliable M&A business advisors in Wisconsin. Why is it a Seller’s Market for a Merger or Acquisition in 2022? How to Sell a Profitable Wisconsin Business in 2022?

Cooley M&A

JANUARY 25, 2023

Although 2022 saw a general decline in M&A activity in the life sciences industry compared to 2021’s frenetic pace (when deal volume was up 52% from 2020 ), life sciences deal flow in 2022 on balance remained strong despite the headwinds. Let’s dig in. Let’s dig in.

Software Equity Group

MARCH 13, 2023

The public markets may have taken a beating, but behind the gloom-and-doom headlines, there was still plenty of good news for private SaaS companies in 2022. Following are some highlights of SaaS M&A deal activity over 2022. Median EV/TTM Revenue Multiple Down from 2021’s high of 7.3x, 2022’s median EV/Revenue multiple of 5.6x

Growth Business

JULY 19, 2023

Some commentators predicted 2022 would be even bigger. There’s a lot of capital available to start-ups today, and seed rounds in 2022 were closer to the Series A rounds of 2012. Alongside raise amount and dilution is the all-important valuation. On valuation, there’s one golden piece of advice: never suggest one to a VC.

Sica Fletcher

JUNE 20, 2024

The History of Private Equity in Insurance One of the primary forces differentiating the insurance M&A market in 2024 from those of decades past is the presence and dominance of private equity (PE) firms in the buyer space. The table of contents below offers quick links for readers seeking specific information in later sections.

Focus Investment Banking

SEPTEMBER 19, 2024

Here’s how: Lower Cost of Debt Private equity firms typically use leverage (borrowed capital) to finance a significant portion of their acquisitions. Valuation Dynamics While lower interest rates may fuel M&A activity by making financing cheaper, they also influence company valuations.

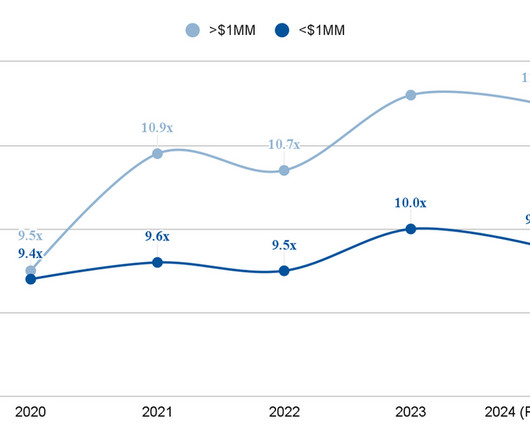

Sica Fletcher

MARCH 8, 2024

Starting in H2 2022, the insurance M&A market has seen a notably difficult 18-month period, afflicted with high interest rates, lowered deal volumes, and lowered valuations. If they do, then we can expect to see valuations and, by extent, EBITDA multiples for insurance agencies rise.

Cooley M&A

OCTOBER 12, 2022

On September 28, 2022, Cooley sponsored the third virtual event in Axios’ Dealmakers series: A Conversation on M&A in Today’s Market. In their discussion, Leigh and Drumond surveyed 2022’s volatile deal flow, market outlook and impacts on various deal participants.

TKO Miller

MAY 11, 2023

Packaging Trends Q1 M&A Update Valuations continue to remain strong across the packaging industry, despite economic uncertainty, looming economic questions, and evidence of a slight slow down in dealmaking; as a result, companies with solid fundamentals can attract premium valuations Private equity was responsible for much of the transaction volume (..)

Mergers and Inquisitions

MARCH 13, 2023

Banks’ lending activities are constrained by: Regulatory Capital – All banks must maintain a certain amount of common shareholders’ equity to absorb unexpected losses on loans and other assets. So, as the Fed hiked rates in 2022 into 2023, all these securities lost value.

Solganick & Co.

MARCH 11, 2022

March 11, 2022 – Solganick & Co. “Public market software company valuations have been battered starting in November of 2021. “We’re not seeing that in the lower middle market, where 2022 M&A is off to a brisk pace, with near-record investor interest and plenty of ready capital available to fund deals.”

Intrepid Banker Insights

OCTOBER 17, 2022

Intrepid Investment Bankers A Rollercoaster Ride for Software Markets It has been a disconcerting journey through the first three quarters of 2022. We ended 2021 having survived another year of the pandemic, with equity markets at or near all-time highs, interest rates near historic lows, and technology M&A activity at record levels.

The Deal

OCTOBER 17, 2023

Direct-to-consumer businesses, darlings of the investor community in 2021, saw their techlike valuations plummet. “We do think some of the transactions that may have launched in 2022 will start to get done in the back half of 2023.”

Cooley M&A

FEBRUARY 7, 2023

That said, cross-border M&A remained largely resilient in 2022, with a return to healthy pre-pandemic levels, and while the types of deals we see in 2023 may evolve, many observers believe that deal volume will remain buoyant throughout the year. Regulators, particularly in the US, are becoming more skeptical of remedies in merger cases.

Focus Investment Banking

MAY 10, 2024

During the same time, private equity firms started betting on the sector, particularly in specialty segments. And private equity firms saw untapped growth potential in food distribution, especially in the produce segment. Financial : Private equity groups seeking to acquire a company as an investment. What’s Ahead?

The Deal

DECEMBER 5, 2023

Mubadala co-invested with Vista Equity Partners LLC in the $8.4 billion, both in 2022. Other parts of Mubadala will pick up smaller equity checks. “We’re seeing digital transformation across a variety of horizontal software capabilities,” Osman said. billion buyout of tax compliance software maker Avalara Inc. and the $2.3

FineMark

JANUARY 17, 2024

The equity market also noted the Fed’s comments as investors piled back into equities and the S&P 500 finished the year up more than 26%. Eventually, the Consumer Price Index retracted, dropping from its peak of 9% in summer 2022 to its current rate of about 3%. in the rising rate period and 11.8%

Sica Fletcher

JULY 23, 2024

Since H2 2022, industries across the board (including insurance) have seen declines in deal volume as prospective buyers have withheld their funds for more favorable conditions in which the cost of debt is not so high. On average, modern deal structures typically consist of about 75% equity, with only 25% in actual cash.

Focus Investment Banking

JANUARY 18, 2024

It has taken two years to return to those levels, after 2022 and 2023 were burdened with interest rate hikes and fears of a recession. And, at least in recent years, there has been enough capital at private equity firms to handle any liquidity needs. As 2024 starts, the U.S. stock markets are at or near their all-time highs.

Sica Fletcher

MAY 29, 2024

2) our team noted unexpected increases in the valuation multiples offered for insurance agencies, as depicted below. In only the last two years, we’ve seen the percentage of equity in insurance M&A transactions double, indicating a strong growth trajectory for equity to play increasingly larger roles in future deals.

Solganick & Co.

DECEMBER 21, 2023

While overall deal volume dipped slightly compared to the record-breaking highs of 2022, falling by around 5%, the total value of transactions remained surprisingly resilient, hovering near the $400 billion mark, according to data from S&P Global Market Intelligence.

Cooley M&A

JANUARY 30, 2024

Globally, 229 campaigns launched in 2023, just under 2022 campaign levels, ushering in the most active two-year period on record. [1] 1] Activism in Europe was a core driver of activity, representing 28% of all campaigns and a 30% increase from 2022. [2] 4] Activists won 134 board seats globally in 2023, a 30% increase from 2022.

Sica Fletcher

JULY 11, 2024

On the other hand, deal volume has seen small dips and valleys since the start of the economic downturn in H2 2022, as depicted in the graph below: Insurance M&A Deal Volume, 2020-2023 This indicates that buyers in 2024 are happy to pay more than before for insurance brokerages (and buy at a loss, in some cases).

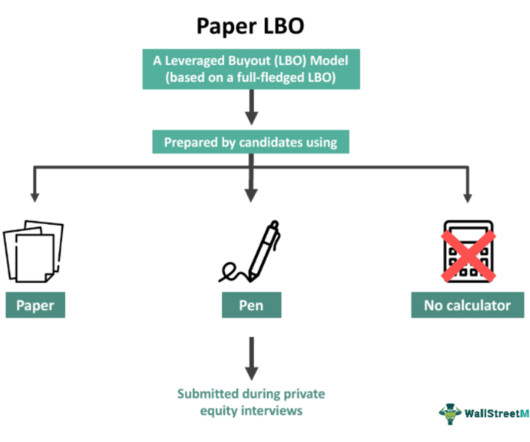

Wall Street Mojo

JANUARY 4, 2024

A Paper LBO, also called a Pen and Paper LBO, usually prepared by candidates during private equity interviews, is a miniature paper version of a full Leveraged Buyout (LBO) Model. Further, it helps interviewers assess a candidate’s knowledge of private equity concepts. What Is A Paper LBO?

Growth Business

MAY 31, 2023

By Dom Walbanke on Growth Business - Your gateway to entrepreneurial success According to research from Beauhurst , the first quarter of 2022 was the top performing equity investment quarter on record, with £7.28bn invested into UK start-ups. Investors typically invest between £250,000 and £2m in equity funding in tech start-ups.

Cooley M&A

JANUARY 23, 2024

While the year saw an overall decline in M&A activity (down 17% from 2022) , total pharmaceuticals and life sciences deal value in 2023 increased by approximately 50% compared to 2022. Why did life sciences outperform the market? The last quarter of the year ended with a surge of deal activity. billion, Mirati for $5.8

Cooley M&A

NOVEMBER 20, 2023

Compensation matters, including retention packages, equity treatment and related disclosure, are always key negotiating points in M&A transactions. Typically, M&A transactions involve converting target equity awards into buyer equity awards and granting new hire and retention awards to incoming employees.

Software Equity Group

FEBRUARY 5, 2024

SaaS Company X: Bridge Analysis Example Let’s say Company X ended 2022 with 100 customers worth $1,000,000 in ARR. We can also see that the customers Company X lost were smaller than the average customer size of $10,000 in 2022. This would be the starting customer count and ARR for 2023.

Sun Acquisitions

FEBRUARY 10, 2023

In 2022 there were at least 132, 228 hotels and motels scattered across the U.S., Step #2 Have a Business Valuation Done Determining the value of your hotel is best left to a business valuation expert. Market trends: These will be weighed into the final valuation. more than in 2021.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content