Global software M&A volume rebounds

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

JD Supra: Mergers

OCTOBER 17, 2023

Through the first half of 2023, the themes of 2022 (reduced deal volume and more competition for private equity deals) continued to cause the deal landscape to be exceedingly tough. According to Bain & Company’s Private Equity Midyear Report 2023, “uncertainty is the enemy of dealmaking, and uncertainty has been.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

SEPTEMBER 26, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Asset/Wealth Management - Sub-sector M&A activity levels soar—market moving deals across wealth management, financial planning, fund management, debt servicing, trust administration, direct lending and private equity funds in the last 12 months.

TM Capital

MARCH 4, 2022

In BDO’s latest PErspectives podcast, Steve Hunter, Managing Director at TM Capital, and others discuss the shifting lifecycle, inflation, deal disruptors, workforce challenges and ESG — the trends and forces defining private equity M&A in 2022. Realized.

Focus Investment Banking

JUNE 12, 2023

Thriving US Middle Market Fundraising and Resilient Private Equity Regarding Global M&A Private Equity Trends, looking at the positive news, the US middle-market fundraising landscape remained stable throughout 2022, with 156 funds closing at an aggregate value of $133.5 trillion as of June 30, 2022.

Mergers and Inquisitions

FEBRUARY 2, 2022

based roles at large banks as of early 2022, along with total compensation from 2021. And then, in January 2022, many banks increased Analyst base salaries again so that 1 st Years earn $110K and 2 nd Years earn $125K. Unfortunately, that has made it difficult to determine the “average ranges.”. Is it $80K + $85K = $165K? VPs: 25-30%.

Solganick & Co.

SEPTEMBER 30, 2022

September 30, 2022 – Manhattan Beach, CA and Dallas, TX – Solganick & Co. has published its latest Healthcare IT M&A Update for Q2 2022. You can download the full report here: Solganick HCIT Q2 2022 M&A transactions have remained active in the healthcare IT sector in Q2 2022.

The Harvard Law School Forum

SEPTEMBER 22, 2022

Posted by Gregory Pryor and Michael Deyong, White & Case LLP, on Wednesday, September 21, 2022 Editor's Note: Gregory Pryor and Michael Deyong are partners at White & Case LLP. As predicted in our previous M&A report, 2022 has not lived up to the runaway performance of 2021. Rates and financing costs to increase.

Private Equity Info

AUGUST 15, 2023

Once a nascent industry, digital media companies have become attractive targets for top private equity firms. The chart below shows the trend of private equity platform investments in digital media companies since 2010.

Solganick & Co.

JANUARY 30, 2023

has issued its latest M&A Update report for the Education, Learning and Training Technology (EdTech) sector, summarizing Q4 2022 and 2023 outlook. Mergers and acquisitions in the EdTech industry have been on the rise since 2020 yet cooled off in 2022. ’s EdTech M&A group, please contact us.

OfficeHours

AUGUST 20, 2023

Written by a Top OfficeHours Private Equity Coach Is PE a Good Fit for you? To know if the buyside is right for you, let’s start with a textbook understanding of “What is private equity?” Many first-year (and some second-year) analysts are unsure if private equity should be their next step.

Benchmark International

MAY 24, 2023

After a very active year in 2021 and a reasonably robust market in 2022, M&A deal-making in the healthcare sector will soar in 2023 thanks to much corporate cash and private equity sitting on plenty of dry powder.

Lake Country Advisors

JULY 5, 2022

Various sectors from different industries have experienced consistent growth in 2022, thanks to the professional services of reliable M&A business advisors in Wisconsin. Why is it a Seller’s Market for a Merger or Acquisition in 2022? How to Sell a Profitable Wisconsin Business in 2022?

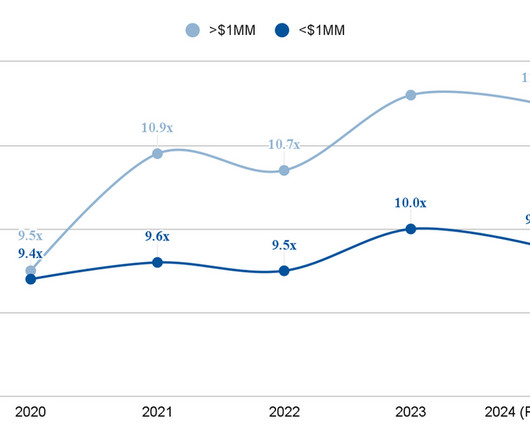

Software Equity Group

MARCH 13, 2023

The public markets may have taken a beating, but behind the gloom-and-doom headlines, there was still plenty of good news for private SaaS companies in 2022. But although the environment has certainly changed, private markets have a different story to tell. Following are some highlights of SaaS M&A deal activity over 2022.

OfficeHours

OCTOBER 23, 2023

However, for private equity investors, this uncertainty represents a unique opportunity to take advantage of investment opportunities in public markets. A “take-private” transaction in the context of private equity is a process by which a PE firm acquires a publicly listed company and converts it into a privately held entity.

Equiteq

NOVEMBER 21, 2022

But EBITDA for management consultancies in the sector appears to be falling – suggesting enthusiasm may cool among private equity investors in the coming year. Deals for life science professional services firms continue at pace, according to a new report.

PE Hub

JUNE 22, 2023

Private equity buyers offer favorable terms to close M&A deals in 2022: an analysis. The post Tools and tactics for getting deals across the finish line appeared first on PE Hub.

Cleary M&A and Corporate Governance Watch

JANUARY 24, 2024

The M&A Environment in 2024 Global deal value in 2023 fell to the lowest level seen in a decade. It was the first year since 2013 that the M&A market failed to hit the $3 trillion value mark, with continued reduced deal activity from private equity firms, which spent 36% less on acquisitions than in 2022.

Focus Investment Banking

JUNE 13, 2023

Compared to other medical fields like dentistry and dermatology, private equity involvement in orthopedic practices has been relatively small. But there have been more deals recently, including 15 alone in 2022. But that’s been changing over the past few years and is likely to continue to grow moving forward.

IBG

JUNE 7, 2023

Four of IBG Business’s partners were recognized by M&A Source on May 24 at the organization’s 2023 Spring Conference & Deal Market in Orlando, Florida. Jim’s award marked his second M&A Source recognition in three years; he was named “Advisor of the Year” in 2021.

Chesapeake Corporate Advisors

JANUARY 13, 2023

2022 was a strong year for CCA, following a record-breaking 2021. In the video below, CCA Managing Partner, Charlie Maskell, Director, Tim Brasel, and Managing Director, Mike Zuidema break down the CCA team, investment banking, and corporate advisory highlights from 2022.

Focus Investment Banking

MAY 10, 2024

In this article, which joins our ongoing coverage of the Food & Beverage industry, we introduce an overview of M&A activity in food distribution with a focus on fresh food. M&A activity flourishes in large industries undergoing growth and stress, making food distribution ripe for dealmaking. What’s Ahead?

Sica Fletcher

FEBRUARY 2, 2022

And What We Anticipate in 2022 2021 is finally behind us, and, as the old curse goes, we still appear to be living in interesting times. 2021 was not an easy year, and now that it's behind us we can't help but wonder what 2022 has in store.

Focus Investment Banking

JUNE 21, 2024

Washington, DC, (June 21, 2024) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, has been recognized as a leading M&A advisor in the industrials sector. For more information, visit www.focusbankers.com.

Peak Frameworks

OCTOBER 4, 2023

Texas A&M is a public, land-grant research university located in College Station, Texas. Texas A&M is the largest school in the U.S. Texas A&M also has a highly-renowned athletics program and student life. Texas A&M has a respectable Presence score of 41% and an Elite Firm Hires % of 48%. Welsh III U.S.

Solganick & Co.

MARCH 11, 2022

March 11, 2022 – Solganick & Co. has been named by Axial as a top software M&A advisory firm. Following a record-setting 2021 for lower middle market software M&A, the Software Top 50 highlights the most active software-focused dealmakers on the Axial platform. We expect this trend to continue in 2022.”

The Deal

OCTOBER 17, 2023

On the latest episode of The Deal’s Behind the Buyouts podcast, Solomon Partners co-head of consumer and retail Cathy Leonhardt talks about the sector’s slow start to M&A this year, categories that continue to shine and potential signs of a resurgence in dealmaking.

Cooley M&A

OCTOBER 12, 2022

On September 28, 2022, Cooley sponsored the third virtual event in Axios’ Dealmakers series: A Conversation on M&A in Today’s Market. Fabricio Drumond, Axios’ chief business officer, then led a “View From the Top” segment with Jamie Leigh – Cooley partner, member of the business department leadership team and M&A co-chair.

Solganick & Co.

JANUARY 21, 2024

2023 Technology Services and IT Consulting M&A: Consolidation, Retooling, and a Cautious Optimism for 2024 The Technology Services and IT Consulting M&A landscape in 2023 mirrored the broader market’s cautious dance.

Equiteq

APRIL 6, 2023

M&A volumes across the ecosystems of Adobe and Salesforce held steady in 2022, when other market segments endured a steep decline. New global studies of both suggest that heightened private equity interest will see deal rates maintain higher levels in the coming year, too.

Focus Investment Banking

JUNE 19, 2023

Washington, DC, (June 19, 2023) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, has been recognized as a leading M&A advisor in the industrial industry.

Focus Investment Banking

APRIL 14, 2024

These characteristics, coupled with bakery manufacturers’ ability to continually innovate and adapt to consumer trends, have attracted investors and boosted M&A activity in recent years. bakery market has shown steady historical growth, with industry revenue rising roughly 4% annum from 2004 to 2022. The $75 billion U.S.

Sica Fletcher

JUNE 20, 2024

The insurance M&A market in 2024 is significantly more complex now than it was 20 years ago. However, this report seeks to make sense of these qualities as a whole to provide an overview of the 2024 insurance M&A market. The table of contents below offers quick links for readers seeking specific information in later sections.

Sica Fletcher

AUGUST 30, 2023

The Sica | Fletcher Agency & Broker Buyer Index is the most comprehensive report on insurance brokerage M&A activity in existence. The Sica | Fletcher Agency & Broker Buyer Index is the most comprehensive report on insurance brokerage M&A activity in existence.

Sica Fletcher

MAY 29, 2024

M&A transactions for insurance companies are part of a robust but complicated market that requires ingesting a great deal of data in order to fully understand. While insurance M&A did see slight dips in deal volume and average value (Fig.2)

Software Equity Group

DECEMBER 21, 2023

While the software M&A market feels the impact of some of the same macroeconomic forces affecting public companies, it’s important to consider the two markets experience separate trajectories. As such, the software M&A market outlook is still strong overall. The following content has been updated as of December 2023.

Software Equity Group

DECEMBER 18, 2023

A Glimpse into the Current SaaS M&A Environment The world of software M&A has never been more exciting for private equity firms and strategic buyers , who view SaaS companies as attractive due to their predictable revenue, capital efficiency, scalability, and ability to measure success. billion in 2023, a 21.7%

Solganick & Co.

DECEMBER 21, 2023

Navigating the Current M&A Landscape for IT Services: Cloud & Data Analytics Partners Take Center Stage by Aaron Solganick, CEO, Solganick & Co. December 21, 2023 The IT services M&A scene in 2023 has painted a dynamic picture, marked by both cautious optimism and strategic boldness.

OfficeHours

JUNE 27, 2023

Early Start Dates Last year, on-cycle recruiting kicked off before Labor Day Weekend, making it t he earliest private equity on-cycle kick-off in history. Our program supplements self-studying with a hands-on approach on everything you need to know to get the best chance of getting a job in Private Equity.

Software Equity Group

MAY 7, 2024

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. But what are the key influences shaping valuation multiples in today’s M&A deals? Do you know how potential buyers value your SaaS business?

Software Equity Group

MAY 8, 2024

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. But what are the key influences shaping valuation multiples in today’s M&A deals? Do you know how potential buyers value your SaaS business?

Software Equity Group

APRIL 24, 2024

SaaS, of course, plays a central role in these efforts, driving a heightened level of M&A activity in the software space. M&A Overview: The Quest for Industry 4.0 After a gradual decline since the mid-20th century, the U.S. manufacturing and industrial sector is making a comeback. Now, signs of recovery are emerging.

Software Equity Group

AUGUST 13, 2024

In 2022, the higher-ed tech market was estimated to be about $36.2 In short, technology is changing the face of Education as we know it, and software is playing a leading role. For the sake of market analysis, the Education sector is typically divided into two broad categories: K-12 and higher education (colleges and universities).

Cooley M&A

JULY 28, 2022

Purchase price adjustment mechanisms are common in private M&A transactions to determine the final price to be paid by the buyer. In the UK and Asia, what is commonly referred to as the “locked-box” approach is more frequently used, particularly in auction processes, corporate carve outs and private equity transactions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content