Global software M&A volume rebounds

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

JD Supra: Mergers

SEPTEMBER 25, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Fintech - Whilst many European start-ups have struggled to successfully execute funding rounds at valuation levels of yesteryear, more mature fintechs have pivoted to acquisitions and partnerships to fuel growth.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

SEPTEMBER 30, 2024

Megadeals were firmly on the agenda in H1 as more stable inflation and attractive valuations boosted boardroom confidence. A total of 51 deals worth more than US$5 billion each were announced during the first six months of the year—the highest number in this price bracket since H1 2022. But can the bull run be sustained?

JD Supra: Mergers

SEPTEMBER 20, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Consumer Finance - Europe's consumer finance decacorns stumble as their valuations crumble. By: White & Case LLP

TechCrunch: M&A

JUNE 22, 2023

The company announced its most recent raise of $15 million in December, when it also touted a 50% boost in its valuation. The company announced its most recent raise of $15 million in December, when it also touted a 50% boost in its valuation. For example, Petal raised $140 million in 2022 at an $800 million valuation.

The Harvard Law School Forum

SEPTEMBER 22, 2022

Posted by Gregory Pryor and Michael Deyong, White & Case LLP, on Wednesday, September 21, 2022 Editor's Note: Gregory Pryor and Michael Deyong are partners at White & Case LLP. As predicted in our previous M&A report, 2022 has not lived up to the runaway performance of 2021. Rates and financing costs to increase.

Solganick & Co.

OCTOBER 7, 2022

October 7, 2022 – Manhattan Beach, CA – Solganick & Co. has published its latest Healthcare IT M&A Update for Q3 2022. The report covers the latest mergers and acquisitions trends and valuations for the industry sector. ’s Healthcare IT M&A Group Solganick & Co.

Solganick & Co.

SEPTEMBER 30, 2022

September 30, 2022 – Manhattan Beach, CA and Dallas, TX – Solganick & Co. has published its latest Healthcare IT M&A Update for Q2 2022. You can download the full report here: Solganick HCIT Q2 2022 M&A transactions have remained active in the healthcare IT sector in Q2 2022.

JD Supra: Mergers

JULY 12, 2023

Overview - The year 2022 started strong but proved to be a mixed year for M&A in what could be described as a return to earth after the record-setting year that was 2021. M&A market alone exceeded $2 trillion in 2021 – a staggering figure that crushed (by nearly 30%) the then-existing record established in 2015.

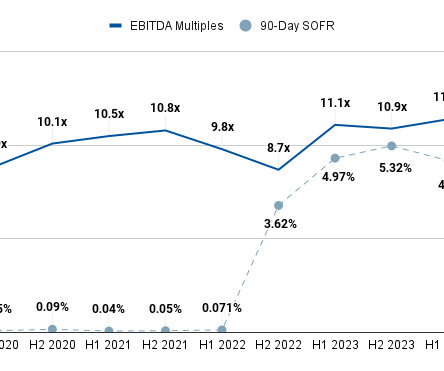

Software Equity Group

MAY 7, 2024

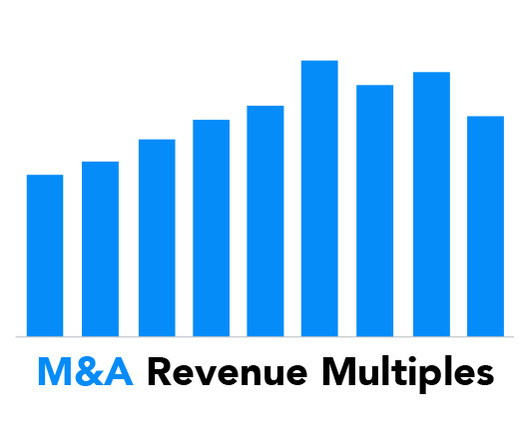

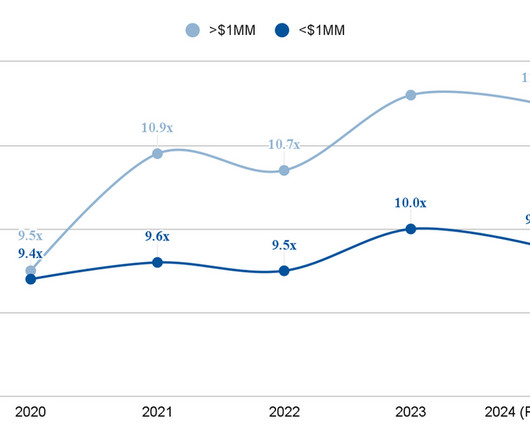

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. But what are the key influences shaping valuation multiples in today’s M&A deals? Do you know how potential buyers value your SaaS business?

Software Equity Group

MAY 8, 2024

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. But what are the key influences shaping valuation multiples in today’s M&A deals? Do you know how potential buyers value your SaaS business?

Software Equity Group

DECEMBER 18, 2023

Given geopolitical instability, high interest rates, and the perception that B2B SaaS valuation multiples are declining, it is no great surprise that many founders interested in pursuing a transaction are considering delaying a liquidity event. Continue reading to learn more about what is driving today’s B2B SaaS valuation multiples.

How2Exit

APRIL 16, 2022

Wouldn’t it be nice if you could get the top strategies of seasoned M&A pros? As a reader of How2Exit, you can click here to get a complimentary copy of Issue 4 featuring content from Ronald Skelton and many other M&A pros. That’s the inspiration behind a helpful new resource, Acquisition Aficionado Magazine.

The Deal

SEPTEMBER 11, 2023

M&A deals in the cryptocurrency space have been on an exponential rise over recent years. There were a record 626 completed deals in 2022, up from 348 in 2021, with the U.S. being the dominant market for M&A activity, according to PwC’s 2023 Global Cryptocurrency M&A and fundraising report.

Lake Country Advisors

JULY 5, 2022

Various sectors from different industries have experienced consistent growth in 2022, thanks to the professional services of reliable M&A business advisors in Wisconsin. Why is it a Seller’s Market for a Merger or Acquisition in 2022? How to Sell a Profitable Wisconsin Business in 2022?

Software Equity Group

DECEMBER 21, 2023

While the software M&A market feels the impact of some of the same macroeconomic forces affecting public companies, it’s important to consider the two markets experience separate trajectories. As such, the software M&A market outlook is still strong overall. The following content has been updated as of December 2023.

TechCrunch: M&A

MAY 31, 2023

Financial terms of the deal, which marks Stripe’s first acquisition since it bought card reader provider BBPOS in January of 2022, were not disclosed. It was while pitching Stripe in 2022 that the small startup “really hit it off with the engineering leaders, and “from there, it evolved into more of an acquisition discussion,” said Boulander.

TKO Miller

APRIL 20, 2023

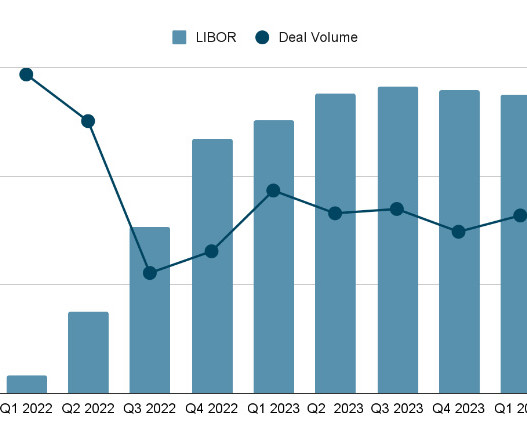

We have all seen the data about M&A valuations decreasing and deal volume falling in the second half of 2022. Unfortunately, data as of April, 2023 shows a continued decline in both volume and valuations across the board for almost all sectors and sizes of transactions.

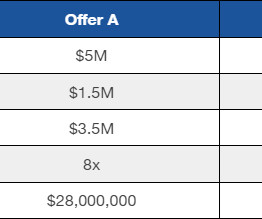

Sica Fletcher

APRIL 2, 2024

The following report examines the health and outlook for insurance M&A deals in 2024. We base this research on several key findings in our proprietary SF database, which observes and records data from the top ~400 insurance M&A buyers. Company: Which Is The Better Insurance M&A Deal?

Trout CPA: M&A

NOVEMBER 23, 2022

For life sciences companies, M&A and collaborations are a key strategy for growth, building product pipelines, and getting products to market as quickly as possible. According to BDO’s Life Sciences CFO Survey, 33% of CFOs planned to pursue M&A in 2022, up 25% from the 2021 survey.

Focus Investment Banking

JUNE 12, 2023

Thriving US Middle Market Fundraising and Resilient Private Equity Regarding Global M&A Private Equity Trends, looking at the positive news, the US middle-market fundraising landscape remained stable throughout 2022, with 156 funds closing at an aggregate value of $133.5 trillion as of June 30, 2022.

Sica Fletcher

JUNE 11, 2024

The following report contains our projections for Q3 2024 insurance broker valuation multiples. Insurance Broker Valuation Multiples: Q3 2024 Projections Using these numbers as a baseline, let’s examine the insurance industry more closely to identify influential factors behind its specific changes. as of H1 2024.

The Deal

OCTOBER 17, 2023

On the latest episode of The Deal’s Behind the Buyouts podcast, Solomon Partners co-head of consumer and retail Cathy Leonhardt talks about the sector’s slow start to M&A this year, categories that continue to shine and potential signs of a resurgence in dealmaking.

Cooley M&A

FEBRUARY 7, 2023

It will come as no surprise that cross-border M&A is impacted by the world we live in, with geopolitical tensions, rising inflation and interest rates, currency fluctuations, and increased regulatory scrutiny all playing their part in making deals more challenging to execute.

Sica Fletcher

MARCH 12, 2024

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

M&A Leadership Council

DECEMBER 24, 2021

Event Dates: 2022-06-28T09:00:00-05:00 to 2022-06-28T12:30:00-05:00 2022-06-29T09:00:00-05:00 to 2022-06-29T12:30:00-05:00 2022-06-30T09:00:00-05:00 to 2022-06-30T12:30:00-05:00 Location: Online. Register Now. Course Description. Consisting of 10.5 instructional hours, conducted over three, 3.5-hour

M&A Leadership Council

DECEMBER 24, 2021

Event Dates: 2022-05-24T09:00:00-05:00 to 2022-05-24T12:30:00-05:00 2022-05-25T09:00:00-05:00 to 2022-05-25T12:30:00-05:00 2022-05-26T09:00:00-05:00 to 2022-05-26T12:30:00-05:00 Location: Online. Register Now. Course Description. Consisting of 10.5 instructional hours, conducted over three, 3.5-hour

Chesapeake Corporate Advisors

JANUARY 13, 2023

2022 was a strong year for CCA, following a record-breaking 2021. In the video below, CCA Managing Partner, Charlie Maskell, Director, Tim Brasel, and Managing Director, Mike Zuidema break down the CCA team, investment banking, and corporate advisory highlights from 2022.

Cooley M&A

JANUARY 25, 2023

Although 2022 saw a general decline in M&A activity in the life sciences industry compared to 2021’s frenetic pace (when deal volume was up 52% from 2020 ), life sciences deal flow in 2022 on balance remained strong despite the headwinds. Let’s dig in.

Software Equity Group

MARCH 13, 2023

The public markets may have taken a beating, but behind the gloom-and-doom headlines, there was still plenty of good news for private SaaS companies in 2022. While median EV/Revenue multiples declined from 4Q20–1Q22, they still outperformed the median public market multiple, and SaaS M&A deal volume jumped to a new record.

Software Equity Group

FEBRUARY 28, 2023

SEG’s 2023 Annual SaaS Report provides a comprehensive analysis of the public SaaS market’s performance and M&A activity in the software industry. Our report provides context for private companies to better understand factors influencing their valuations and evaluate how they can position themselves within a changing marketplace.

Solganick & Co.

MARCH 11, 2022

March 11, 2022 – Solganick & Co. has been named by Axial as a top software M&A advisory firm. Following a record-setting 2021 for lower middle market software M&A, the Software Top 50 highlights the most active software-focused dealmakers on the Axial platform. We expect this trend to continue in 2022.”

Sica Fletcher

JUNE 20, 2024

The insurance M&A market in 2024 is significantly more complex now than it was 20 years ago. However, this report seeks to make sense of these qualities as a whole to provide an overview of the 2024 insurance M&A market. The table of contents below offers quick links for readers seeking specific information in later sections.

Cooley M&A

OCTOBER 12, 2022

On September 28, 2022, Cooley sponsored the third virtual event in Axios’ Dealmakers series: A Conversation on M&A in Today’s Market. Fabricio Drumond, Axios’ chief business officer, then led a “View From the Top” segment with Jamie Leigh – Cooley partner, member of the business department leadership team and M&A co-chair.

Focus Investment Banking

MAY 10, 2024

In this article, which joins our ongoing coverage of the Food & Beverage industry, we introduce an overview of M&A activity in food distribution with a focus on fresh food. M&A activity flourishes in large industries undergoing growth and stress, making food distribution ripe for dealmaking. What’s Ahead?

Cooley M&A

JANUARY 9, 2023

On November 8 and 9, Cooley and the Berkeley Center for Law and Business presented the 2022 Berkeley Fall Forum on Corporate Governance. Discussions covered trends and lessons from financial transactions and corporate strategy in the volatile 2022 environment and insights into the year ahead.

Sica Fletcher

MAY 29, 2024

M&A transactions for insurance companies are part of a robust but complicated market that requires ingesting a great deal of data in order to fully understand. While insurance M&A did see slight dips in deal volume and average value (Fig.2)

Sica Fletcher

JULY 23, 2024

In it, we provide readers with a quick and simple overview of the current insurance brokerage M&A market , after which we discuss several macroeconomic and industry-specific factors that could drastically affect transactions in the next six months.

Solganick & Co.

DECEMBER 21, 2023

Navigating the Current M&A Landscape for IT Services: Cloud & Data Analytics Partners Take Center Stage by Aaron Solganick, CEO, Solganick & Co. December 21, 2023 The IT services M&A scene in 2023 has painted a dynamic picture, marked by both cautious optimism and strategic boldness.

TKO Miller

AUGUST 30, 2023

Packaging Trends Q2 M&A Update U.S. middle market valuation multiples and deal volume are down slightly through Q2 of 2023. this year through June 2023, but middle market valuations are down approximately 8% based on the TKO Miller analysis. Paperboard prices have also come down significantly from their peak in late 2022.

Sica Fletcher

JULY 11, 2024

The following report details insurance brokerage M&A multiple averages for H1 2024. Insurance Brokerage M&A Multiples: Market Overview The 2020s have proven to be a complex market for insurance brokerages. Because several kinds of insurance are legally required (e.g., Streamlined Operations.

Software Equity Group

JANUARY 22, 2024

In this post, we’ll offer further insights into what’s driving the need for healthcare SaaS solutions and how business owners can capitalize on heightened activity in healthcare M&A. Between January 2000 and December 2022, the cost of hospital services rose 227%, faster than any other spending category. Simply put, U.S.

Software Equity Group

JANUARY 22, 2024

In this post, we’ll offer further insights into what’s driving the need for healthcare SaaS solutions and how business owners can capitalize on heightened activity in healthcare M&A. Between January 2000 and December 2022, the cost of hospital services rose 227%, faster than any other spending category. Simply put, U.S.

Software Equity Group

APRIL 24, 2024

SaaS, of course, plays a central role in these efforts, driving a heightened level of M&A activity in the software space. M&A Overview: The Quest for Industry 4.0 After a gradual decline since the mid-20th century, the U.S. manufacturing and industrial sector is making a comeback. Now, signs of recovery are emerging.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content