Insurance Agency Valuation 101: Understanding the Essentials

Sica Fletcher

MARCH 12, 2024

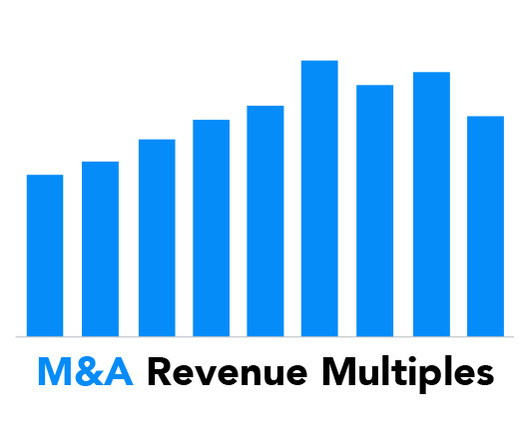

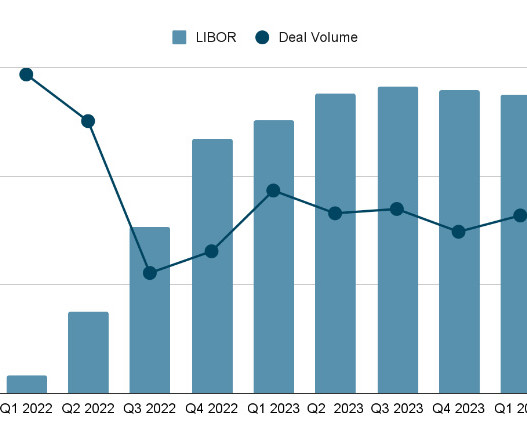

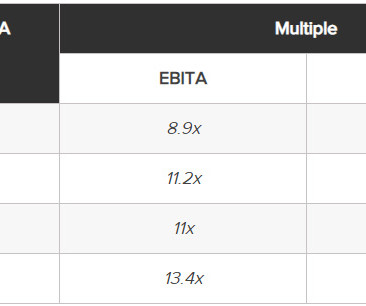

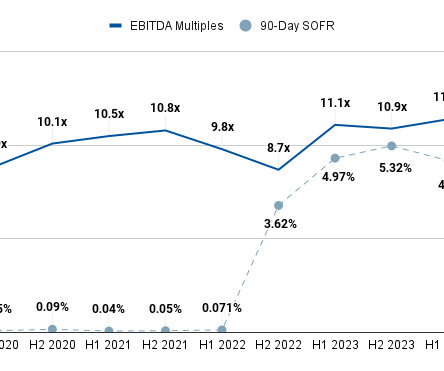

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

Let's personalize your content