As S&P 500 hits new record, three indicators point to a pullback

CNBC: Investing

JANUARY 19, 2024

The S&P 500 sits within swinging distance of its all-time high from January 2022.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

JANUARY 19, 2024

The S&P 500 sits within swinging distance of its all-time high from January 2022.

CNBC: Investing

FEBRUARY 13, 2024

The prior bull market for stocks peaked about two years ago, with the S&P 500 hitting a record high on Jan.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

JANUARY 19, 2024

The S&P 500 crossed above its January 2022 peak after weeks of wavering. Investors have been buying stocks after homing in on signals that the Fed’s campaign of raising interest rates is over.

The Harvard Law School Forum

MAY 2, 2023

stock market in 2022 experienced increased volatility relative to 2021. Persistently high inflation, coupled with the fastest Fed tightening cycle seen since 1988, contributed to making 2022 the worst performing year for the S&P 500 Index since 2008, thrashing growth and technology stocks in particular. [1]

The Harvard Law School Forum

OCTOBER 6, 2022

Kushner, FTI Consulting, on Thursday, October 6, 2022 Editor's Note: Jason Frankl and Brian G. In July 2022, the U.S. While the market has gained some ground from the lows of summer, as of September 1, 2022, the Dow Jones Industrial Average (“DJIA”) was down 12.9% year-to-date for 2022, the S&P 500 was lower by 16.8%

CNBC: Investing

JUNE 15, 2023

The S&P 500 and the Nasdaq Composite reached their highest levels since April 2022.

CNBC: Investing

AUGUST 21, 2023

With a decline of 4.8%, this is the worst month so far for the S&P 500 since December 2022.

Sica Fletcher

OCTOBER 27, 2023

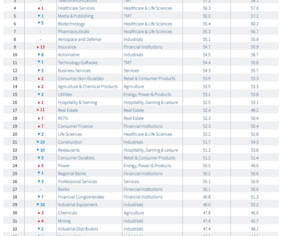

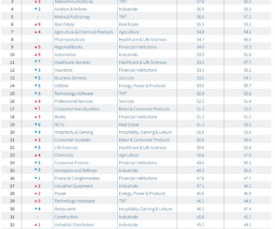

S&P Global’s 2023 September YTD Market Intelligence League Table Released NEW YORK, NY - October 27, 2023 - Sica | Fletcher, a premier financial advisory firm, retains its commanding presence in the #1 spot on S&P Global’s Market Intelligence League Table, a position the firm has held quarter-over-quarter since 2017.

Global Banking & Finance

SEPTEMBER 2, 2024

The S&P Global UK Manufacturing Purchasing Managers’ Index rose to 52.5 LONDON (Reuters) – British factories had their strongest month in more than two years in August as demand at home offset a fall in exports, according to a survey published on Monday that added to signs of momentum in the economy.

The TRADE

OCTOBER 10, 2024

They complement Cboe’s existing securities-based VIX index options, which are designed to provide similar risk management and yield enhancement capabilities. Catherine Clay, global head of derivatives at Cboe The new options on VIX futures will offer investors an additional tool to help manage US equity market volatility.

Global Banking & Finance

SEPTEMBER 9, 2024

The S&P 500 appeared set to snap a four-session losing streak, bouncing back along with the Dow from its biggest weekly percentage loss since March 2022. By Stephen Culp NEW YORK (Reuters) -U.S. The […]

Sica Fletcher

AUGUST 23, 2023

According to the S&P Global Market Intelligence League Table, Sica | Fletcher closed 51 M&A deals year to date (mainly insurance-related), representing a commanding 46% of all 2023 transactions and nearly double that of its closest competitor. Learn more at , SicaFletcher.com.

TKO Miller

AUGUST 30, 2023

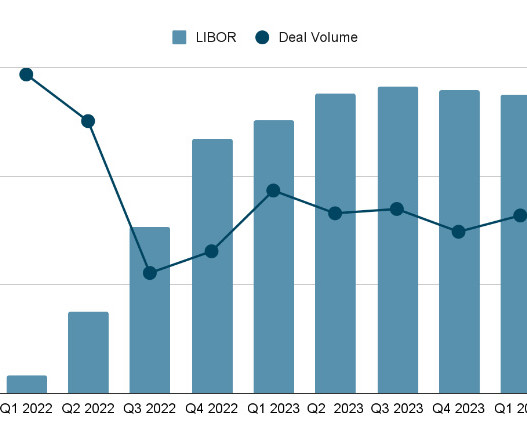

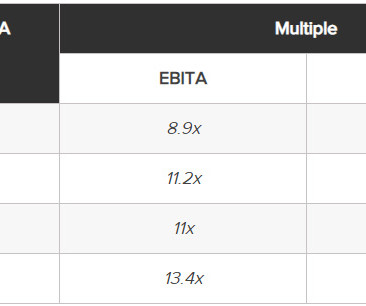

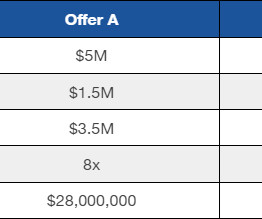

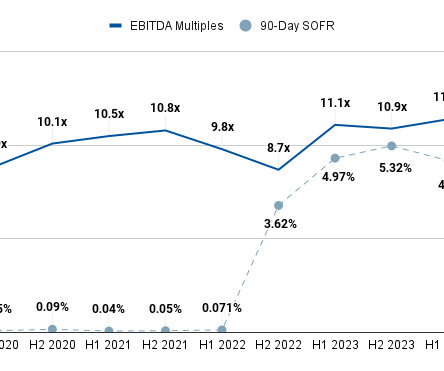

The S&P 500 Index is up 16.5% Paperboard prices have also come down significantly from their peak in late 2022. Packaging Trends Q2 M&A Update U.S. middle market valuation multiples and deal volume are down slightly through Q2 of 2023.

The TRADE

JANUARY 22, 2025

When Mike called me about the opportunity to join Conversant, he emphasised the firm’s long-term, buy-and-hold strategy, akin to private equity. There’s been a reopening in capital markets. It’s been busy. There’s a very healthy dialogue at all times at both the portfolio-level and the position-level.

Shearman & Sterling

JANUARY 18, 2023

On December 27, 2022, Vice Chancellor Morgan T. Zurn of the Delaware Court of Chancery substantially granted plaintiff's motion for summary judgment in an action seeking attorneys' fees. 2022-0132-MTZ (Del. Garfield v. Boxed, Inc., Plaintiff, a stockholder of defendant Seven Oaks Acquisition Corp.,

OfficeHours

OCTOBER 16, 2023

Even in 2022, when take-private deals hit a new record, they only accounted for 37% of the total value of transactions. According to S&P Global, the S&P fell 18.11% in 2022 amid surging inflation, rising interest rates, and an overall uncertain global outlook.

OfficeHours

AUGUST 23, 2023

She earned her bachelor’s degree in Business Administration (BBA) from the University of Michigan – Stephen M. Ross School of Business and her master’s degree from Harvard Business School. How has your role as an investor helped you succeed personally and professionally?

OfficeHours

OCTOBER 23, 2023

Even in 2022, when take-private deals hit a new record, they only accounted for 37% of the total value of transactions. According to S&P Global, the S&P fell 18.11% in 2022 amid surging inflation, rising interest rates, and an overall uncertain global outlook.

Focus Investment Banking

JULY 2, 2024

This was despite a generally favorable market that pushed the S&P 500 up 3.6% However, the sector still lagged both the S&P 500 and NASDAQ by a wide margin over the past year. The S&P 500 is up 26.3% billion, which is already well above any year in the last five with the lone exception of 2022.

Mergers and Inquisitions

JANUARY 3, 2024

The markets in 2023 were almost a complete reversal of 2022, and hardly anyone – me included – saw it coming. My portfolio did “OK” (up 10% for the year), but it greatly underperformed the S&P 500 , which was up 24%. But my real estate investment funds were down ~10% , which hurt.

Shearman & Sterling

JANUARY 18, 2023

On December 27, 2022, Vice Chancellor Morgan T. Zurn of the Delaware Court of Chancery substantially granted plaintiff's motion for summary judgment in an action seeking attorneys' fees. 2022-0132-MTZ (Del. Garfield v. Boxed, Inc., Plaintiff, a stockholder of defendant Seven Oaks Acquisition Corp.,

The TRADE

APRIL 8, 2024

Previously in his career, he spent over five years in the CME S&P 500 futures trading pit. Grinfeld will head up the division alongside Brian Cashin who joined Liquidnet from Bank of America in March 2022.

Sica Fletcher

FEBRUARY 6, 2024

An analysis of the most active acquirers in the insurance brokerage space reveals 13% higher average revenue values but lower transaction volume than 2022 as the year closed. According to S&P Global, Sica | Fletcher ranked as the #1 advisor to the insurance industry for 2017-2023 in terms of total deals advised.

Growth Business

MAY 23, 2023

By Aisling O'Toole on Growth Business - Your gateway to entrepreneurial success Despite UK fintech funding dropping 8 per cent in 2022, the sector is still in good health and remains ahead of rival hubs in Europe and Asia, says industry body Innovate Finance. Apply here.

Software Equity Group

MARCH 13, 2023

The public markets may have taken a beating, but behind the gloom-and-doom headlines, there was still plenty of good news for private SaaS companies in 2022. On the surface, things looked rough: the Dow Jones, S&P 500, and the NASDAQ all finished the year with significant losses, with tech stocks hit particularly hard.

Sica Fletcher

AUGUST 30, 2023

Despite this representing a drop in acquisition volume compared to 2022, revenue was higher period-over-period due to the average acquired agency size being considerably larger in the first half of 2023. While half of the Index Members increased deal volume, the other half slowed down, completing 60% fewer deals than YTD June 2022.

Sica Fletcher

APRIL 2, 2024

Here is a snippet from our SF Index, which tracks 22 of the most active acquirers in the insurance brokerage space: SF Index Deal Count, 2022-2023 The top 2 acquirers on the SF index also saw the most losses between 2022 and 2023. In contrast, however, the remaining agencies actually saw modest increases in deal count.

The TRADE

DECEMBER 29, 2023

David Taylor, chief executive officer, Exegy In 2022, we conducted a survey of executives in principal trading, brokerage, and asset management firms to quantify demand for buying predictive signals and content from third-party providers (like us) as a supplement to internal development.

Sica Fletcher

JUNE 11, 2024

2023 saw a modest drop in insurance brokerage deal volume, from 1043 in 2022 to 957 in 2023, which experts predicted would remain static as the market regrouped to begin a slow growth into 2025. Whereas 2022 saw equity making up nearly 17.5% Last year's data saw PE firms acting as buyers in ~90% of all transactions.

The Harvard Law School Forum

JUNE 27, 2023

5] Despite the instability, investors were granted some breathing room in May as inflation continued to recede from its June 2022 peak. [6] 7] A pause may be more beneficial to investors than a direct rate cut would be; the S&P 500 has historically climbed 16.9% 3] [4] The U.S. drop in the 12 months following a rate cut.

Sica Fletcher

NOVEMBER 9, 2023

An analysis of the most active acquirers in the insurance brokerage space reveals higher average revenue values but lower transaction volume compared to 2022 as the market enters Q4. Broadstreet, Assured, and Gallagher all demonstrated notable increases in deal volume, outpacing their 2022 momentum by over 30%.

Sica Fletcher

MARCH 8, 2024

Starting in H2 2022, the insurance M&A market has seen a notably difficult 18-month period, afflicted with high interest rates, lowered deal volumes, and lowered valuations. According to S&P Global, Sica | Fletcher ranked as the #1 advisor to the insurance industry for 2017-2023 YTD in terms of total deals advised on.

The TRADE

AUGUST 4, 2023

million in Q2 2022. Designed in house by Cboe Labs, the new index measures the current day’s expected market volatility of the S&P 500 Index. More recently, Cboe’s European equities exchange launched new sweep order types to bolster liquidity targeting for traders. million, up 20% from 235.3

Solganick & Co.

DECEMBER 21, 2023

While overall deal volume dipped slightly compared to the record-breaking highs of 2022, falling by around 5%, the total value of transactions remained surprisingly resilient, hovering near the $400 billion mark, according to data from S&P Global Market Intelligence.

Focus Investment Banking

JANUARY 18, 2024

The S&P 500 has recently traded near 4800, close to its record at the end of 2021. It has taken two years to return to those levels, after 2022 and 2023 were burdened with interest rate hikes and fears of a recession. As 2024 starts, the U.S. stock markets are at or near their all-time highs.

The TRADE

AUGUST 14, 2023

Redburn Atlantic will build upon the combined firms’ corporate access programmes, which previously provided more than 400 corporate and expert events and brought 40% of the S&P 500 by market cap to Europe last year.

Mergers and Inquisitions

DECEMBER 6, 2023

Beta-Neutral Portfolios: For example, if the S&P 500 goes up or down by 5%, your team’s portfolio should move by ~0%. For example, between 1990 and 2022, Citadel’s Wellington fund delivered 19% annualized returns , which some have said is “ almost impossible.”

Cleary M&A and Corporate Governance Watch

AUGUST 2, 2023

11] Form S-3 Eligibility Not Affected. cybersecurity incident will not result in loss of Form S-3 or other short form eligibility, consistent with how the Commission approaches other Form 8-K items that include subjective materiality determinations. The rule provides that untimely filing of a Form 8-K relating to an Item 1.05

Sica Fletcher

JULY 23, 2024

Since H2 2022, industries across the board (including insurance) have seen declines in deal volume as prospective buyers have withheld their funds for more favorable conditions in which the cost of debt is not so high. Consult data sources like S&P Global data to get an idea of a firm’s activity within the industry.

The Harvard Law School Forum

JUNE 27, 2023

5] Despite the instability, investors were granted some breathing room in May as inflation continued to recede from its June 2022 peak. [6] 7] A pause may be more beneficial to investors than a direct rate cut would be; the S&P 500 has historically climbed 16.9% 3] [4] The U.S. drop in the 12 months following a rate cut.

Sica Fletcher

JULY 11, 2024

However, the brokerage's tech stack now handles many of these job functions, which significantly improves the bottom line and increases profitability. Founders Michael Fletcher and Al Sica are two of the industry's leading dealmakers who have advised on over $16 billion in insurance agency and brokerage transactions since 2014.

Software Equity Group

MAY 7, 2024

Learn more about the external influences shaping your SaaS company’s valuation multiple below. #1. Also of note, ERP / Business Management saw stable M&A volume in 2023, which mirrors its consistent growth and steady valuations in the public markets and further demonstrates the category’s mission-critical nature. #2.

Software Equity Group

MAY 8, 2024

Learn more about the external influences shaping your SaaS company’s valuation multiple below. #1. Also of note, ERP / Business Management saw stable M&A volume in 2023, which mirrors its consistent growth and steady valuations in the public markets and further demonstrates the category’s mission-critical nature. #2.

Sica Fletcher

JUNE 20, 2024

PE firms rely on leveraged buyouts (LBOs) for the lion's share of their deals, which often involve using the acquired company’s assets as collateral to insure the loan used to purchase it. Both 2022 and 2023 saw sequential declines in deal volume, dropping to a grand total of 857 by the end of Q4 2023. Keeping sellers involved.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content