Report: M&A Risks in First Half of 2023

Deal Lawyers

JULY 26, 2023

The key takeaways from […]

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Deal Lawyers

JULY 26, 2023

The key takeaways from […]

European Investment Bank

FEBRUARY 18, 2024

The EIB Advisory 2023 report outlines how advisory assistance is a core part of the European Investment Bank Group. Advisory simplifies complex EU policy objectives for clients and offers clear solutions. This work is crucial to the EIB’s role as a development institution.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The TRADE

JANUARY 16, 2024

Panmure Gordon and Liberum are set to merge to create the UK’s largest independent investment bank, with ex-Barclays executive Rich Ricci stepping into the chief executive role of the combined entity. The deal comes just three months after Deutsche Bank completed the acquisition of institutional broker Numis for £410 million.

Focus Investment Banking

OCTOBER 30, 2023

Washington, DC, (October 30, 2023) – FOCUS Investment Banking (“FOCUS”), a leading national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, is honored to be named among the Top Lower Middle Market Investment Banks for the third quarter of 2023 by Axial.

Focus Investment Banking

OCTOBER 2, 2023

Washington, DC, (October 2, 2023) – FOCUS Investment Banking (“FOCUS”), a leading national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, is excited to be named among the Top 100 Lower Middle Market Investment Banks of 2023 by Axial.

Focus Investment Banking

FEBRUARY 1, 2024

2023 was a bit of a slower year for middle market M&A, with deals taking far longer than what we’ve become accustomed to. To assemble the list of top investment banks in North America, Axial reviewed the deal-making activities of over 800 investment banks and M&A advisory firms for the full 2023 calendar year.

OfficeHours

JUNE 14, 2023

After all, ask yourself this: During a recession and a non-competitive market — will the firm that has money to spend do well acquiring assets (Private Equity Firms) or will the firm that is dependent on small advisory fees on less deal flow do well (Investment Banks)? Have any thoughts on the above?

Focus Investment Banking

JULY 27, 2023

Washington, DC, (July 27, 2023) – FOCUS Investment Banking (“FOCUS”) a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, is thrilled to announce its exceptional achievement of being named #1 on Axial’s second quarter 2023 lower middle market investment bank league table.

Solganick & Co.

JULY 29, 2024

July 29, 2024 – Los Angeles and Dallas – Solganick has been named a Top 25 Lower Middle Market Investment Bank by Axial for Q2 2024. Axial released its Q2 2024 Lower Middle Market Investment Banking League Tables. In Q2 of this year, the sell-side membership marketed 2,574 deals on the Axial platform.

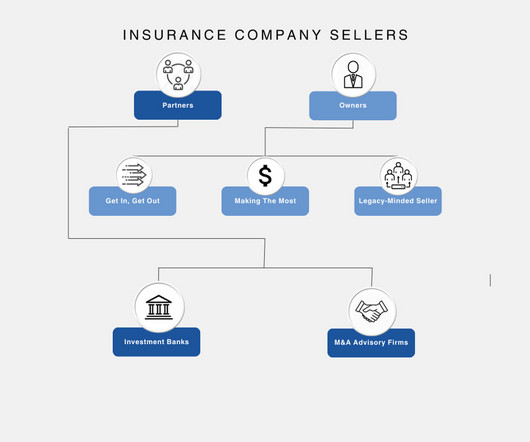

Sica Fletcher

AUGUST 21, 2024

Sica | Fletcher has been providing M&A advisory services to agencies and brokerages of all sizes for a decade. In that time, we’ve represented thousands of clients and quickly became one of the most active boutique M&A advisory firms in the market today. Do You Need An Insurance Agency Investment Bank?

Sica Fletcher

AUGUST 14, 2024

For agencies and brokerages looking to grow their businesses prior to a sale, most owners typically opt to work with an investment bank. Insurance sector specializations, however, are skills rarely found on investment bank teams, which tend to specialize across a variety of industries. Client References.

Chesapeake Corporate Advisors

MAY 12, 2023

Baltimore, MD, MAY 12, 2023 —To support its continued growth as a top boutique investment banking and corporate advisory firm in the Mid-Atlantic region, Chesapeake Corporate Advisors (CCA) recently welcomed Miles Gally to the investment banking team.

Sica Fletcher

AUGUST 6, 2024

Our research team’s latest report compares the top insurance agency investment banks of 2024. Insurance Agency Investment Banks: Investment banks that specialize in the insurance industry. Insurance Agency Investment Banks: Investment banks that specialize in the insurance industry.

Focus Investment Banking

OCTOBER 2, 2023

Washington, DC, (October 2, 2023) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, has been recognized as a leading M&A advisor in the consumer industry.

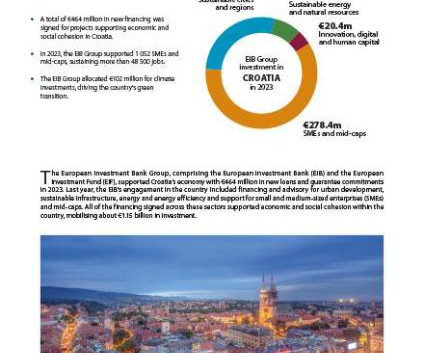

European Investment Bank

FEBRUARY 27, 2024

The European Investment Bank Group, comprising the European Investment Bank (EIB) and the European Investment Fund (EIF), supported Croatia’s economy with €464 million in new loans and guarantee commitments in 2023.

TKO Miller

JUNE 21, 2023

TKO Miller, LLC, a middle-market investment banking firm based in Milwaukee, WI, announced three new additions to its team. We are excited to have Griffin, Noah, and Jack as colleagues in delivering the unparalleled advisory services of TKO Miller," said Tammie Miller, Managing Director. "We MILWAUKEE, WI. – Noah holds a B.B.A

Focus Investment Banking

AUGUST 15, 2023

Washington, DC, (August 15, 2023) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture and corporate finance services, announced today that it has added two new managing directors, Mike McCraw and William R. Bill”) Snow.

Global Newswire by Notified: M&A

DECEMBER 1, 2023

01, 2023 (GLOBE NEWSWIRE) -- Mizuho Financial Group, Inc. today announced that Mizuho Americas has completed the acquisition of Greenhill, adding complementary services to the firm’s existing capital markets, banking, and private capital advisory capabilities across the corporate and investment bank.

Focus Investment Banking

JUNE 8, 2023

Argyle is a leading advisory and creative services provider for US public company shareholder communications. Download this press release as a PDF The post FOCUS Investment Banking Represents The LABRADOR Group in its acquisition of Argyle appeared first on FOCUS Investment Banking LLC.

Solganick & Co.

OCTOBER 11, 2023

October 11, 2023 – Solganick has published its latest M&A update report on the Legal Technology (LegalTech) industry sector. market outlook from 2023 to 2030. About Solganick Solganick is a data-driven investment bank and M&A advisory firm focused exclusively on the technology services and software industry sectors.

Solganick & Co.

FEBRUARY 15, 2023

February 16, 2023 – Solganick & Co. We expect that cybersecurity, AI/ML competencies (particularly within cloud computing), DevOps, software development, digital transformation and immersive environments will be themes for 2023 in technology services M&A These segments are expected to grow significantly in the coming years.

Mergers and Inquisitions

MARCH 22, 2023

But that would have happened anyway because of the firm’s plans to spin off its IB group into Michael Klein’s advisory firm, M. But this spin-off might not even happen now; UBS has said that it plans to continue moving away from investment banking in favor of wealth management (it’s currently ~54% of revenue). Klein & Co.

Solganick & Co.

DECEMBER 21, 2023

December 21, 2023 The IT services M&A scene in 2023 has painted a dynamic picture, marked by both cautious optimism and strategic boldness. is a data-driven investment bank and M&A advisory firm focused exclusively on software and IT services companies. Solganick & Co.

Solganick & Co.

DECEMBER 20, 2024

December 20, 2024 – The software and IT services M&A market has seen a rebound in 2024 after a dip in 2023, with a focus on smaller transactions and strategic acquisitions. Solganick is a data-driven investment bank and mergers and acquisitions (M&A) advisory firm focused exclusively on software and IT services companies.

Solganick & Co.

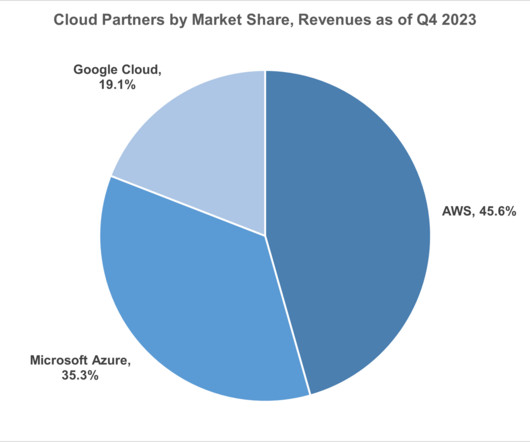

NOVEMBER 6, 2023

November 6, 2023 – Solganick & Co. You can download the full report here: Solganick Update – Cloud Computing (Nov 2023) The following summarizes the report: Overall, cloud computing companies continues to remain in high demand among both strategic and financial buyers. The AWS business unit generated $7.0

Mergers and Inquisitions

NOVEMBER 22, 2023

I never expected to revisit the topic of bulge bracket banks so quickly because the full list changes slowly, and we updated it a few years ago. But the events of 2023, including the UBS acquisition of Credit Suisse and the rise of firms like Wells Fargo, Jefferies, and RBC, have shaken up the traditional list.

Chesapeake Corporate Advisors

AUGUST 14, 2024

from June 2023 to June 2024, showing a trend closer to the Fed’s target of 2%. The PCE price index, the Fed’s preferred measure of inflation, increased 2.5%

Solganick & Co.

MAY 1, 2023

M&A Snapshot Technology Services MSPs April 2023 May 1, 2023 – Solganick & Co. We are seeing private equity firms continue to invest in and consolidate the MSP sector. has published its latest M&A snapshot on the technology services industry sector, with a focus on managed services providers.

Solganick & Co.

JANUARY 25, 2024

January 15, 2024 Shifting Gears: Mergers and Acquisitions Reshape the Education, Learning, and Training Technology Landscape in 2023 and Beyond The Education, Learning, and Training Technology sectors went through a transformative dance in 2023. Top 10 Education, Learning and Training Technology M&A Transactions of 2023: 1.

Chesapeake Corporate Advisors

JANUARY 26, 2023

Baltimore, MD, JANUARY 26, 2023 —Chesapeake Corporate Advisors (CCA) is pleased to announce that Stuart Knott has joined the firm as a Managing Director. Knott brings a unique and creative perspective based on 20 years of experience in the middle market as both an investment banker and a private equity investor.

Solganick & Co.

FEBRUARY 6, 2024

Cloud Wars Heat Up: A Look at Q4 2023 Cloud Revenue and Growth Drivers by Aaron Solganick, CEO Solganick & Co. Let’s dive into their Q4 2023 financial performance and explore the factors fueling their success: AWS : The undisputed leader, AWS raked in $24.2 billion in revenue , maintaining a 31% market share.

Solganick & Co.

AUGUST 24, 2023

is attending the following technology and PE conferences for Q3-Q4 2023: Google Next, August 29-31, 2023 – San Francisco, CA – We are excited to attend this conference to see our clients and learn about current and upcoming Google Cloud, analytics, and artificial intelligence offerings. Solganick & Co.

The TRADE

NOVEMBER 6, 2023

The TRADE is delighted to announce the shortlisted nominees for the Industry Person of the Year Award 2023. He began his career in program trading sales at London-based investment bank SG Warburg. The post Leaders in Trading 2023: Industry Person of the Year shortlist revealed appeared first on The TRADE.

Solganick & Co.

JULY 5, 2023

Solganick was the exclusive financial advisor to Nextira in its sale to Accenture July 5, 2023 New York and Austin Solganick & Co. Terms of the transaction were not disclosed and was originally announced on June 1, 2023. For more information, please refer to the Accenture press release: [link] About Solganick & Co.

Sica Fletcher

APRIL 11, 2024

Generally, these fall into two distinct categories of advisory firms or investment banks. M&A Advisory Firms vs. Investment Banks We should emphasize that the comparison information above is generalized , and may not apply to all such firms or banks.

Tyton Partners

SEPTEMBER 13, 2023

The study, which surveyed over 2,000 students and 4,000 instructors, advisors, and administrators from various two- and four-year public and private institutions in March 2023, provides valuable insights on where institutional and student perspectives and experiences diverge. BOSTON, Sept. Learn more at www.tytonpartners.com.

Chesapeake Corporate Advisors

JULY 10, 2023

Director Timothy Brasel led the transaction for the CCA investment banking team , alongside WBCM President Marco Legaluppi, EVP Joe O’Neil, and EVP Jesse Lindsay. The WBCM and TranSystems combination is natural with similar focuses on innovative transportation and infrastructure solutions,” said TranSystems CEO Richard Morsches.

Solganick & Co.

JUNE 2, 2024

In 2023, the value of the big data and business analytics market expanded to $220.2 Solganick is a data-driven investment bank that specilzes in mergers and acquistions (M&A) advisory services exclusively for the software and IT services sector. Solganick & Co. billion—with a CAGR of 12.7% until 2030.

The Deal

FEBRUARY 7, 2024

Katz’s comments come after the company on May 22 announced the acquisition of New York-based boutique investment bank Greenhill & Co. Editor’s note: The original, full version of this article was published May 30, 2023, on The Deal’s premium subscription website. GHC) for about $550 million.

MergersCorp M&A International

OCTOBER 15, 2024

As of October 2023, the SPAC market remains a dynamic component of the global financial landscape, prompting service providers to refine their offerings. MergersCorp , a prominent player in the mergers and acquisitions advisory sector, recognizes the unique challenges and opportunities within the SPAC ecosystem.

Chesapeake Corporate Advisors

JANUARY 13, 2023

We successfully advised five clients on liquidity events last year, and despite headwinds and whispers of recession, look forward to an equally successful year in 2023. CCA’S investment banking team successfully completed five deal transactions across healthcare, engineering, and a variety of other industries.

Solganick & Co.

AUGUST 14, 2023

August 14, 2023 – Solganick & Co. Here are the highlights of the report: Transaction volume and valuation multiples for technology services companies has remained solid during the first half of 2023, continuing to exceed pre-pandemic levels in aggregate. Solganick & Co.

Chesapeake Corporate Advisors

APRIL 8, 2024

This article was originally published on October 7, 2023 on the I-95 Business website. When investment bankers apply a strategic approach to taking the business to market and provide the right resources and guidance, they and their clients thrive. The fact is that great deals are still happening for A+ companies.

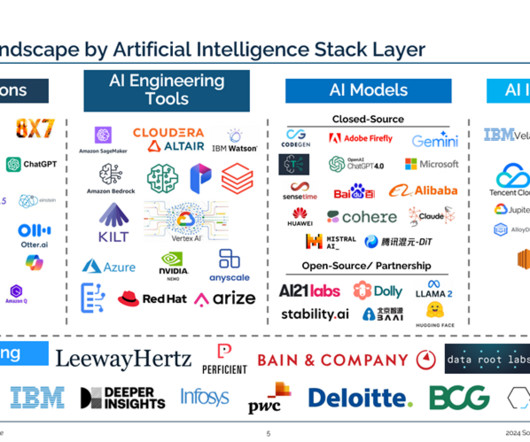

Solganick & Co.

JULY 12, 2024

The following summarizes the highlights of the report: 2023 was AI’s “year in the sun” as OpenAI’s Chat-GPT exploded onto the consumer scene. Acquisitions of AI-related companies in Q2 of 2024 accounted for 195 technology deals, down from 2021 highs but continuing a recent uptrend.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content