Report: M&A Risks in First Half of 2023

Deal Lawyers

JULY 26, 2023

The key takeaways from […]

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Deal Lawyers

JULY 26, 2023

The key takeaways from […]

Solganick & Co.

DECEMBER 20, 2024

December 20, 2024 – The software and IT services M&A market has seen a rebound in 2024 after a dip in 2023, with a focus on smaller transactions and strategic acquisitions. AI and Automation: Increased investment in AI and automation technologies is expected to drive M&A activity in these sectors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Align Business Advisory Services

NOVEMBER 6, 2023

Artificial Intelligence in Mergers & Acquisitions In late 2023, you’d have to be living under a rock to not have heard the buzz about the transformative nature of Artificial Intelligence (AI) in business. Read More » The post AI in M&A appeared first on Align BA.

Sica Fletcher

OCTOBER 27, 2023

S&P Global’s 2023 September YTD Market Intelligence League Table Released NEW YORK, NY - October 27, 2023 - Sica | Fletcher, a premier financial advisory firm, retains its commanding presence in the #1 spot on S&P Global’s Market Intelligence League Table, a position the firm has held quarter-over-quarter since 2017.

iMerge Advisors

MARCH 7, 2023

Selling a software or technology business can be a daunting task, especially when it comes to mergers and acquisitions (M&A) transactions. These processes can be time-consuming and burdensome for decision-makers and the management team.

Solganick & Co.

FEBRUARY 15, 2023

February 16, 2023 – Solganick & Co. has published its latest M&A report on the Technology Services industry. You can download the complete report here: Technology Services M&A Update – Feb 2023 Solganick & Co. For more information, please contact us.

Solganick & Co.

OCTOBER 11, 2023

October 11, 2023 – Solganick has published its latest M&A update report on the Legal Technology (LegalTech) industry sector. market outlook from 2023 to 2030. The team has collectively closed over $20B in M&A transactions. Streamlined operations utilizing LegalTech are the bedrock of the 10.8%

Solganick & Co.

NOVEMBER 6, 2023

November 6, 2023 – Solganick & Co. has published its latest mergers and acquisitions (M&A) update on the Cloud Computing sector. It covers relavant M&A transactions within the cloud partner ecosystem including AWS Cloud, Google Cloud, and Microsoft Intelligent Cloud/Azure (and others).

Solganick & Co.

JANUARY 21, 2024

2023 Technology Services and IT Consulting M&A: Consolidation, Retooling, and a Cautious Optimism for 2024 The Technology Services and IT Consulting M&A landscape in 2023 mirrored the broader market’s cautious dance.

Focus Investment Banking

OCTOBER 30, 2023

Washington, DC, (October 30, 2023) – FOCUS Investment Banking (“FOCUS”), a leading national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, is honored to be named among the Top Lower Middle Market Investment Banks for the third quarter of 2023 by Axial.

Solganick & Co.

MAY 1, 2023

M&A Snapshot Technology Services MSPs April 2023 May 1, 2023 – Solganick & Co. has published its latest M&A snapshot on the technology services industry sector, with a focus on managed services providers. We are seeing private equity firms continue to invest in and consolidate the MSP sector.

Sica Fletcher

AUGUST 5, 2024

YTD June 2024 Agency and Broker Buyer Index Shows a Steady Rise for M&As NEW YORK, NY – August 6, 2024 - Sica | Fletcher releases the Q2 2024 Agency & Broker Buyer Index. BroadStreet Partners demonstrated marked deal volume growth since 2023, leading the group during Q2 2024 with over 70% more deals than the #2 Index member.

Sica Fletcher

AUGUST 5, 2024

YTD June 2024 Agency and Broker Buyer Index Shows a Steady Rise for M&As NEW YORK, NY – August 5, 2024 - Sica | Fletcher releases the Q2 2024 Agency & Broker Buyer Index. BroadStreet Partners demonstrated marked deal volume growth since 2023, leading the group during Q2 2024 with over 70% more deals than the #2 Index member.

Focus Investment Banking

OCTOBER 2, 2023

Washington, DC, (October 2, 2023) – FOCUS Investment Banking (“FOCUS”), a leading national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, is excited to be named among the Top 100 Lower Middle Market Investment Banks of 2023 by Axial.

Solganick & Co.

DECEMBER 21, 2023

Navigating the Current M&A Landscape for IT Services: Cloud & Data Analytics Partners Take Center Stage by Aaron Solganick, CEO, Solganick & Co. December 21, 2023 The IT services M&A scene in 2023 has painted a dynamic picture, marked by both cautious optimism and strategic boldness.

Solganick & Co.

JANUARY 25, 2024

January 15, 2024 Shifting Gears: Mergers and Acquisitions Reshape the Education, Learning, and Training Technology Landscape in 2023 and Beyond The Education, Learning, and Training Technology sectors went through a transformative dance in 2023. Top 10 Education, Learning and Training Technology M&A Transactions of 2023: 1.

Benchmark International

JULY 25, 2023

Mergermarket has released their global financial advisor rankings for the first half of 2023 and Benchmark International ranked prominently in several prestigious categories.

Focus Investment Banking

FEBRUARY 1, 2024

2023 was a bit of a slower year for middle market M&A, with deals taking far longer than what we’ve become accustomed to. To assemble the list of top investment banks in North America, Axial reviewed the deal-making activities of over 800 investment banks and M&A advisory firms for the full 2023 calendar year.

Solganick & Co.

JULY 12, 2024

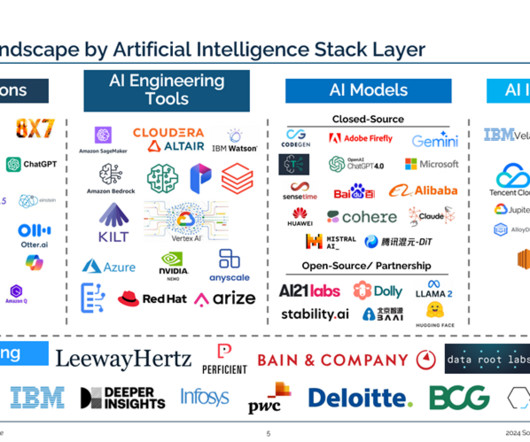

Report: Artificial Intelligence in a Growing M&A Landscape, 1H 2024 July 12, 2024 – Solganick has published its latest M&A update on the artificial intelligence industry sector as of 1H 2024. AI was cited as the most impactful disruptive technology industry by business executives surveyed by Gartner.

Focus Investment Banking

JULY 27, 2023

Washington, DC, (July 27, 2023) – FOCUS Investment Banking (“FOCUS”) a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, is thrilled to announce its exceptional achievement of being named #1 on Axial’s second quarter 2023 lower middle market investment bank league table.

Solganick & Co.

JUNE 2, 2024

has published its latest mergers and acquisitions (M&A) and market update and report on the data analytics sector. It covers the latest M&A transactions, provides a data analytics market map, updates on industry size and growth data, and publicly traded companies and valuations in the sector. Solganick & Co. until 2030.

Solganick & Co.

AUGUST 14, 2023

August 14, 2023 – Solganick & Co. has published its latest M&A Market Update on the Technology Services industry sector. Demand among strategic and financial acquirers for software application partners continues to grow, with considerable levels of capital available to deploy towards M&A in the coming years.

Global Newswire by Notified: M&A

DECEMBER 1, 2023

01, 2023 (GLOBE NEWSWIRE) -- Mizuho Financial Group, Inc. today announced that Mizuho Americas has completed the acquisition of Greenhill, adding complementary services to the firm’s existing capital markets, banking, and private capital advisory capabilities across the corporate and investment bank. TOKYO and NEW YORK, Dec.

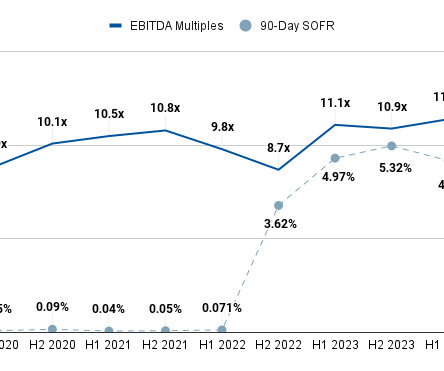

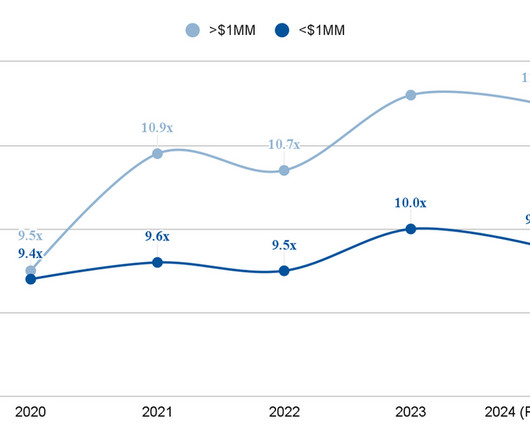

Sica Fletcher

JULY 11, 2024

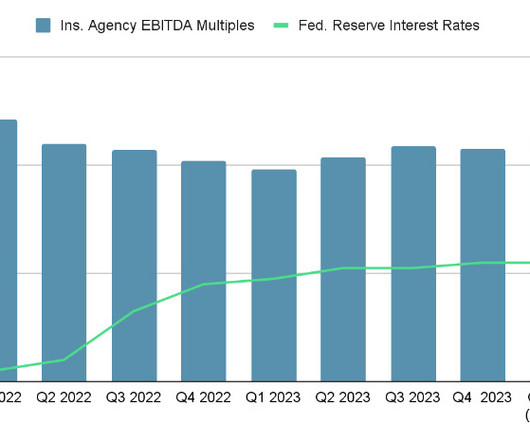

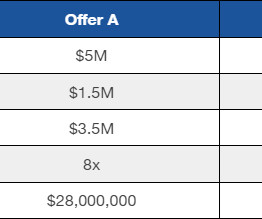

The following report details insurance brokerage M&A multiple averages for H1 2024. Insurance Brokerage M&A Multiples: Market Overview The 2020s have proven to be a complex market for insurance brokerages. Because several kinds of insurance are legally required (e.g., Streamlined Operations.

Sica Fletcher

APRIL 2, 2024

The following report examines the health and outlook for insurance M&A deals in 2024. We base this research on several key findings in our proprietary SF database, which observes and records data from the top ~400 insurance M&A buyers. Agency vs. Company: Which Is The Better Insurance M&A Deal?

Sica Fletcher

AUGUST 23, 2023

According to the S&P Global Market Intelligence League Table, Sica | Fletcher closed 51 M&A deals year to date (mainly insurance-related), representing a commanding 46% of all 2023 transactions and nearly double that of its closest competitor. Learn more at , SicaFletcher.com.

Sica Fletcher

JULY 31, 2024

The 2024 insurance M&A market has changed substantially from just a few years ago, with potentially staggering implications for the future of insurance M&A transactions. Insurance M&A Transactions in 2024 The insurance M&A transactions we have observed thus far in 2024 indicate larger trends in the sector.

Solganick & Co.

DECEMBER 21, 2023

Two of the major data analytics software companies, Snowflake and Alteryx, announced M&A transactions during the week of December 18th. December 21, 2023 Solganick & Co. Two transactions were announced in the data analytics sector this week. Two transactions were announced in the data analytics sector this week.

Sica Fletcher

AUGUST 14, 2024

The overall tenure of an investment bank suggests that they have the expertise necessary to thrive in a wide array of M&A markets, as well as a large variance in terms of client needs and deal structures. We recommend looking at three central elements: Years of Experience. Success Rate/Close Rate. Awards & Honors.

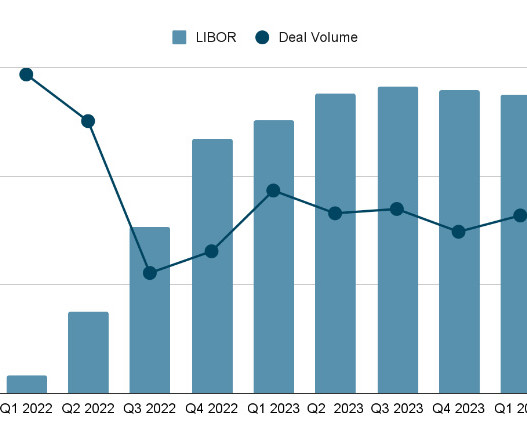

Sica Fletcher

MAY 29, 2024

M&A transactions for insurance companies are part of a robust but complicated market that requires ingesting a great deal of data in order to fully understand. While insurance M&A did see slight dips in deal volume and average value (Fig.2)

Focus Investment Banking

OCTOBER 2, 2023

Washington, DC, (October 2, 2023) – FOCUS Investment Banking (“FOCUS”), a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, has been recognized as a leading M&A advisor in the consumer industry. For more information, visit www.focusbankers.com.

Sica Fletcher

MARCH 28, 2024

The following report contains our observations of insurance M&A trends in 2024. As a result, our analysts predict a flurry of M&A activity in H2 2024. As insurance M&A enters into the 2020s, however, buyers are looking at several additional factors that speak to an agency’s more intangible qualities.

Global Newswire by Notified: M&A

AUGUST 14, 2023

14, 2023 (GLOBE NEWSWIRE) -- Gordon Brothers, the global advisory and investment firm, has acquired the global consumer electronics brand Telefunken. Boston, Aug.

Sica Fletcher

MAY 13, 2024

Q1 2024 Agency and Broker Buyer Index Reveals a Dynamic Landscape for Insurance M&A NEW YORK, NY - May 13, 2024 - Sica | Fletcher releases the Q1 2024 Agency & Broker Buyer Index. Many SF Index Members demonstrated steady increases in Q1 2024 deals compared to Q1 2023, while others have taken a strategic pause.

PCE

JANUARY 11, 2024

You may have noticed that 2023 was a slower year for mergers and acquisitions, but here’s some good news: we at PCE anticipate a strong rebound in M&A transaction volume for 2024.

Global Newswire by Notified: M&A

SEPTEMBER 6, 2023

06, 2023 (GLOBE NEWSWIRE) -- Saint Louis, MO, September 2023 – The M&A Advisor announced the finalists of the 22nd Annual M&A Advisor Awards across several categories of M&A Transactions. LOUIS, Sept. ButcherJoseph & Co.

Lake Country Advisors

AUGUST 7, 2023

In 2023, many business owners may find themselves pondering this very question. In the ever-changing business world, timing is everything, especially when considering the best time to sell your business. The current market conditions and economic landscape have created a fertile environment for business sales.

Benchmark International

JULY 12, 2023

The professional services sector is expected to reach a 10-year high in 2023, based on the latest figures in a report by Experian. According to its MarketIQ Micro Insight report, there have been a total of 92 acquisitions in the advisory sector to date in 2023 with a total value of £899m.

Sica Fletcher

JUNE 20, 2024

The insurance M&A market in 2024 is significantly more complex now than it was 20 years ago. However, this report seeks to make sense of these qualities as a whole to provide an overview of the 2024 insurance M&A market. The table of contents below offers quick links for readers seeking specific information in later sections.

Sica Fletcher

JULY 23, 2024

In it, we provide readers with a quick and simple overview of the current insurance brokerage M&A market , after which we discuss several macroeconomic and industry-specific factors that could drastically affect transactions in the next six months. The market is already highly competitive, but it’s also limited to what buyers can afford.

Sica Fletcher

AUGUST 30, 2023

Q2 Broker Buyer Index Shows a 16% Increase in Deal Volume Over Q1 2023 NEW YORK, NY - August 30, 2023 - Sica | Fletcher releases the Q2 2023 Agency & Broker Buyer Index. The Sica | Fletcher Agency & Broker Buyer Index is the most comprehensive report on insurance brokerage M&A activity in existence.

Global Newswire by Notified: M&A

OCTOBER 31, 2023

31, 2023 (GLOBE NEWSWIRE) -- Essential Energy Services Ltd. the “Acquisition”) announced on September 15, 2023. (the the “Acquisition”) announced on September 15, 2023. CALGARY, Alberta, Oct.

Chesapeake Corporate Advisors

APRIL 8, 2024

This article was originally published on October 7, 2023 on the I-95 Business website. The Bad News Is Not So Bad Rising interest rates and economic uncertainty have tamped down the M&A frenzy that peaked in 2021. Adaptability The M&A market is dynamic, as the last few years have underscored.

Global Newswire by Notified: M&A

NOVEMBER 1, 2023

01, 2023 (GLOBE NEWSWIRE) -- Essential Energy Services Ltd. the “Acquisition”) announced on September 15, 2023. (the the “Acquisition”) announced on September 15, 2023. CALGARY, Alberta, Nov. LLC (“Glass Lewis”) in support of the proposed acquisition of Essential by Element Technical Services Inc.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content