Global software M&A volume rebounds

JD Supra: Mergers

MAY 18, 2023

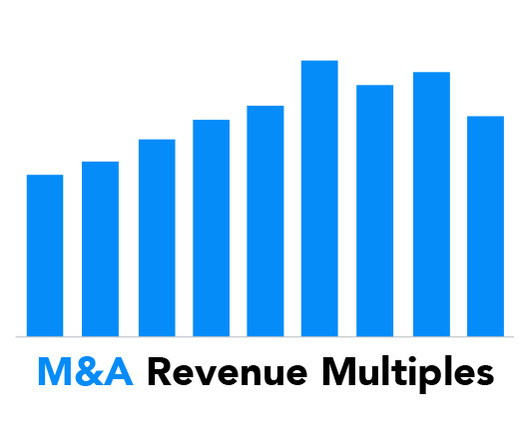

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

TechCrunch: M&A

OCTOBER 23, 2023

Just last month the company raised $500 million at an eye-popping $43 billion valuation. With that kind of dough in its coffers, the company […] © 2023 TechCrunch. Databricks has remained a hot startup at a time when interest from investors has cooled across the ecosystem. All rights reserved.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

SEPTEMBER 25, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Fintech - Whilst many European start-ups have struggled to successfully execute funding rounds at valuation levels of yesteryear, more mature fintechs have pivoted to acquisitions and partnerships to fuel growth.

JD Supra: Mergers

SEPTEMBER 20, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Consumer Finance - Europe's consumer finance decacorns stumble as their valuations crumble. By: White & Case LLP

TechCrunch: M&A

JULY 18, 2024

HeadSpin’s 2023 revenue was $21 million and its Q1 2024 revenue stood at $5 million, the […] © 2024 TechCrunch. Canadian private equity firm PartnerOne paid $28.2 million for HeadSpin, a mobile app testing startup whose founder was sentenced for fraud earlier this year, according to documents viewed by TechCrunch.

JD Supra: Mergers

JUNE 26, 2024

billion in 2023—a six-year low. A combination of prolonged market volatility, stubbornly high interest rates, heightened regulatory scrutiny and plunging valuations all dampened dealmaking. Global deal value sank to US$456.6 By: White & Case LLP

TechCrunch: M&A

OCTOBER 12, 2023

billion valuation in May 2021 when it announced a $130 million Series C. As […] © 2023 TechCrunch. Atlassian announced this morning that it is acquiring video messaging service Loom for $975 million, the same company that had a $1.53 All rights reserved. For personal use only.

Solganick & Co.

DECEMBER 20, 2024

December 20, 2024 – The software and IT services M&A market has seen a rebound in 2024 after a dip in 2023, with a focus on smaller transactions and strategic acquisitions. AI and Automation: Increased investment in AI and automation technologies is expected to drive M&A activity in these sectors.

Deal Lawyers

MAY 29, 2024

In our latest Deal Lawyers Download Podcast, SRS Acquiom’s Kip Wallen joined me to discuss his firm’s 2024 M&A Deal Terms Study.

Midaxo

APRIL 24, 2023

In March 2023, the Transaction Advisors Institute (TAI) held their annual San Francisco conference for corporate development and M&A. We were excited to partner with TAI as a sponsor this year to share ideas with attendees on how to elevate dealmaking using modern SaaS technologies for managing their M&A processes.

JD Supra: Mergers

JULY 12, 2023

Overview - The year 2022 started strong but proved to be a mixed year for M&A in what could be described as a return to earth after the record-setting year that was 2021. M&A market alone exceeded $2 trillion in 2021 – a staggering figure that crushed (by nearly 30%) the then-existing record established in 2015.

Software Equity Group

MAY 7, 2024

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. But what are the key influences shaping valuation multiples in today’s M&A deals? The most active verticals in 2023 were Healthcare, Financial Services, and Real Estate.

Software Equity Group

MAY 8, 2024

2023 saw a myriad of factors impact SaaS M&A multiples, including economic developments, technological advancements, and a public market rebound. But what are the key influences shaping valuation multiples in today’s M&A deals? The most active verticals in 2023 were Healthcare, Financial Services, and Real Estate.

Growth Business

JANUARY 29, 2024

By Jeannette Linfoot on Growth Business - Your gateway to entrepreneurial success Mergers and acquisitions (M&As) are essential in the corporate world, as companies buy and sell each other to expand their businesses and increase profitability. Once this offer has been presented, the two companies can negotiate terms in more detail.

TKO Miller

AUGUST 30, 2023

Packaging Trends Q2 M&A Update U.S. middle market valuation multiples and deal volume are down slightly through Q2 of 2023. this year through June 2023, but middle market valuations are down approximately 8% based on the TKO Miller analysis. The S&P 500 Index is up 16.5%

Solganick & Co.

FEBRUARY 15, 2023

February 16, 2023 – Solganick & Co. has published its latest M&A report on the Technology Services industry. Highlights of public valuation multiples include: The report covers public and private companies including public valuation tables for each subsector.

Software Equity Group

DECEMBER 18, 2023

The following content has been updated as of December 2023. Given geopolitical instability, high interest rates, and the perception that B2B SaaS valuation multiples are declining, it is no great surprise that many founders interested in pursuing a transaction are considering delaying a liquidity event. billion in 2023, a 21.7%

Solganick & Co.

NOVEMBER 6, 2023

November 6, 2023 – Solganick & Co. has published its latest mergers and acquisitions (M&A) update on the Cloud Computing sector. It covers relavant M&A transactions within the cloud partner ecosystem including AWS Cloud, Google Cloud, and Microsoft Intelligent Cloud/Azure (and others).

The Deal

SEPTEMBER 11, 2023

M&A deals in the cryptocurrency space have been on an exponential rise over recent years. being the dominant market for M&A activity, according to PwC’s 2023 Global Cryptocurrency M&A and fundraising report. There were a record 626 completed deals in 2022, up from 348 in 2021, with the U.S.

OfficeHours

OCTOBER 20, 2023

For private equity investors who have been monitoring the situation around inflation for the last few months to a year, many have been disappointed to see the slow trajectory with which inflation has been coming down from highs. Currently, inflation in the U.S. Currently, inflation in the U.S.

Software Equity Group

DECEMBER 21, 2023

The following content has been updated as of December 2023. While the software M&A market feels the impact of some of the same macroeconomic forces affecting public companies, it’s important to consider the two markets experience separate trajectories. As such, the software M&A market outlook is still strong overall.

Solganick & Co.

JANUARY 9, 2024

January 9, 2024 2023: A Year of Strategic Consolidation and Diversification In 2023, the Healthcare IT sector witnessed a significant transformation marked by strategic mergers and acquisitions (M&A).

OfficeHours

JULY 11, 2023

What’s the plan with said asset, add-ons, more M&A, economies of scale with current portfolio companies? If you can really nail valuation questions but struggle with regulatory questions, make sure you can get all the valuation questions right to maximize your points there. Are you seeing US govt. agencies scaling back?

The Harvard Law School Forum

JUNE 16, 2023

Posted by Sally Wagner Partin, Sharon Flanagan, and Hannah M. Brown, Sidley Austin LLP, on Friday, June 16, 2023 Editor's Note: Sally Wagner Partin and Sharon R. Flanagan are Partners and Hannah M. Brown is an Associate at Sidley Austin LLP. This post is based on their Sidley Austin memorandum. 1] (more…)

TKO Miller

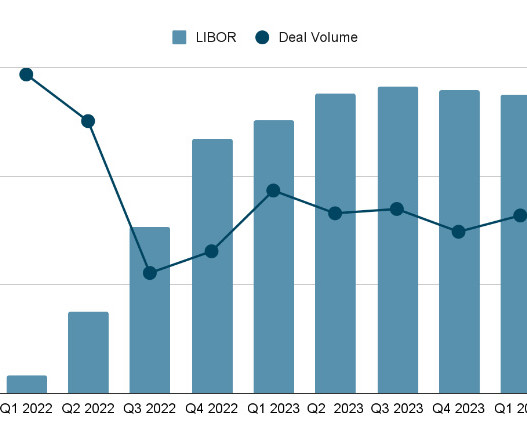

APRIL 20, 2023

We have all seen the data about M&A valuations decreasing and deal volume falling in the second half of 2022. Unfortunately, data as of April, 2023 shows a continued decline in both volume and valuations across the board for almost all sectors and sizes of transactions.

Sica Fletcher

DECEMBER 13, 2023

Since the dramatic uptick in interest rates last year, a number of articles appeared in the press arguing that the insurance brokerage M&A market would slow due to higher interest rates. This prediction that the market would slow was simply incorrect. The full article can be downloaded here.

OfficeHours

JULY 4, 2023

Going to keep today rather simple — we want to celebrate and kick off the second half of the year with a simple offer for the first 10 people that take advantage of the below — PE Platform Access for $225 OFF = $74 out of pocket for lifetime access Our flagship program has placed mentees into most major private equity firms since launching in 2020.

Focus Investment Banking

DECEMBER 26, 2023

The 6th annual Midwest M&A/Private Equity Forum sponsored by the Thomson Reuters Institute was held in early December in Columbus, Ohio, and for your humble correspondent, this was not only my second time as one of the participants, but my first time as a moderator of a panel! More on that later.

Solganick & Co.

JANUARY 9, 2024

HR Tech/HRIT mergers and acquistions January 9, 2024 – The mergers and acquisitions environment for HR technology companies in 2023 has been characterized by various trends and key developments. However, the latter half of 2023 saw a resurgence in M&A activity, though the overall value of these deals remained below past averages.

Solganick & Co.

JUNE 2, 2024

has published its latest mergers and acquisitions (M&A) and market update and report on the data analytics sector. It covers the latest M&A transactions, provides a data analytics market map, updates on industry size and growth data, and publicly traded companies and valuations in the sector. Solganick & Co.

Solganick & Co.

DECEMBER 21, 2023

Navigating the Current M&A Landscape for IT Services: Cloud & Data Analytics Partners Take Center Stage by Aaron Solganick, CEO, Solganick & Co. December 21, 2023 The IT services M&A scene in 2023 has painted a dynamic picture, marked by both cautious optimism and strategic boldness.

Solganick & Co.

AUGUST 14, 2023

August 14, 2023 – Solganick & Co. has published its latest M&A Market Update on the Technology Services industry sector. Demand among strategic and financial acquirers for software application partners continues to grow, with considerable levels of capital available to deploy towards M&A in the coming years.

Solganick & Co.

JANUARY 11, 2024

January 12, 2024 State of Software Mergers and Acquisitions (M&A) in 2023 and 2024 Outlook Overview of 2023 The landscape of software mergers and acquisitions in 2023 was marked by significant deals despite economic uncertainties and increased regulatory scrutiny.

Solganick & Co.

JANUARY 11, 2024

January 12, 2024 State of Software Mergers and Acquisitions (M&A) in 2023 and 2024 Outlook Overview of 2023 The landscape of software mergers and acquisitions in 2023 was marked by significant deals despite economic uncertainties and increased regulatory scrutiny.

Sica Fletcher

JUNE 11, 2024

The following report contains our projections for Q3 2024 insurance broker valuation multiples. Insurance Broker Valuation Multiples: Q3 2024 Projections Using these numbers as a baseline, let’s examine the insurance industry more closely to identify influential factors behind its specific changes.

TKO Miller

OCTOBER 3, 2023

TKO Miller Debt Capital Market Analysis Leverage multiples have pulled back significantly in M&A transactions from their 2021 peaks due to a tightening of the lending environment, Sr. in Q2 of 2023 (as shown in the below graph). Debt / EBITDA, decreased from 4.0x in 2021 to 3.5x

Solganick & Co.

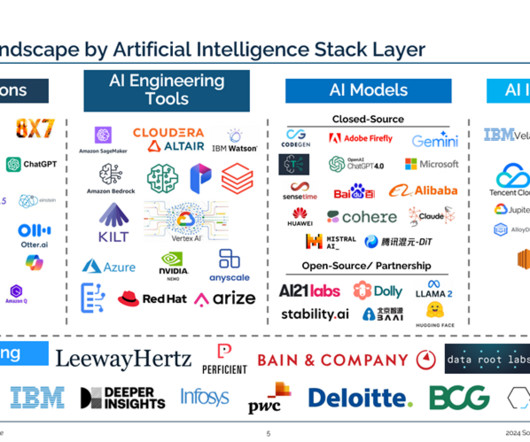

JULY 12, 2024

Report: Artificial Intelligence in a Growing M&A Landscape, 1H 2024 July 12, 2024 – Solganick has published its latest M&A update on the artificial intelligence industry sector as of 1H 2024. It will be a buyer’s “techquisition” market as valuations face pressure.

Cooley M&A

OCTOBER 23, 2023

On October 4, 2023, Cooley M&A partner Kevin Cooper appeared at Axios’ Dealmakers: The M&A Forecast virtual event. During the “View From the Top” segment, Cooper spoke with Fabricio Drumond, chief business officer at Axios, about the M&A landscape going into Q4 2023.

Sica Fletcher

APRIL 2, 2024

The following report examines the health and outlook for insurance M&A deals in 2024. We base this research on several key findings in our proprietary SF database, which observes and records data from the top ~400 insurance M&A buyers. Company: Which Is The Better Insurance M&A Deal?

The Deal

OCTOBER 17, 2023

On the latest episode of The Deal’s Behind the Buyouts podcast, Solomon Partners co-head of consumer and retail Cathy Leonhardt talks about the sector’s slow start to M&A this year, categories that continue to shine and potential signs of a resurgence in dealmaking.

PCE

JULY 13, 2023

Get the latest business valuation multiples, M&A transaction details and trends in the Aerospace, Defense & Government Contracting industry for Q2 2023.

Focus Investment Banking

NOVEMBER 27, 2023

Whether due to new technologies supplanting the old, overhyped valuations crashing to earth, errors in judgement, or lack of business acumen, the tech world is rife with the rise and fall of companies and careers. he grandees of Silicon Valley often view Mergers and Acquisitions through a different lens than much of the rest of the country.

Sica Fletcher

JUNE 20, 2024

The insurance M&A market in 2024 is significantly more complex now than it was 20 years ago. However, this report seeks to make sense of these qualities as a whole to provide an overview of the 2024 insurance M&A market. The table of contents below offers quick links for readers seeking specific information in later sections.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content