Practical M&A Treatise: The 2025 Edition is Here!

Deal Lawyers

NOVEMBER 18, 2024

We recently put the finishing touches on the annual update for the Practical M&A Treatise.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Deal Lawyers

NOVEMBER 18, 2024

We recently put the finishing touches on the annual update for the Practical M&A Treatise.

OfficeHours

JANUARY 25, 2025

In 2025 we recommend focusing more on an actively engaging and proactive strategy. If you seriously mess up with a headhunters client, that feedback will come back to the headhunter – and sometimes in a super blunt manner. Real world example: Wow, X was not ready for this – how did they make the cut? Not recommended. It depends.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

TechCrunch: M&A

JULY 7, 2023

The bloc has a history of greenlighting tech M&A, even when concerns are high, such as Google’s controversial purchase of Fitbit — which the EU cleared at the end of 2020 after accepting commitments in relation to the Fitbit API and a pledge from Google not to use Fitbit users’ health data for advertising for ten years.

OfficeHours

JUNE 27, 2023

So where do we stand today… On-Cycle Buyside Recruiting UPDATE FOR 2025 Headhunters, including Henkel and Gold Coast , are already reaching out to incoming analysts about on-cycle buyside recruiting. Connect with an OfficeHours Coach for an update on what we’re hearing live! Should I interview today?:

OfficeHours

JULY 8, 2023

What we know/What we don’t know Hey All — Rohit here, we’ve been getting asked quite a bit about On-Cycle 2025 — when it might happen, should individuals be getting reached out to by Headhunters, what firms individuals should focus on, when they should begin their prep, how we might be able to help, etc. I don’t think so.

Devensoft

MAY 16, 2023

Mergers and acquisitions (M&As) are surefire ways of helping companies grow in size and leapfrog their rivals. However, while they are significant investments that promise game-changing returns, neglecting M&A cybersecurity can present serious risks. trillion by 2025. What Is Cybersecurity Due Diligence?

OfficeHours

SEPTEMBER 26, 2023

His passion for learning more about software companies and the founders that scale them led him to transition into Software M&A and Capital Raising at Union Square Advisors LLC. Overheard on OfficeHours Listen to OfficeHours on Spotify. How was your experience recruiting into Private Equity?

Solganick & Co.

MARCH 10, 2025

March 10, 2025 — Solganick is pleased to announce that it served as the exclusive M&A advisor to Kavaliro for the sale of its Salesforce consulting division to Accordion. Kavaliro is expecting to increase its workforce in these two areas by over 20% in 2025. ORLANDO, FL.,

OfficeHours

OCTOBER 11, 2023

Periscope Equity & OfficeHours Discuss Associate Success in Private Equity OfficeHours From IB Associate to Growth Equity to Entrepreneurship OfficeHours From Student-Athlete to Private Equity Associate to Incoming MBA OfficeHours Where do you currently stand in On-Cycle 2025 Recruiting? Yes, I’m interested!

OfficeHours

OCTOBER 27, 2023

Bring Questions for Rhea Harsoor TODAY at 3PM ET! How does one go from IB to Media? Transitioning from a career in investment banking to the dynamic world of media may seem like a significant shift. Overheard on OfficeHours Listen to OfficeHours on Spotify.

OfficeHours

OCTOBER 17, 2023

Once I started working in finance, I educated myself on different investment types, what effective budgeting really meant, and where I should be putting my money to maximize return and diversification. This stuff isn’t rocket science, but it’s also not intuitive! So you want to pursue a role in Private Equity and Growth Equity?

OfficeHours

JULY 13, 2023

When they ask you about your deals, metrics, did you hold the pen on the model, what did synergies look like on the M&A front, did you think through revenue builds, organic growth, inorganic means, etc. WHAT DEAL AND METRICS AND MODEL ARE YOU GOING TO TALK ABOUT SINCE YOU’RE ONLY IN TRAINING?! Interviews then will be tougher.

OfficeHours

AUGUST 23, 2023

She earned her bachelor’s degree in Business Administration (BBA) from the University of Michigan – Stephen M. Come listen to Alice speak about her time recruiting as a Lazard IB Associate into TCV Growth Equity! Ross School of Business and her master’s degree from Harvard Business School.

Solganick & Co.

APRIL 24, 2024

Solganick Technology Services M&A Update – Q1 2024 Final April 25, 2024 – Los Angeles and Dallas – Solganick & Co. (“Solganick”) has issued its latest technology services industry sector mergers and acquistions (M&A) update report for Q1 2024. of all transactions through YTD.

OfficeHours

OCTOBER 23, 2023

Even in 2022, when take-private deals hit a new record, they only accounted for 37% of the total value of transactions. Written by a top OfficeHours Coach; Original article published on October 16, 2023 In today’s world, there is much uncertainty around public markets.

OfficeHours

OCTOBER 20, 2023

For private equity investors who have been monitoring the situation around inflation for the last few months to a year, many have been disappointed to see the slow trajectory with which inflation has been coming down from highs. Currently, inflation in the U.S. Currently, inflation in the U.S.

OfficeHours

OCTOBER 16, 2023

If you’re a ‘ new kid on the block ’ in the world of finance, you might have thought about what it’s really like to work on the Buyside and if all the excitement is true. People often say not to mess up an interview because it could affect your chances for more opportunities in the future. Take advantage of our October Promotion! Just do it.

OfficeHours

JULY 11, 2023

Is It Possible That On-Cycle 2025 Is Around The Corner? Hey All — Rohit here and it’s been a busy couple of days – word has gotten out about Diversity Events at Megafunds already starting for On-Cycle 2025… needless to say we’ve been pretty swamped with inbounds and LOTS of calls happening. Are you seeing US govt.

Focus Investment Banking

JUNE 22, 2023

trillion in 2016, and by 2025 global ESG assets may exceed $50 trillion. trillion in 2016, and by 2025 global ESG assets may exceed $50 trillion. ESG—environmental, social, and governance factors—continues to capture headlines for a variety of reasons, perhaps most notably for its rapid rise. trillion in 2018 and $22.8

Global Newswire by Notified: M&A

JANUARY 10, 2025

10, 2025 (GLOBE NEWSWIRE) -- MIND C.T.I. YOQNEAM, Israel, Jan.

Mergers and Inquisitions

DECEMBER 20, 2023

The IB internship recruiting timeline is now so insane that even mainstream news sources like the Wall Street Journal are writing about it (“ The Race Is On to Hire Interns for 2025. If you want to know how to get an investment banking internship, it’s simple: Start very, very early and have a great “Plan B” if something goes wrong.

Sica Fletcher

OCTOBER 16, 2024

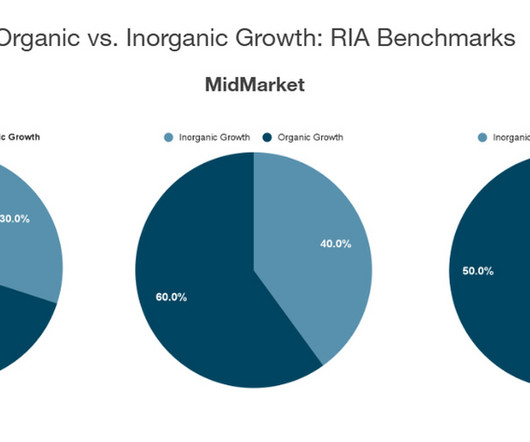

The tables below outline the multiples proper, while the sections that follow take a deeper look into factors affecting RIA valuations as well as market conditions moving into Q4 of 2024 and into 2025. The following sections outline factors affecting these individual deals, including fee structure, client demographics, and growth potential.

Software Equity Group

SEPTEMBER 17, 2024

Choosing the correct corporate structure is vital for software executives who want to optimize tax efficiency and prepare for potential M&A exits. Some tax experts have their clients elect S Corp or LLC status to avoid double taxation, but there’s much more to consider if you’re interested in any type of M&A exit.

Focus Investment Banking

SEPTEMBER 10, 2024

The take-home segment dominates, accounting for $17 billion of the market. Who Are The Buyers in Dairy Products M&A? Unlock the potential of the dairy market by embracing change and innovation in an evolving industry For business owners in the food and beverage industry, the dairy market presents both challenges and opportunities.

InvestmentBank.com

SEPTEMBER 18, 2019

until 2025 [2]. They account for $3.67 Those making online, direct-to-consumer (DTC), nutritional supplement purchases—not through Amazon which is ~29%—only accounts for about 3% of all nutritional supplement sales [7]. Simplicity, transparency, and trust fuel the growth of the nutritional supplement industry.

The TRADE

JULY 17, 2024

I’m not trying to make every single trader into a multi-asset trader and spread them across every asset class we trade. The London-based asset manager has undergone not one but three makeovers in recent years as it continues to evolve with the demands of the street. We have a very strong, talented desk.

Solganick & Co.

NOVEMBER 12, 2024

November 13, 2024 – Solganick has published its latest M&A update report on the Technology Services industry sector. We expect M&A deal volume to increase in the technology services sector for the remainder of 2024 and continue into 2025. The Average deal volume is 462 transactions from Q1 2021 to Q3 2024.

Cleary M&A and Corporate Governance Watch

MARCH 29, 2023

Individual Tax Rate Increases Currently, the top marginal individual income tax rate is 37% until after December 31, 2025, when the top marginal tax rate will be increased to 39.6%. This proposal would be effective for gains required to be recognized and dividends received after the date of enactment.

Lake Country Advisors

MARCH 13, 2025

Cross-border M&A transactions are gaining momentum in 2025, fueled by global economic integration and emerging market opportunities. Mitigating Legal Risks Legal risks in M&A transactions can stem from contract misinterpretations, intellectual property concerns, or licensing issues.

Global Newswire by Notified: M&A

MARCH 14, 2025

New York, March 14, 2025 (GLOBE NEWSWIRE) -- Inception Growth Acquisition Limited (NASDAQ: IGTA, the Company), a publicly traded special purpose acquisition company, announced today that on March 12, 2025, the Company deposited $11,199.60

Focus Investment Banking

MARCH 20, 2025

Public Markets Summary Twelve Month Index Returns Sector and Sub Sector Returns Sector and Sub Sector Revenue Multiples Sector and Sub Sector EBITDA Multiples M&A Activity The level of M&A activity in the Telecom Technology sector continued to run at a very low level with only nine transactions for the current reporting period.

Focus Investment Banking

JANUARY 14, 2025

PUBLIC MARKET SUMMARY Twelve Month Index Returns Sector and Sub Sector Returns Sector and Sub Sector Revenue Multiples Sector and Sub Sector EBITDA Multiples M&A Activity The Telecom Business Services sector ended 2024 with a bang as the sector notched 24 total transactions for the period. Sub sector multiples rose from 0.7x

Cooley M&A

JANUARY 30, 2025

With the 2025 proxy season in full swing, lets take a fresh look at the landscape. 43% of 2024 activist campaigns were M&A focused, in line with the three-year average. 2024 was a prolific year for activists, with 243 campaigns launched globally the highest number since 2018.

Focus Investment Banking

FEBRUARY 7, 2025

OVERVIEW In the FOCUS HCM 2024 Year in Review, we take a closer look at M&A activity in two key parts of the HCM market: 1. While the outlook for further cuts in 2025 is uncertain the full percentage point reduction should benefit the many acquirers, particularly private equity, who utilize debt to finance deals.

Global Newswire by Notified: M&A

MARCH 13, 2025

NEW YORK, March 13, 2025 (GLOBE NEWSWIRE) -- Legato Merger Corp. See further discussion in Note 1 to the Companys financial statements included in the Companys Annual Report on Form 10-K.

Focus Investment Banking

FEBRUARY 15, 2025

OVERVIEW The Food and Beverage industry capped off 2024 with a steady volume of M&A activity, with a total of 412 transactions. Large corporate buyers accounted for several mega deals in 2024 including Mars acquiring Kellanova for $36 billion and Campbells Soup purchasing Sovos Brands for $2.3 The main takeaway of 2024? billion.

The TRADE

JANUARY 13, 2025

The transaction is expected to complete in Q2 2025, subject to regulatory approvals. According to Clearwater, around 66% of its core Total Addressable Market (TAM) stems from the asset management industry, yet this accounts for just a third of its overall revenue. The post Clearwater Analytics picks up SaaS business Enfusion in $1.5

MergersCorp M&A International

FEBRUARY 25, 2025

In 2025, a significant shift is occurring in the business landscape. The Baby Boomer generation, born between 1946 and 1964, is in their golden years and embarking on a new phase of life. This transition is not just personal; it’s reshaping the economic fabric of our nation. Motivations Behind the Sell-Off 1.Retirement

Focus Investment Banking

MARCH 7, 2025

We explore the root causes of the technician shortage, highlight innovative solutions to bridge the skills gap, and discuss how shop owners can recruit, train, and retain top talent in an increasingly competitive market. Jay Goninen: Every time I get to talk to you, we have a lot of fun. But it’s it’s always a pleasure, my friend.

The TRADE

JANUARY 29, 2025

My journey to the trading desk has been anything but traditional, and I’m incredibly proud of that. Rowe Price Baltimore base – set to unveil their new HQ at the location in late Q1 2025, The TRADE understands. Brian Rubin, Dwayne Middleton, Paul Cable T. Im now into my twenty-sixth year at T.

Focus Investment Banking

MARCH 4, 2025

In this episode of the Collision Vision driven by Auto Body News , were joined by Lance Bull and Steve Davis from Techmotive , a company dedicated to helping collision repair shops navigate the complexities of ADAS calibration with the right tools, technology and expertise. Cole Strandberg: Looking forward to a fun conversation. He saw this coming.

Cooley M&A

FEBRUARY 3, 2025

After a rough 2023 , tech M&A in 2024 was slow to start but ended the year strong, with deal values up 32% from 2023 , well outpacing the overall M&A markets 10% growth in 2024. So is tech M&A back? Tech M&A may not be back, but its story is far from over. billion acquisition of Altair, IBMs pending $6.4

Mergers and Inquisitions

NOVEMBER 6, 2024

I was barely paying attention to this year’s election cycle for a long time. But in late June, something interesting finally happened: Biden debated Trump, and his brain exploded and got sucked into a black hole on stage. elections reviews” for 16 years, with the first one right after Obama’s win in 2008. What Happened in the 2024 Election?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content