Momentum Shift: Canada’s M&A Landscape in 2025

JD Supra: Mergers

JANUARY 10, 2025

A variety of factors are expected to significantly increase Canadian M&A activity in 2025. We expect to enter 2025 with some positive momentum in Canadian dealmaking.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JANUARY 10, 2025

A variety of factors are expected to significantly increase Canadian M&A activity in 2025. We expect to enter 2025 with some positive momentum in Canadian dealmaking.

JD Supra: Mergers

FEBRUARY 12, 2025

We continue to observe the growth of professional sports as an asset class, with private capital having transformed team investments in recent years from trophy assets to opportunities for significant growth. By: Akin Gump Strauss Hauer & Feld LLP

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

JANUARY 8, 2025

December 4, 2024: Raise Green, an equity crowdfunding platform designed to facilitate businesses in raising capital for green infrastructure and clean energy projects, was acquired by Honeycomb Credit for an undisclosed amount. By: Mintz - Energy & Sustainability Viewpoints

Accenture Capital Markets

NOVEMBER 16, 2023

At Accenture’s capital markets team, we’ve completed a research project into the future of capital raising. More so, I suspect people most interested may be small-cap issuers, many of whom currently seem to struggle to raise the capital in the way that best suits their needs and at times when they need it the most.

Solganick & Co.

DECEMBER 20, 2024

Private Equity Influence: PE-driven deals are expected to reach record highs, driven by the availability of capital and attractive valuations in the software sector. Forecast for 2025: Continued Growth: M&A activity is expected to continue to rise in 2025, with a focus on strategic acquisitions and digital transformation.

JD Supra: Mergers

MARCH 10, 2025

On 5 March 2025, the United Kingdoms Financial Conduct Authority (FCA) published the findings of its multi-firm review of valuation processes for private market assets (the Review). By: Proskauer - Regulatory & Compliance

Focus Investment Banking

JANUARY 21, 2025

and Dublin, Ireland January 23, 2025 FOCUS Investment Banking based in the US (the Company) and FOCUS Capital Partners (FCP) based in Ireland have combined ownership and operations to provide best in class investment banking services for middle-market clients. Washington, D.C.

Growth Business

JULY 24, 2023

By Dom Walbanke on Growth Business - Your gateway to entrepreneurial success A cross-committee of MPs is urging Government to demand that venture capital firms publish their diversity statistics in order to qualify for tax breaks, such as SEIS and VCT.

Focus Investment Banking

JANUARY 8, 2025

Washington, DC, (January 8, 2025) FOCUS Investment Banking, a leading middle-market investment banking firm, is pleased to announce that Bob Lipton has joined the firm as a Managing Director in the Human Capital Management (HCM) team.

OfficeHours

JUNE 27, 2023

So where do we stand today… On-Cycle Buyside Recruiting UPDATE FOR 2025 Headhunters, including Henkel and Gold Coast , are already reaching out to incoming analysts about on-cycle buyside recruiting. Do you plan on recruiting for On-Cycle 2025? Self-study on the platform and then receive 1:1 coaching to master your understanding.

OfficeHours

JULY 8, 2023

What we know/What we don’t know Hey All — Rohit here, we’ve been getting asked quite a bit about On-Cycle 2025 — when it might happen, should individuals be getting reached out to by Headhunters, what firms individuals should focus on, when they should begin their prep, how we might be able to help, etc.

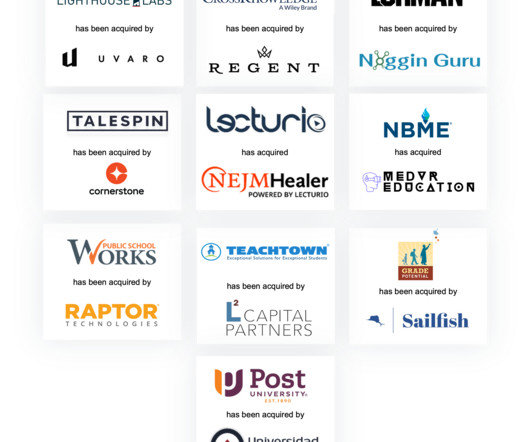

Tyton Partners

DECEMBER 19, 2024

Using this lens to look ahead, we asked our firms consulting practice leaders to reflect on the complex, interconnected education ecosystem and share their thoughts on the following: What do you most want to discuss in 2025, and why is it important? Catalytic capital is not bad investing. If not now, when?

OfficeHours

JUNE 30, 2023

Are you preparing for upcoming private equity interviews? If so, understanding the mechanics of a leveraged buyout is paramount… Paper LBOs are an important part of any private equity interview. To go from equity value to enterprise value, add the net debt (debt minus cash) of the company to equity value.

Solganick & Co.

JANUARY 28, 2025

January 28, 2025 – Dallas and Los Angeles. Private Equity Influence : Private equity firms continue to play a significant role in the M&A landscape, investing in promising IT solution providers and driving further consolidation. World Wide Technology (WWT) acquisition of Canada based Softchoice for C$1.8B.

OfficeHours

SEPTEMBER 26, 2023

.” These webinars are packed with valuable insights from industry professionals and experts in the world of Finance – from private equity to investment banking, career transitions, career growth, and a whole lot more! How was your experience recruiting into Private Equity?

The TRADE

JANUARY 22, 2025

I spent the first 20 years of my career at the global bulge bracket banks, first in investment banking and then on the institutional equity desks, in a cross-asset and special situations role. I was there through 2015, then Bank of America, before I joined Conversant Capital in early 2021. What does your role involve?

OfficeHours

AUGUST 18, 2023

We are excited to host a FORMER MENTEE of ours who will speak about his experience TODAY AT 12PM ET regarding how he transitioned from a student-athlete to Investment Banker to Private Equity Associate and now an Incoming MBA ! billion in aggregate committed capital. Where do you currently stand in On-Cycle 2025 Recruiting?

Global Banking & Finance

OCTOBER 29, 2024

billion pound ($7 billion) takeover by an international consortium in the first quarter of 2025. The consortium, consisting of Europe’s largest private equity firm CVC Capital Partners, Abu Dhabi’s sovereign wealth fund and Swedish private equity […]

TM Capital

JANUARY 9, 2025

April 29-30, 2025 | Georgia Aquarium | Atlanta, GA The Owners Summit offers privately-held businesses the opportunity to meet with investor groups in an exclusive, one-on-one setting. These investor groups include private equity firms, family offices, growth equity firms, and sovereign wealth funds investing across all industries.

OfficeHours

AUGUST 23, 2023

Growth Equity (ex-TCV Investor) Webinar TOMORROW at 12PM ET! Come listen to Alice speak about her time recruiting as a Lazard IB Associate into TCV Growth Equity! Join us as Alice Shang shares her insights and journey TOMORROW 8/24 AT 12PM ET regarding her journey from Investment Banking to Growth Equity to Entrepreneurship.

OfficeHours

OCTOBER 11, 2023

For the past months, OfficeHours has had some amazing speakers, including private equity pros, HBS MBA grads, and successful founders. We cover topics like private equity, investment banking, switching careers, and how to grow in your job. You can now listen to their talks on our Spotify channel, “ Overheard on OfficeHours.

The TRADE

NOVEMBER 27, 2024

Whit Conary, Steve Miele Steve Miele, who currently serves as chief strategy officer, has been appointed new chief executive officer of Kezar Marekts, effective 1 January 2025. Conary’s capital markets career spans four decades, with his retirement paving the way for Kezar Markets’ continued growth plans.

OfficeHours

OCTOBER 27, 2023

OfficeHours is an online platform that provides 1-on-1 coaching, training, and advice to help you land a job in competitive finance careers including investment banking, private equity, growth equity, venture capital, and hedge funds. He began his professional journey as an Investment Banking Analyst at UBS.

Global Newswire by Notified: M&A

FEBRUARY 5, 2025

LONDON and BOSTON and TUSTIN, Calif.,

Growth Business

AUGUST 23, 2023

By Timothy Adler on Growth Business - Your gateway to entrepreneurial success Capital invested by venture capital trusts increased by 8 per cent last year to £664m. How do you know it’s time to raise venture capital? – There’s a lot to consider when looking to raise venture capital.

Focus Investment Banking

DECEMBER 23, 2024

Strategic buyers pursued opportunities across the food and beverage landscape, while private equity was largely sidelined by the rate environment. Overall, there was a healthy amount of dealmaking throughout the year, offering a positive signal for 2025. merged with Missouri-based Zeal Creamery, a premium grass-fed dairy milk brand.

Tyton Partners

FEBRUARY 3, 2025

As we project toward 2025, this sector is poised to sustain its robust performance, driven by substantial investor interest and the opportunities presented by a highly fragmented market. In 2025, investors are expected to focus increasingly on companies that enhance operational efficiencies within the education sector.

The TRADE

JUNE 5, 2024

First reported by Wall Street Journal, TXSE is aiming for a launch at the start of 2025 and host its first listing in 2026. Texas has been noted by market participants as an increasingly significant market in North America and globally, playing host to around 5000 private equity-backed firms and 1500 publicly listed firms.

Global Newswire by Notified: M&A

APRIL 11, 2024

DUBLIN, IRELAND, April 11, 2024 (GLOBE NEWSWIRE) -- ) - STERIS plc (NYSE: STE) (“STERIS” or the “Company”) today announced that the Company has entered into a definitive agreement to divest its Dental segment to Peak Rock Capital, a leading middle-market private investment firm, for $787.5 The Transaction is structured as an equity sale.

OfficeHours

AUGUST 10, 2023

We are excited to invite you to our upcoming webinar, a unique opportunity to gain insights from an industry professional who transitioned successfully from being an M&A Investment Banking Analyst at RBC Capital Markets into a Senior Strategy Analyst at The Walt Disney Company. Where do you currently stand in On-Cycle 2025 Recruiting?

OfficeHours

OCTOBER 20, 2023

For private equity investors who have been monitoring the situation around inflation for the last few months to a year, many have been disappointed to see the slow trajectory with which inflation has been coming down from highs. Explore the role of private equity now. Currently, inflation in the U.S.

OfficeHours

JULY 20, 2023

What I want to talk about today is more pressing since there are so many ppl buzzing with the question… Is On-Cycle 2025 Starting Now? Lots of rumors in the rumor-sphere — we’ve all heard it where people are thinking On-Cycle 2025 should start soon. How ready do you feel for On-Cycle 2025 Recruiting?

The TRADE

FEBRUARY 29, 2024

The London Stock Exchange (LSEG) saw overall growth across its key businesses in 2023, with considerable improvement across data and analytics, capital markets, and in particular, post-trade. year-on-year increase, while capital markets saw a 6.1% In capital markets, the 6.1% rise year-on-year as compared to 2022. respectively.

The Deal

JUNE 26, 2023

Kian Capital Partners LLC is chasing add-ons in contiguous Southern states for its new platform, Nashville-based HVAC distributor Team Air Distributing Inc., The post Kian Capital Builds Sunbelt HVAC Distributor appeared first on The Deal. the firm’s principal Jordan Lee told The Deal. in April and Novacap Investments Inc.

The TRADE

DECEMBER 20, 2023

Yet, the evaluation for the CTP is only set to take place from Q1-Q3 2025, with the authorisation of this bond CTP not expected until Q4 2025 – a year on from the initial launch of the bond CTP selection. The establishment of a consolidated tape for bonds in the UK is a major milestone.

OfficeHours

OCTOBER 23, 2023

However, for private equity investors, this uncertainty represents a unique opportunity to take advantage of investment opportunities in public markets. A “take-private” transaction in the context of private equity is a process by which a PE firm acquires a publicly listed company and converts it into a privately held entity.

Global Newswire by Notified: M&A

OCTOBER 16, 2024

Nasdaq: DECA) for a pre-transaction equity value of $2.5 billion which transaction is expected to occur by the end of fourth quarter of 2024 or the first quarter of 2025. PALO ALTO, Calif.,

OfficeHours

AUGUST 14, 2023

Chris Sacca, the famed venture investor, gives an example of how a 15-year-old did exactly that here and secured an internship at Lowercase Capital. To know if the buyside is right for you, let’s start with a textbook understanding of “What is private equity?”

The TRADE

JULY 27, 2023

The bank also noted an overall decrease in equity market revenues – citing a “lacklustre environment” during the quarter. decrease, while equity and prime services saw a fall of 3% – demonstrating better resiliency in the face of the dip in client activity. Revenue for the corporate and institutional banking area were down 2.3%

Global Newswire by Notified: M&A

MARCH 13, 2025

Impact), a capital pool company listed on the TSX Venture Exchange (the Proposed Merger), Impact has obtained a valuation report from Evans & Evans, Inc. Evans & Evans), which indicates that in the opinion of Evans & Evans, the fair market value of the equity interests of Fort Products as of January 31, 2025, is between CAD 16.8

The TRADE

JANUARY 16, 2024

Currently, Mifir foresees three consolidated tapes for Europe, a bond CT – set to be operational by mid-2025, an equities tape set to be operational in early 2026, and a derivatives CT planned for later the same year. At EuroCTP, we stand by the shared principle of increasing market data transparency and accessibility.

Global Newswire by Notified: M&A

FEBRUARY 5, 2025

LONDON, Feb. LONDON, Feb.

Global Newswire by Notified: M&A

JANUARY 15, 2025

15, 2025 (GLOBE NEWSWIRE) -- Amplify Energy Corp. Pro forma for the Transaction, Amplify shareholders will retain approximately 61% of Amplifys outstanding equity and approximately 39% will be owned by Juniper. HOUSTON, Jan. Under the terms of the Merger Agreement, Amplify will issue Juniper approximately 26.7

Focus Investment Banking

JANUARY 10, 2025

I hope 2024 treated you and yours incredibly well, and I’m looking forward to an even better year in 2025. The focus of the collision vision in 2025 is to double down on the most important and timely topics in the collision repair business and to triple or even quadruple down on offering actionable insights for your business.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content