European leveraged finance: A market reawakened

JD Supra: Mergers

FEBRUARY 6, 2025

European loan and bond issuance nearly doubled year-on-year. Refinancing and repricing drove activity, as issuers.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

FEBRUARY 6, 2025

European loan and bond issuance nearly doubled year-on-year. Refinancing and repricing drove activity, as issuers.

JD Supra: Mergers

FEBRUARY 13, 2025

After a subdued 2023 during which it was challenging for private equity (PE) to raise debt financing as a result of elevated interest rates and a difficult syndicated lending market, 2024 featured a material shift in the global credit landscape. By: Akin Gump Strauss Hauer & Feld LLP

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

JULY 15, 2024

Welcome to this edition of Credit Conditions, a quarterly publication from McDermott Will & Emery that analyzes recent debt market trends. Key Debt Market Trends - Interest Rates - “Start your engines” has shifted to “hold your horses” as rates continue to remain “higher for longer.”

JD Supra: Mergers

MARCH 10, 2025

On 5 March 2025, the United Kingdoms Financial Conduct Authority (FCA) published the findings of its multi-firm review of valuation processes for private market assets (the Review). By: Proskauer - Regulatory & Compliance

Global Banking & Finance

DECEMBER 10, 2024

By Naomi Rovnick LONDON (Reuters) – The threat of soaring government debt supply destabilising financial markets has intensified, the world’s top central banking advisory body said on Tuesday, as it urged policymakers to act swiftly to prevent economic damage.

Global Banking & Finance

DECEMBER 26, 2024

KYIV (Reuters) – Moldova’s parliament approved the budget for 2025 with a deficit of 4.05% of gross domestic product (GDP) on Thursday. The state debt is […] Budget revenues were put at 71.6 billion Moldovan lei ($3.9 billion), up by 6.8% compared with 2024, and the expenditures were put at 85.4

Razorpay

FEBRUARY 6, 2024

In this blog, we share the Latest TDS rate chart for the Financial Year 2024-25 and Assessment Year 2025-26 to help you calculate and pay TDS error-free. It is applicable on various payments ranging from contractor payments, salary, commission and more. The TDS rates are predecided by the Government under the Income Tax Act.

Global Banking & Finance

OCTOBER 8, 2024

in 2025, outperforming Europe’s major economies, thanks to strong tourism revenues, robust consumer spending and investment, a 2025 draft budget showed on Monday. Greece, which is still recovering from a debt crisis that nearly saw the country drop out […]

OfficeHours

JUNE 30, 2023

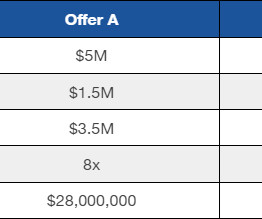

To go from equity value to enterprise value, add the net debt (debt minus cash) of the company to equity value. Step 3: Calculate Debt and Equity Funding Amounts (Sources & Uses) Since LBOs are financed using a combination of debt and equity, you’ll need to determine how much of each will be used in the transaction.

OfficeHours

OCTOBER 20, 2023

Inflation can also have an impact on the cost of debt required to finance an investment. Inflation itself does not directly affect the cost of debt or interest; rather, since inflation and interest rates are very closely related, changes in inflation impact changes in interest rates.

Focus Investment Banking

JANUARY 21, 2025

and Dublin, Ireland January 23, 2025 FOCUS Investment Banking based in the US (the Company) and FOCUS Capital Partners (FCP) based in Ireland have combined ownership and operations to provide best in class investment banking services for middle-market clients. Washington, D.C.

Global Banking & Finance

DECEMBER 24, 2024

The plan for 2025 sovereign debt issuance would be a sharp increase from this year’s […]

Global Banking & Finance

DECEMBER 24, 2024

The plan for 2025 sovereign debt issuance would be a sharp increase from this year’s […]

Global Newswire by Notified: M&A

DECEMBER 24, 2024

With the regulatory approval under the HSR Act secured (HSR Approval), Mattr expects the balance of the conditions to closing of this transaction to be achievable within a timeline which will permit completion of the transaction on or about January 2, 2025. EPA:NEX) for a purchase price of US$280M.

OfficeHours

OCTOBER 17, 2023

Existing Debt The US is a country riddled with debt. Others may have car payments, mortgages, credit card debt, or other debt that could hang over their head as a large liability. Yes, I’m interested! No, I’m not Login or Subscribe to participate in polls.

Global Banking & Finance

NOVEMBER 26, 2024

By Jan Strupczewski BRUSSELS (Reuters) -France’s draft 2025 budget and medium-term plan to bring down public debt are in line with EU rules and credible, while spending plans of the normally frugal Netherlands are too high, the European Commission said on Tuesday.

Global Banking & Finance

NOVEMBER 18, 2024

(Reuters) -Britain’s Thames Water said on Monday creditors of its Class A debt approved a proposal to let it use about 400 million pounds ($505.88 million) of cash from its reserve accounts, providing a cash runway to February 2025.

OfficeHours

OCTOBER 23, 2023

Once the terms are agreed upon, the acquisition is financed through a combination of debt and equity from the PE firm , as with a typical transaction. This results in the target company receiving a potentially very different capital structure than they previously had, typically with higher debt levels.

Global Newswire by Notified: M&A

JANUARY 15, 2025

15, 2025 (GLOBE NEWSWIRE) -- Amplify Energy Corp. per share, and assume approximately $133 million in net debt ( 2 ). The transaction is expected to close in the second quarter of 2025, subject to customary closing conditions, including obtaining the requisite shareholder and regulatory approvals. HOUSTON, Jan.

Global Newswire by Notified: M&A

MAY 15, 2024

per share, to be paid to its pre-merger shareholders in January 2025 • Vastned Retail will declare and pay an interim dividend of EUR 1.70 per share, to be paid to its pre-merger shareholders in January 2025 • Vastned Retail will declare and pay an interim dividend of EUR 1.70 EUR 2.0 - 2.5 EUR 2.0 - 2.5 EUR 2.0 - 2.5

The TRADE

OCTOBER 15, 2024

Lisa Schirf Launched 40 years ago, The WGBI measures the performance of fixed-rate, local currency, investment-grade bonds and comprises sovereign debt from over 25 countries, denominated in a variety of currencies. Tradeweb FTSE Closing Prices are expected be included in March 2025.

Global Newswire by Notified: M&A

JULY 9, 2024

million on a debt-free basis, subject to customary adjustments for closing working capital and transaction expenses. Upon the closing of the transaction, which is expected to occur by the end of the first quarter of 2025, Bangor will become a wholly owned subsidiary of Unitil. HAMPTON, N.H., a subsidiary of Hope Utilities, Inc.,

Global Newswire by Notified: M&A

MAY 15, 2024

per share, to be paid to its pre-merger shareholders in January 2025 • Vastned Retail will declare and pay an interim dividend of EUR 1.70 per share, to be paid to its pre-merger shareholders in January 2025 • Vastned Retail will declare and pay an interim dividend of EUR 1.70 EUR 2.0 - 2.5 EUR 2.0 - 2.5 EUR 2.0 - 2.5

iMerge Advisors

APRIL 9, 2025

Some common missteps include: Ignoring customer concentration or churn issues Overlooking deferred revenue or technical debt Assuming all revenue is equally valuable (e.g., Common Valuation Pitfalls to Avoid Founders often overestimate value by focusing solely on revenue or product innovation, while underestimating risk factors.

Focus Investment Banking

MARCH 10, 2025

Optimize Working Capital (One Year Ahead) What It Is: Net Working Capital (NWC) is Current assets minus current liabilities (A/R + Inventory A/P + Accrued Expenses), excluding cash, which you keep (in a typical cash-free, debt-free transaction). Why It Matters: Healthy working capital keeps the business running smoothly day-to-day.

iMerge Advisors

APRIL 13, 2025

Buyers will assess scalability, defensibility, and technical debt. Products and Technology Overview of core products or services Technology stack and architecture Product roadmap and innovation pipeline Intellectual property (IP) and proprietary assets For SaaS and software companies, this section is critical.

The TRADE

JANUARY 22, 2025

We look for the opportunity that best achieves opportunistic returns on the best risk-adjusted basis, be it in equities, corporate bonds, distressed bonds, bank debt, or convertibles. The setup for 2025 is harder. We do some listed options more on the index side as hedging instruments. We are nimble and agile.

Sica Fletcher

JULY 31, 2024

In addition to the high cost of debt interfering with their bottom line, they also have to contend with a buyer pool that’s larger than ever before , with 50+ buyers in the current pool where there used to be ~5. Sellers are remaining patient and working with M&A advisosr to identify areas of opportunity.

Focus Investment Banking

JANUARY 10, 2025

I hope 2024 treated you and yours incredibly well, and I’m looking forward to an even better year in 2025. The focus of the collision vision in 2025 is to double down on the most important and timely topics in the collision repair business and to triple or even quadruple down on offering actionable insights for your business.

iMerge Advisors

APRIL 16, 2025

Document Tech Stack: Provide a clear architecture overview, third-party dependencies, and any known technical debt. Organize Contracts: Centralize customer, vendor, and employee agreements. Flag any change-of-control clauses.

Successful Acquisitions

AUGUST 30, 2023

The ability to convert some purchases to installment payments over time appeals to generations made wary of the higher interest rates associated with credit card debt. As soon as 2025, 33% of all global assets under management are expected to have ESG mandates.

iMerge Advisors

APRIL 14, 2025

AR Aging and Collections History Accounts receivable aging reports help buyers assess the quality of your revenue and the risk of bad debt. Ensure you have a current, fully diluted cap table including all SAFEs, convertible notes, and unexercised options to avoid surprises during diligence.

iMerge Advisors

APRIL 14, 2025

Financial and Tax Documents Final working capital adjustment schedules Tax allocation statements (especially in asset sales) IRS Form 8594 (Asset Acquisition Statement) Payoff letters for outstanding debt or convertible notes 5. Legal and Regulatory Filings Secretary of State filings (e.g.,

iMerge Advisors

APRIL 8, 2025

litigation, debt) are disclosed Team & Org: Document key roles, retention plans, and any dependencies on founders or key personnel Many founders underestimate the time and effort required here.

Sica Fletcher

JULY 23, 2024

Since H2 2022, industries across the board (including insurance) have seen declines in deal volume as prospective buyers have withheld their funds for more favorable conditions in which the cost of debt is not so high.

The TRADE

DECEMBER 5, 2024

These changes are designed to improve market stability, increase transparency, and mitigate systemic risks in bond markets, affecting everything from Treasury securities to corporate debt. For trading desks, the new rules will result in a range of operational and regulatory shifts.

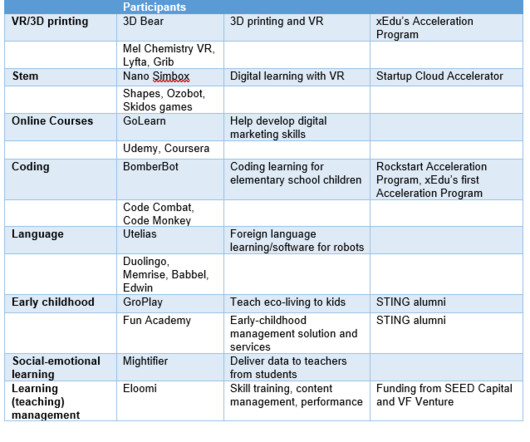

InvestmentBank.com

AUGUST 14, 2019

of total educational expenditures by 2025 [6]. With high levels of student loan debt, this demand has become more urgent. Even though digitization only occupies 2.6% There are a few major segments within the EdTech realm, including early childhood, K-12, higher education and lifelong learning.

Software Equity Group

SEPTEMBER 17, 2024

If your business faces financial difficulties, creditors typically cannot pursue your personal assets to satisfy business debts. LLC—offer limited liability protection, meaning your personal assets are generally protected from the company’s liabilities. This is why public companies are almost always C Corp.

JD Supra: Mergers

JANUARY 16, 2025

Floating-rate debt will likely be the chosen option by borrowers. Additionally, borrowers with strong banking and other lending relationships may opt to finance with short-term debt, holding off on obtaining longer-term loans until interest rates stabilize. By: Allen Matkins

JD Supra: Mergers

MARCH 7, 2025

Given the UKs status as the largest centre for private market asset management in Europe, and the importance of fair and robust valuation practices in private markets, the FCA has addressed its review to valuation practices in the fund and portfolio management sector, as well as advisory services in the private equity, venture capital, private debt.

JD Supra: Mergers

JANUARY 23, 2025

On January 16, 2025, the Treasury Department (Treasury) and Internal Revenue Service (IRS) published new proposed regulations related to tax-free spin-offs and split-offs (collectively, spin-offs) and other corporate transactions (Proposed Regulations). By: Skadden, Arps, Slate, Meagher & Flom LLP

Global Newswire by Notified: M&A

APRIL 1, 2025

April 01, 2025 (GLOBE NEWSWIRE) -- Unitil Corporation (NYSE: UTL) ( unitil.com ) today announced that it has entered into a definitive agreement to acquire Maine Natural Gas Company (Maine Natural) from Avangrid Enterprises, Inc., million on a debt-free basis, subject to adjustment for closing working capital and transaction expenses.

Global Newswire by Notified: M&A

MARCH 6, 2025

CALGARY, Alberta, March 06, 2025 (GLOBE NEWSWIRE) -- Prospera Energy Inc. PEI, OTC: GXRFF) ("Prospera", PEI or the "Corporation") White.

European Investment Bank

FEBRUARY 5, 2025

The findings indicate that higher financial leverage is associated with lower emission intensity at the firm level, primarily due to firms having used long-term debt. It uses a novel dataset that combines information from the EU Emission Trading System with data on firms financial accounts.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content