Asset management association pushes for Europe to switch to T+1 in 2026

The TRADE

OCTOBER 22, 2024

The post Asset management association pushes for Europe to switch to T+1 in 2026 appeared first on The TRADE.

The TRADE

OCTOBER 22, 2024

The post Asset management association pushes for Europe to switch to T+1 in 2026 appeared first on The TRADE.

The TRADE

FEBRUARY 9, 2024

What are the costs associated with opening a North American FX trading desk? Each trader will need a terminal depending on the trading platform being used, which carries a considerable cost. All of that is the bare minimum set up and the cost of those items are necessary when considering opening a trading desk.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The TRADE

JUNE 21, 2024

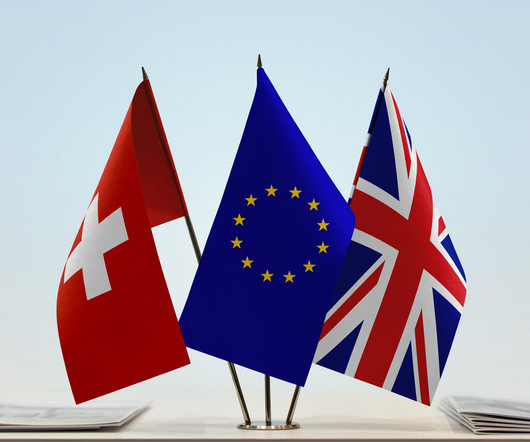

The current timeline for the UK appears to include a plan being put in place in 2025 with the implementation of a T+1 settlement cycle in UK occurring no later than 31 December 2027. When we proposed the rule in February 2022, only about two-thirds (68%) of transactions were being affirmed on trade day. Gensler said.

The TRADE

NOVEMBER 18, 2024

The European Securities and Markets Authority (ESMA) has proposed a move to T+1 in the EU by Q4 2027 – in line with the UK. Published in the watchdog’s final T+1 recommendations, ESMA recommends that the migration to T+1 occurs simultaneously across all relevant instruments – with a coordinated approach across the continent “desirable”. In a (..)

The TRADE

DECEMBER 20, 2024

The transition to a T+1 settlement cycle in North America this year highlighted the need for efficient and automated processes both pre- and post-trade, fostering a broader conversation on optimising post-trade workflows to handle growing complexities.

The TRADE

DECEMBER 31, 2024

Jim Kaye, Executive Director at the FIX Trading Community Next year will be the year of preparation. Market participants readiness for key milestones, like the anticipated go-live of the European consolidated tape (CTP) in 2025 or the transition to T+1 settlement in the UK/EU in 2027, will be critical to ensure long-term success.

The TRADE

JANUARY 17, 2025

I think it’s similar to 2024 to some extent, the main challenges are going to be political and macroeconomic uncertainties and how that will impact traders trading strategy. Financial products are different in EM than in developed markets where products are more electronic, with more high frequency trading, etc.

Let's personalize your content