Sharing Bank Accounts Can Deepen a Couple’s Relationship

The New York Times: Banking

FEBRUARY 9, 2025

Fewer couples are combining their bank accounts. But that trend may not promote partners overall financial health, experts say.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

FEBRUARY 9, 2025

Fewer couples are combining their bank accounts. But that trend may not promote partners overall financial health, experts say.

The New York Times: Banking

NOVEMBER 18, 2023

Banks have suddenly shut down the accounts of scores of customers. Here’s how you can avoid becoming one of them.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

DECEMBER 30, 2023

When banks close checking and credit-card accounts because of “suspicious activity,” chaos and anxiety ensue. It doesn’t have to be this way.

The New York Times: Banking

SEPTEMBER 13, 2024

Facing competition for business, banks are offering incentives to switch. But as one expert put it, “You have to read the fine print.”

Mergers and Inquisitions

DECEMBER 4, 2024

This partially explains why sports investment banking has become a hot field, with JP Morgan and Goldman Sachs launching their own sports coverage groups. For a long time, sports teams and franchises were not worth that much, so banks rarely put their “A-Teams” on these deals. What is Sports Investment Banking?

Razorpay

JANUARY 19, 2024

Powerful current accounts always come with a caveat; a minimum balance requirement. Whether it is a few ten thousand or a few lakhs, most accounts are not zero balance current accounts. Would a zero balance current account really be so beneficial to businesses?

The New York Times: Banking

JULY 9, 2024

For unsuspecting depositors of online financial start-ups, the unraveling of a little-known intermediary has separated them from their life savings.

The New York Times: Banking

DECEMBER 9, 2023

Here’s what bank security employees might be thinking when deciding whether to shut down a customer account after detecting unusual activity.

The New York Times: Banking

FEBRUARY 5, 2024

Moscow may be trying to help Pyongyang with access to the international financial system in exchange for missiles and ammunition, U.S.-allied allied intelligence officials suggest.

The New York Times: Banking

JANUARY 30, 2024

New York’s attorney general said the bank failed to protect its customers from hackers who, in some cases, stole their life savings and college funds.

The New York Times: Banking

JANUARY 3, 2025

After being grounded for 12 hours in Berlin, a mother and daughter were owed both compensation and a rebooked flight. All they got were nonsensical responses from customer service.

The New York Times: Banking

FEBRUARY 28, 2025

The bank temporarily credited a customers account with trillions of dollars, adding to scrutiny of risk management systems after a series of errors.

The New York Times: Banking

JANUARY 14, 2025

Federal regulators said in a lawsuit on Tuesday that the giant bank deliberately underpaid savings account interest, even as rates rose.

The New York Times: Banking

SEPTEMBER 15, 2023

Prosecutors had sought a year of incarceration, which they said would be a deterrent to other corporate executives.

Razorpay

MARCH 27, 2024

What is a Checking Account? A checking account is a type of bank account that allows you to deposit and withdraw money, write checks or use a debit card to make purchases or pay bills. Generally, account holders use these accounts on a short-term basis for paying daily expenses like food bills.

Razorpay

MARCH 19, 2024

Many startup founders initially feel that they can manage their organisation without having a current account. However, sooner than later, they would realise they require a current account to facilitate streamlined withdrawals, deposits and other business transactions. Let’s get right into it. What is a Startup Current Account?

The New York Times: Banking

JUNE 7, 2023

shared new details about how Binance’s accounts at Signature Bank and Silvergate Bank were used to move customer funds quickly through a web of foreign companies.

The New York Times: Banking

JULY 26, 2023

Alison Rose of NatWest, one of the country’s largest banks, resigned after Nigel Farage, a Brexit firebrand, said his account had been shut because of his political views.

The New York Times: Banking

JUNE 6, 2024

Then it reviewed his account activity. Last year, JPMorgan Chase wanted to pay Mansoor Shams a low-six-figure salary to work in a marketing role.

The New York Times: Banking

JUNE 1, 2024

Landlords are required to put security deposits in interest-bearing bank accounts. How much of that interest goes to you?

The New York Times: Banking

JANUARY 18, 2025

The company said a technical issue with a third-party vendor was to blame for a disruption with deposits and payment processing that stretched into the weekend.

Razorpay

DECEMBER 1, 2023

Once you have set up a business account, it is important to set up an online merchant account as well. But what is a merchant account? Let’s read further to learn everything about merchant accounts. Let’s read further to learn everything about merchant accounts. What is a Merchant Account? Wondering why?

Razorpay

MARCH 18, 2024

What is Corporate Account? A corporate account is a bank account one can open in the name of a business. Every small business that is required to pay tax should have a corporate bank account for business banking and its numerous benefits. Explore RazorpayX 2.

Global Banking & Finance

OCTOBER 7, 2024

Furqan Siddiqui, SOC Operations Officer at Obrela As custodians of sensitive financial data, banks and financial institutions face several cloud security threats that demand security controls and mitigation strategies.

The New York Times: Banking

JULY 11, 2023

The bank double-charged overdraft fees, withheld card perks and opened unauthorized accounts, regulators said. It will repay customers more than $80 million.

The New York Times: Banking

NOVEMBER 22, 2024

Interest rates have been falling, but deposits are earning more than inflation.

The New York Times: Banking

AUGUST 15, 2023

The action comes days after a U.S.-led led coalition accused Riad Salameh of decades of corruption to enrich himself at the expense of his country.

Global Banking & Finance

FEBRUARY 29, 2024

Fraud Against Financial Institutions Calls for Tighter Security Measures Protecting Customers in 2024 In January 2024, Citigroup was sued for its weak security measures against fraud.

Razorpay

MAY 6, 2024

These actions involve secure gateways, banks and consumer accounts to facilitate the exchange of funds for goods and services. It serves as a bridge between the merchant’s point of sale and the financial institution. What is Payment Processing? It plays a pivotal role in safeguarding sensitive information.

The New York Times: Banking

JANUARY 7, 2024

Should you keep a separate checking account for writing checks? Is there a specific pen you should use? We answer some reader questions.

The New York Times: Banking

JULY 27, 2024

Here is what experts say are the costliest stumbles people make with their retirement savings accounts — and how to get back on course.

Razorpay

JUNE 18, 2023

Traditional banking, which has been the go-to for hundreds of years now, has not been able to keep up with today’s tech-savvy customers. Long waiting times, security issues, and fixed working hours are a few of the problems plaguing legacy financial institutions today. So are they really better than traditional banks?

Razorpay

JUNE 8, 2023

What is Banking? A bank is any financial institution that helps people and businesses store, invest and borrow money. Banks provide services like deposits, loans, and investment options. Banks in India are regulated by the Reserve Bank of India (RBI), which is the central banking authority of the country.

Global Newswire by Notified: M&A

FEBRUARY 11, 2025

Market-leading data integration technology enables nCino to accelerate project timelines and offer increased connectivity and data sources across onboarding, loan origination, account opening and more Market-leading data integration technology enables nCino to accelerate project timelines and offer increased connectivity and data sources across onboarding, (..)

Razorpay

MAY 17, 2023

Bank reconciliation refers to the process by which the bank account balance of a business entity is reconciled with the amount recorded by financial institutions in the latest bank statement. What is a Bank Reconciliation Statement? It is to make sure all transactions are properly accounted for.

Razorpay

MAY 27, 2024

What is Core Banking Solution? A core banking solution (CBS) is a software used by banks to manage primary operations. It is a centralized system that allows customers or businesses to carry out transactions from any branch rather than only from the branch where the account was opened.

The New York Times: Banking

MARCH 23, 2024

A financial firm told an account owner that it had turned over her money to the state. When she filed a claim, something strange happened.

Business Standard - FInance

JUNE 22, 2023

The RBI circular permitting banks to enter into a one-time settlement with wilful defaulters poses a significant risk to the stability of financial institutions in the country, the CPI MP Binoy Viswam has said. This circular poses significant risks to the stability of our financial system," he said.

The New York Times: Banking

DECEMBER 9, 2023

Although check usage has declined in the last couple of decades, check fraud has risen sharply, creating a problem for banks — and customers trying to pay their bills.

The New York Times: Banking

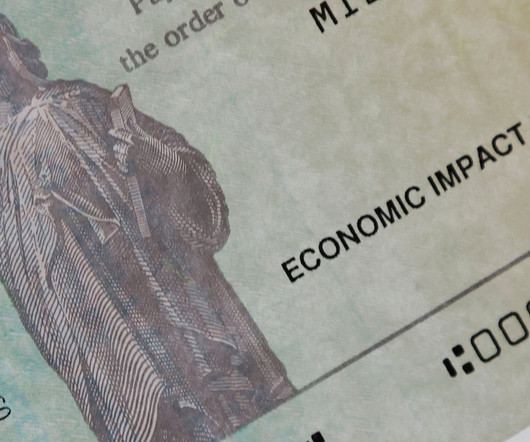

DECEMBER 23, 2024

Some Americans who qualified for a pandemic-era tax credit but did not claim it will get up to $1,400 in their account within the next month.

Razorpay

DECEMBER 15, 2024

What is Private Banking? Private banking is a personalized financial and wealth management service provided by banks to high-net-worth individuals (HNWIs). Unlike retail banking, which caters to the general public, private banking focuses on delivering banking services for affluent individuals and businesses.

Razorpay

MAY 15, 2024

This service, based on the USSD code *99#, lets you perform various mobile banking transactions without an active Internet connection. You can transfer money, request funds, change your UPI PIN, and check your account balance anytime and anywhere. Enter your bank’s IFSC code in the text field as requested.

Business Standard - FInance

JUNE 13, 2023

India Mortgage Guarantee Corporation (IMGC) would focus on strengthening partnerships with banks and financial institutions, a top official said on Tuesday. The company is backed by marquee investors -- Enact MI, Sagen (Brookfield Group), National Housing Bank, IFC (World Bank Group), And Asian Development Bank.

Razorpay

JUNE 20, 2023

It acts as a secure bridge between the customer’s payment method (such as a credit card or digital wallet) and the merchant’s bank account, facilitating the authorisation and processing of transactions. Step 2: Website directs customer to payment gateway where they enter bank/card details.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content