How to Keep Your Bank from Canceling All Your Accounts

The New York Times: Banking

NOVEMBER 18, 2023

Banks have suddenly shut down the accounts of scores of customers. Here’s how you can avoid becoming one of them.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

NOVEMBER 18, 2023

Banks have suddenly shut down the accounts of scores of customers. Here’s how you can avoid becoming one of them.

The New York Times: Banking

DECEMBER 30, 2023

When banks close checking and credit-card accounts because of “suspicious activity,” chaos and anxiety ensue. It doesn’t have to be this way.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Razorpay

JANUARY 19, 2024

Powerful current accounts always come with a caveat; a minimum balance requirement. Whether it is a few ten thousand or a few lakhs, most accounts are not zero balance current accounts. Would a zero balance current account really be so beneficial to businesses?

The New York Times: Banking

JULY 9, 2024

For unsuspecting depositors of online financial start-ups, the unraveling of a little-known intermediary has separated them from their life savings.

The New York Times: Banking

FEBRUARY 5, 2024

Moscow may be trying to help Pyongyang with access to the international financial system in exchange for missiles and ammunition, U.S.-allied allied intelligence officials suggest.

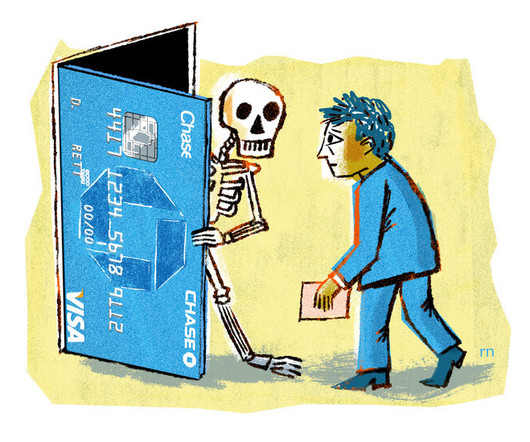

The New York Times: Banking

SEPTEMBER 13, 2024

Facing competition for business, banks are offering incentives to switch. But as one expert put it, “You have to read the fine print.”

The New York Times: Banking

JANUARY 30, 2024

New York’s attorney general said the bank failed to protect its customers from hackers who, in some cases, stole their life savings and college funds.

The New York Times: Banking

DECEMBER 9, 2023

Here’s what bank security employees might be thinking when deciding whether to shut down a customer account after detecting unusual activity.

Razorpay

MARCH 19, 2024

Many startup founders initially feel that they can manage their organisation without having a current account. However, sooner than later, they would realise they require a current account to facilitate streamlined withdrawals, deposits and other business transactions. Let’s get right into it. What is a Startup Current Account?

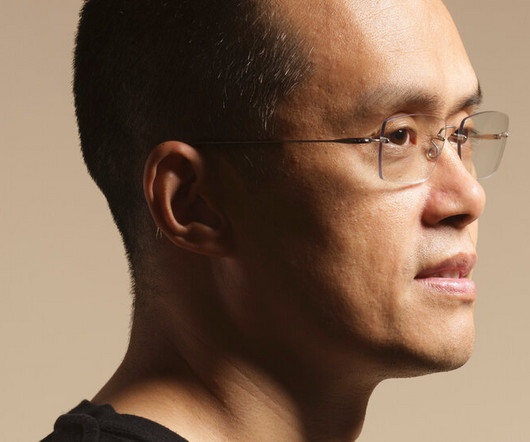

The New York Times: Banking

SEPTEMBER 15, 2023

Prosecutors had sought a year of incarceration, which they said would be a deterrent to other corporate executives.

Razorpay

MARCH 27, 2024

What is a Checking Account? A checking account is a type of bank account that allows you to deposit and withdraw money, write checks or use a debit card to make purchases or pay bills. Generally, account holders use these accounts on a short-term basis for paying daily expenses like food bills.

The New York Times: Banking

JUNE 1, 2024

Landlords are required to put security deposits in interest-bearing bank accounts. How much of that interest goes to you?

Razorpay

MARCH 18, 2024

What is Corporate Account? A corporate account is a bank account one can open in the name of a business. Every small business that is required to pay tax should have a corporate bank account for business banking and its numerous benefits. Explore RazorpayX 2.

The New York Times: Banking

JUNE 6, 2024

Then it reviewed his account activity. Last year, JPMorgan Chase wanted to pay Mansoor Shams a low-six-figure salary to work in a marketing role.

The New York Times: Banking

JULY 26, 2023

Alison Rose of NatWest, one of the country’s largest banks, resigned after Nigel Farage, a Brexit firebrand, said his account had been shut because of his political views.

The New York Times: Banking

JUNE 7, 2023

shared new details about how Binance’s accounts at Signature Bank and Silvergate Bank were used to move customer funds quickly through a web of foreign companies.

Razorpay

DECEMBER 1, 2023

Once you have set up a business account, it is important to set up an online merchant account as well. But what is a merchant account? Let’s read further to learn everything about merchant accounts. Let’s read further to learn everything about merchant accounts. What is a Merchant Account? Wondering why?

Global Banking & Finance

FEBRUARY 29, 2024

Fraud Against Financial Institutions Calls for Tighter Security Measures Protecting Customers in 2024 In January 2024, Citigroup was sued for its weak security measures against fraud.

The New York Times: Banking

NOVEMBER 22, 2024

Interest rates have been falling, but deposits are earning more than inflation.

Global Banking & Finance

OCTOBER 7, 2024

Furqan Siddiqui, SOC Operations Officer at Obrela As custodians of sensitive financial data, banks and financial institutions face several cloud security threats that demand security controls and mitigation strategies.

The New York Times: Banking

JANUARY 7, 2024

Should you keep a separate checking account for writing checks? Is there a specific pen you should use? We answer some reader questions.

The New York Times: Banking

JULY 11, 2023

The bank double-charged overdraft fees, withheld card perks and opened unauthorized accounts, regulators said. It will repay customers more than $80 million.

Mergers and Inquisitions

DECEMBER 4, 2024

This partially explains why sports investment banking has become a hot field, with JP Morgan and Goldman Sachs launching their own sports coverage groups. For a long time, sports teams and franchises were not worth that much, so banks rarely put their “A-Teams” on these deals. What is Sports Investment Banking?

The New York Times: Banking

AUGUST 15, 2023

The action comes days after a U.S.-led led coalition accused Riad Salameh of decades of corruption to enrich himself at the expense of his country.

Razorpay

MAY 6, 2024

These actions involve secure gateways, banks and consumer accounts to facilitate the exchange of funds for goods and services. It serves as a bridge between the merchant’s point of sale and the financial institution. What is Payment Processing? It plays a pivotal role in safeguarding sensitive information.

The New York Times: Banking

JULY 27, 2024

Here is what experts say are the costliest stumbles people make with their retirement savings accounts — and how to get back on course.

Razorpay

JUNE 8, 2023

What is Banking? A bank is any financial institution that helps people and businesses store, invest and borrow money. Banks provide services like deposits, loans, and investment options. Banks in India are regulated by the Reserve Bank of India (RBI), which is the central banking authority of the country.

Razorpay

JUNE 18, 2023

Traditional banking, which has been the go-to for hundreds of years now, has not been able to keep up with today’s tech-savvy customers. Long waiting times, security issues, and fixed working hours are a few of the problems plaguing legacy financial institutions today. So are they really better than traditional banks?

The New York Times: Banking

MARCH 23, 2024

A financial firm told an account owner that it had turned over her money to the state. When she filed a claim, something strange happened.

Razorpay

MAY 17, 2023

Bank reconciliation refers to the process by which the bank account balance of a business entity is reconciled with the amount recorded by financial institutions in the latest bank statement. What is a Bank Reconciliation Statement? It is to make sure all transactions are properly accounted for.

Razorpay

MAY 27, 2024

What is Core Banking Solution? A core banking solution (CBS) is a software used by banks to manage primary operations. It is a centralized system that allows customers or businesses to carry out transactions from any branch rather than only from the branch where the account was opened.

Razorpay

DECEMBER 15, 2024

What is Private Banking? Private banking is a personalized financial and wealth management service provided by banks to high-net-worth individuals (HNWIs). Unlike retail banking, which caters to the general public, private banking focuses on delivering banking services for affluent individuals and businesses.

Business Standard - FInance

JUNE 22, 2023

The RBI circular permitting banks to enter into a one-time settlement with wilful defaulters poses a significant risk to the stability of financial institutions in the country, the CPI MP Binoy Viswam has said. This circular poses significant risks to the stability of our financial system," he said.

The New York Times: Banking

DECEMBER 9, 2023

Although check usage has declined in the last couple of decades, check fraud has risen sharply, creating a problem for banks — and customers trying to pay their bills.

The TRADE

FEBRUARY 29, 2024

During the last few years, there has been a notable increase in financial institutions and corporates in Peru accessing offshore liquidity through electronic platforms, with transparency and high liquidity for G10 currencies some of the main drivers that promoted an increase in market activity.

Razorpay

MARCH 21, 2024

In 2001, you needed money and had to take a bank loan. After visiting your bank, you received a pamphlet with loan details. You compared other banks, gathered documents, submitted them, and waited for verification. You approached a bank for a loan and realized you could avail benefits without visiting the bank.

Razorpay

MAY 15, 2024

This service, based on the USSD code *99#, lets you perform various mobile banking transactions without an active Internet connection. You can transfer money, request funds, change your UPI PIN, and check your account balance anytime and anywhere. Enter your bank’s IFSC code in the text field as requested.

Business Standard - FInance

JUNE 13, 2023

India Mortgage Guarantee Corporation (IMGC) would focus on strengthening partnerships with banks and financial institutions, a top official said on Tuesday. The company is backed by marquee investors -- Enact MI, Sagen (Brookfield Group), National Housing Bank, IFC (World Bank Group), And Asian Development Bank.

Razorpay

JUNE 20, 2023

It acts as a secure bridge between the customer’s payment method (such as a credit card or digital wallet) and the merchant’s bank account, facilitating the authorisation and processing of transactions. Step 2: Website directs customer to payment gateway where they enter bank/card details.

The TRADE

APRIL 30, 2024

These regulations have significantly impacted the operations and behaviour of financial institutions, contributing to greater stability, transparency, and accountability in global financial markets. The years following 2008’s GFC experienced continued financial regulatory reform.

Bronte Capital

APRIL 30, 2021

Feature one: compulsory privatised pensions (called superannuation) Australians are forced to save almost ten percent of their salary into lock-box savings accounts that they cannot touch until retirement. Financial institutions in Australia have been fattened on fees from these collected savings. He got two and a half years.

The New York Times: Banking

AUGUST 31, 2023

The Swiss bank’s sharply discounted takeover of Credit Suisse led to a paper gain that gave it the biggest quarterly profit by a bank in history.

Wall Street Mojo

JANUARY 17, 2024

Statement of Cash Flows Definition A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. It helps identify the availability of liquid funds with the organization in a particular accounting period.

Wall Street Mojo

JANUARY 4, 2024

Accrued interest Accrued Interest Accrued Interest is the unsettled interest amount which is either earned by the company or which is payable by the company within the same accounting period. Still, the same is not received or paid in the same accounting period. And the loan is payable every month.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content