Practical M&A Treatise: The 2025 Edition is Here!

Deal Lawyers

NOVEMBER 18, 2024

We recently put the finishing touches on the annual update for the Practical M&A Treatise.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Deal Lawyers

NOVEMBER 18, 2024

We recently put the finishing touches on the annual update for the Practical M&A Treatise.

Midaxo

SEPTEMBER 14, 2023

That is especially true for organizations working in corporate development and M&A, where preventing unauthorized user access and protecting the confidentiality of data is paramount. Studies confirm that cloud-based M&A platforms are more secure and better able to respond to security challenges than generic, standalone tools.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Deal Lawyers

NOVEMBER 17, 2023

John has recently put the finishing touches on the annual update for the Practical M&A Treatise.

JD Supra: Mergers

OCTOBER 12, 2023

As part of our ongoing series on tax issues for accounting firms, this article provides information on retirement or deferred compensation arrangements, the related rules of Section 409A of the Internal Revenue Code, and how these issues may impact M&A deal structures and negotiations. By: Levenfeld Pearlstein, LLC

Sun Acquisitions

MARCH 8, 2022

One of the first questions a seller often asks is, “What documents are needed to sell a business?”. We’ve split the required documents as follows: A checklist of the legal documents needed to sell a business. A checklist of the financial documents needed to sell a business. Legal Documents Needed to Sell a Business.

Midaxo

DECEMBER 1, 2022

More specifically, platforms designed for M&A deal management eliminate siloed teams and disjointed communications that have long plagued deal flow. Below we discuss four ways an M&A platform helps enable efficient and collaborative due diligence. Additional notes regarding these forms of communication can also be captured.

Midaxo

APRIL 25, 2023

Introduction This article showcases how ChatGPT can serve as an effective M&A consultant by demonstrating how it can be used to help develop a best practices-based M&A playbook. An M&A playbook is a comprehensive framework that guides an organization’s M&A activities from start to finish.

The M&A Lawyer

SEPTEMBER 8, 2015

The primary transaction agreement in every M&A deal contains representations and warranties, colloquially referred to as “reps and warranties” or simply “reps,” from each party to the other. Walk rights.

How2Exit

MARCH 12, 2023

Ron Concept 1: Have Legal Documents Ready When it comes to buying or selling a business, having the right legal documents in place is essential. Without the appropriate legal documents, the process of acquiring or merging with another business can be difficult, time-consuming, and costly.

How2Exit

NOVEMBER 6, 2023

Ron rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. Their team is experienced in M&A, and they hire the best talent available. Reconciled sets the standard for consistency and quality that you can count on.

Francine Way

JULY 8, 2017

Buying and selling a company has many overlaps to buying and selling a house. There are many reasons to sell a house: wanting liquidity and diversification (especially if the house is an investment property), lack of progress toward a financial / strategic goals (i.e. the house failed to increase in expected value), mature market (i.e.

M&A Leadership Council

FEBRUARY 7, 2022

Part 1: Integration Management Office (IMO) Playbook: Your Coach’s Handbook to M&A. Adapted from The Art of M&A Integration for Maximum Results. Not only did Coach Bobby Knight know what it took to win, he knew that preparation was the key to that success , and he documented it – to help coach his team to execute consistently.

How2Exit

MARCH 1, 2023

Ron Concept 1: Bring the Lawyer in Last When buying or selling a small business, Joel recommends bringing the lawyer in last. He believes that attorneys often have a reputation for killing deals and that they should only be brought in once the deal is nearly done and due diligence needs to be completed.

How2Exit

MARCH 16, 2023

11 Things We Learned about M&A by Interviewing Christian Haack E105: Watch Here Here is what my team and I learned from this interview: (These are notes from team members, writers, sometimes AI, and even listeners who submitted what i learned loosely edited and shared here) - If it seems a bit unrefined, you're reading our notes, so.

Trout CPA: M&A

FEBRUARY 22, 2023

M&A Transaction disputes can be a costly and time-consuming affair. While it's generally fun to tease the accountants and attorneys in the room, this is where your advisors can help steer clear of unnecessary chafe after the transaction closes. So, how do you avoid them?

Sun Acquisitions

OCTOBER 21, 2024

In the dynamic world of mergers and acquisitions (M&A), financing plays a pivotal role in bringing deals to fruition. For mid-sized businesses eyeing growth opportunities through M&A, understanding the available financing options is essential for success.

GillAgency

OCTOBER 18, 2023

One crucial aspect of M&A process is the consideration of add-backs, which play a significant role in determining a company’s true earnings potential. While necessary for accounting, they don’t directly impact cash flow and can be added back. What are Add-Backs?

Beyond M&A

OCTOBER 16, 2024

A prior breach can significantly impact the due diligence process, making it imperative to demonstrate accountability, corrective action, and ongoing security vigilance. The reality is that cybersecurity issues often stem from internal vulnerabilities and human error, requiring a culture of accountability and proactive cybersecurity measures.

M&A Leadership Council

JUNE 18, 2024

A Step-by-Step Guide By M&A Leadership Council An M&A risk assessment is a systematic evaluation process used to identify, analyze, and mitigate potential risks associated with a merger or acquisition. Key Components of an M&A Risk Assessment 1. Steps in Conducting an M&A Risk Assessment 1.

How2Exit

MARCH 24, 2023

Ron Concept 1: Play A Bigger Game In today's society, it's easy to get stuck in a rut. We often feel content with the status quo, and don't want to challenge ourselves to do more. However, if we want to reach our full potential, it's important to challenge ourselves to play a bigger game. This is where investing with skills and experience can help.

Devensoft

JUNE 14, 2023

If you’re looking to navigate the world of mergers and acquisitions (M&A) effectively, it’s crucial to understand the differences between sell side and buy side transactions. These two approaches to M&A can have vastly different outcomes, depending on the goals of the parties involved.

How2Exit

SEPTEMBER 22, 2024

Ian's career began as a Scottish Chartered Accountant and rapidly transitioned into the world of mergers and acquisitions (M&A). With over 15 years of experience in investment banking, primarily in London, Ian has led numerous successful M&A transactions. E244: Exit Strategy 2.0:

The M&A Lawyer

AUGUST 25, 2015

Most private M&A transactions are structured as acquisitions of stock , rather than mergers or asset purchases. However, M&A transactions are anything but basic. In later posts on The M&A Lawyer Blog, I will examine each of these sections more closely and provide a more detailed and nuanced discussion of their contents.

How2Exit

NOVEMBER 6, 2023

Ron rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. Their team is experienced in M&A, and they hire the best talent available. Reconciled sets the standard for consistency and quality that you can count on.

How2Exit

MARCH 21, 2023

This process involves researching the business’s financials, legal documents, and other relevant information. Another important part of due diligence is researching the legal documents associated with the business. This includes contracts, leases, and other documents that are relevant to the business.

Mergers and Inquisitions

DECEMBER 4, 2024

No matter the economic climate, you can always bet on sports fans to show up for their favorite teams. This partially explains why sports investment banking has become a hot field, with JP Morgan and Goldman Sachs launching their own sports coverage groups. Sir Jim Ratcliffe and Manchester United or Mark Cuban and the Mavericks).

Focus Investment Banking

SEPTEMBER 3, 2024

Simplifying the M&A process with a well-vetted team When it comes to mergers and acquisitions, your investment banker shouldn’t be the only member of your team you are closely vetting. A great M&A team should also be made up of a great set of attorneys—both inside and outside your organization. in the winter of 2024.

M&A Leadership Council

SEPTEMBER 6, 2023

SaaS Executives Share 5 Lessons By John Christman, Former Corporate Development Global Head of M&A Integration, Cognizant Technology Solutions Digital transformation is increasingly driving the acquisition of new, different and non-traditional businesses that require a substantially different approach to integration.

The M&A Lawyer

AUGUST 31, 2015

However, M&A transactions are anything but basic. APAs provide for use of legal instruments necessary to transfer ownership, such as bills of sale (for personal property), assignment and assumption agreements (for contracts and permits), intellectual property assignments, real property transfer documents and so on.

Cooley M&A

OCTOBER 29, 2020

On September 24, Cooley M&A partner, Garth Osterman, moderated a webinar on the current trend in going public: SPACs! Key highlights from the webinar are summarized below and a link to the recording can be found here. compares to the prior two iterations of SPAC activity, with the first (SPAC 1.0) Increased Frequency and Size.

M&A Leadership Council

FEBRUARY 10, 2022

By Mark Herndon, Chairman and CEO of the M&A Leadership Council . In Part 1, “ IMO Playbook: Your Coach’s Handbook to M&A ,” we discussed the importance of having an integration management office (IMO) playbook and the business results other companies have experienced by using an effective IMO playbook.

Devensoft

MAY 16, 2023

Mergers and acquisitions (M&As) are surefire ways of helping companies grow in size and leapfrog their rivals. However, while they are significant investments that promise game-changing returns, neglecting M&A cybersecurity can present serious risks. trillion by 2025. What Is Cybersecurity Due Diligence?

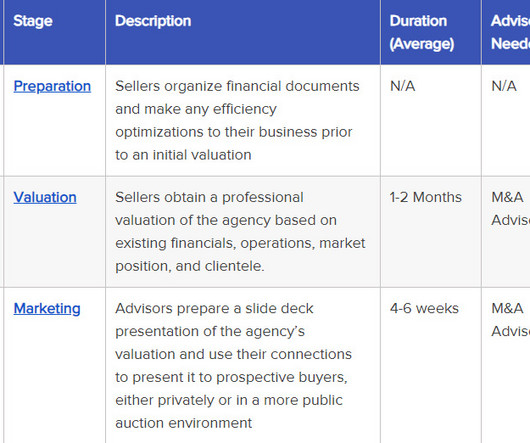

Sica Fletcher

MARCH 26, 2024

On average, company leaders in any industry who attempt an M&A transaction using an in-house team average 30% less once the deal is complete. Below, we offer a basic breakdown of the most common advisors in an M&A transaction. The two most common types of M&A buyers are: Strategic. Retirement. Financial Security.

How2Exit

FEBRUARY 23, 2023

When considering buying an existing business, it is important to take into account the size of the business. However, it is important to take into account the size of the business and to understand the process of buying an existing business. The 11 Concepts And Ideas I Learned From Interviewing ChatGPT On How To Buy A Business.

How2Exit

JUNE 26, 2023

Wendy's own experience with selling her business, Document Warehouse, illustrates the importance of choosing a target acquirer. Ron Concept 1: Grow A Business To Sell In the How to Exit podcast, Wendy Dickinson, a business coach, discusses the importance of growing a business to sell.

Sun Acquisitions

AUGUST 12, 2022

Responsibilities also cover the preparation of company documents and transactional records – including any and all previous legal history. A professional M&A broker can assist you with your preparations to sell. Can you sell your business during a lawsuit? Issue #1 Disclosure of litigation details to your buyers.

M&A Leadership Council

JUNE 18, 2024

A Step-by-Step Guide By M&A Leadership Council An M&A risk assessment is a systematic evaluation process used to identify, analyze, and mitigate potential risks associated with a merger or acquisition. Key Components of an M&A Risk Assessment 1. Steps in Conducting an M&A Risk Assessment 1.

Focus Investment Banking

AUGUST 29, 2023

He gave us an outline of what we were going to need—our revenue, our EBITDA, our taxes, what amounted to thousands of documents. The documentation was smooth initially. Our CFO and accounting system get credit for how well and quickly we did it. FOCUS Investment Banking represented DIGITALiBiz, Inc. iBiz), a U.S.

Beyond M&A

OCTOBER 22, 2024

Keep in mind, technology only accounts for about 40% of the total due diligence process. So we used to run courses to groups of M&A experts help them understand the challenge of integration and how to approach it. They were already managing their own complex tech environment, and now they’ve got two to deal with.

Devensoft

JUNE 13, 2023

Preparing for Post-Merger Integration or Divestiture In this chapter, we will discuss the steps that need to be taken before embarking on an M&A integration or divestiture transaction. For any mergers and acquisitions (M&A) or divestitures team, understanding the company’s goals and objectives is crucial for success.

Software Equity Group

OCTOBER 3, 2023

There’s no doubt workplace trends are rapidly evolving, and therefore, so are the trends impacting Workplace Tech SaaS M&A. Accounting and Finance Tools These tools help businesses manage their finances, track expenses, and create invoices, resulting in improved financial management and cost savings.

RKJ Partners

AUGUST 6, 2017

Due diligence plays a pivotal role in the buy side M&A process as it is critical in helping to uncover potential risks and items deemed to be “deal-breakers”. Due diligence plays a pivotal role in the buy side M&A process as it is critical in helping to uncover potential risks and items deemed to be “deal-breakers”.

MergersCorp M&A International

JANUARY 16, 2024

When it comes to mergers and acquisitions (M&A), meticulous corporate administration can make all the difference in ensuring the success and smooth execution of these complex financial transactions. Therefore, it offers a range of corporate administration services to alleviate these burdens and optimize the M&A process.

Software Equity Group

JULY 1, 2024

A QoE report is a document from a third-party accounting firm that objectively presents the company’s financial position after a comprehensive analysis. QoE reports have become a standard component of due diligence leading up to an M&A transaction. You are at the helm of a dynamic business as a software CEO.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content