Explaining Bookkeeping in Plain English: What is Bookkeeping?

Peak Frameworks

MAY 23, 2023

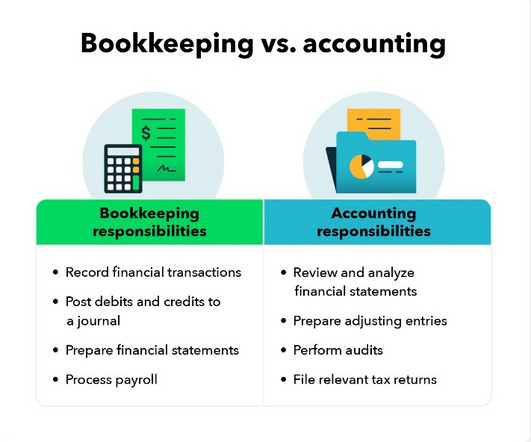

Bookkeepers are the backbone of an organization's financial health, diligently tracking every financial transaction to ensure accuracy and transparency. They play a pivotal role in not just recording but also making sense of the company's financial data. Recording financial transactions.

Let's personalize your content