11 Things You and I Can Learn About Business and Exit Events From Our Interview With Nate Lind - Successful Serial Entrepreneur and Broker.

How2Exit

MARCH 17, 2023

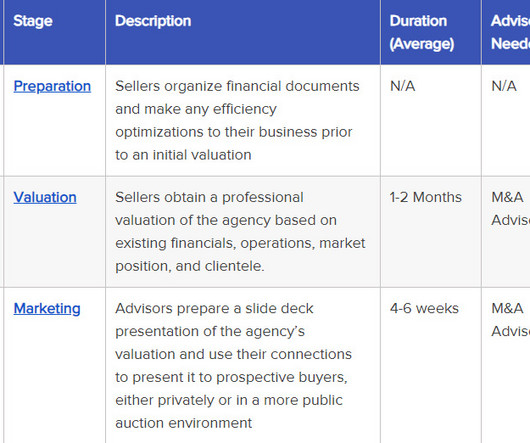

11 Things You and I Can Learn About Business and Exit Events From Our Interview With Nate Lind - Successful Serial Entrepreneur and Broker. Nate was able to negotiate a deal that was ten times the cost of his parent’s home, which was a huge success. Nate Lind is a prime example of how to monetize your influence.

Let's personalize your content