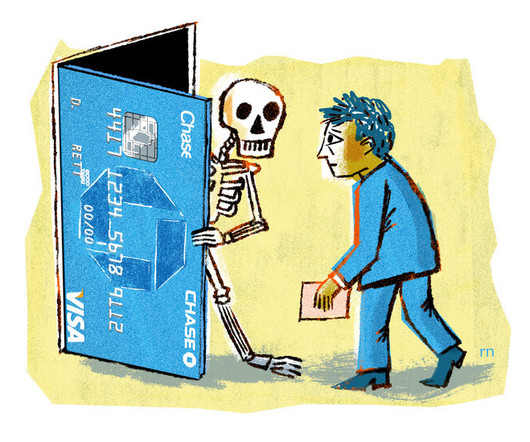

How to Keep Your Bank from Canceling All Your Accounts

The New York Times: Banking

NOVEMBER 18, 2023

Banks have suddenly shut down the accounts of scores of customers. Here’s how you can avoid becoming one of them.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

NOVEMBER 18, 2023

Banks have suddenly shut down the accounts of scores of customers. Here’s how you can avoid becoming one of them.

The New York Times: Banking

FEBRUARY 9, 2025

Fewer couples are combining their bank accounts. But that trend may not promote partners overall financial health, experts say.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Razorpay

JANUARY 19, 2024

Powerful current accounts always come with a caveat; a minimum balance requirement. Whether it is a few ten thousand or a few lakhs, most accounts are not zero balance current accounts. Would a zero balance current account really be so beneficial to businesses?

The New York Times: Banking

DECEMBER 30, 2023

When banks close checking and credit-card accounts because of “suspicious activity,” chaos and anxiety ensue. It doesn’t have to be this way.

Growth Business

JUNE 29, 2023

The objectives you set for the business will dictate the type of finance you should raise: the two key options being equity (selling shares in your company) and debt (borrowing from a bank or financial institution). In order to raise equity finance, you need to set up a limited company that is registered at Companies House.

Razorpay

MARCH 27, 2024

What is a Checking Account? A checking account is a type of bank account that allows you to deposit and withdraw money, write checks or use a debit card to make purchases or pay bills. Generally, account holders use these accounts on a short-term basis for paying daily expenses like food bills.

Global Banking & Finance

FEBRUARY 29, 2024

Fraud Against Financial Institutions Calls for Tighter Security Measures Protecting Customers in 2024 In January 2024, Citigroup was sued for its weak security measures against fraud.

The New York Times: Banking

DECEMBER 9, 2023

Here’s what bank security employees might be thinking when deciding whether to shut down a customer account after detecting unusual activity.

Razorpay

MARCH 18, 2024

A business owner must keep the funds intended for the business separate from their personal finances. What is Corporate Account? A corporate account is a bank account one can open in the name of a business. Read on to learn the vital details associated with a corporate bank account. Explore RazorpayX 2.

Razorpay

MARCH 19, 2024

Many startup founders initially feel that they can manage their organisation without having a current account. However, sooner than later, they would realise they require a current account to facilitate streamlined withdrawals, deposits and other business transactions. Let’s get right into it. What is a Startup Current Account?

The New York Times: Banking

SEPTEMBER 13, 2024

Facing competition for business, banks are offering incentives to switch. But as one expert put it, “You have to read the fine print.”

Business Standard - FInance

JUNE 13, 2023

India Mortgage Guarantee Corporation (IMGC) would focus on strengthening partnerships with banks and financial institutions, a top official said on Tuesday. In FY2022-23, IMGC doubled its market share in South India accounting 30 per cent of all originations in the region.

The New York Times: Banking

JANUARY 7, 2024

Should you keep a separate checking account for writing checks? Is there a specific pen you should use? We answer some reader questions.

Razorpay

JUNE 18, 2023

Fintech is the future of finance, and neobanking is the future of fintech. Long waiting times, security issues, and fixed working hours are a few of the problems plaguing legacy financial institutions today. Before we dive into whether neobanks are better than legacy finance, do we know what neobanks are?

Wall Street Mojo

JANUARY 17, 2024

Statement of Cash Flows Definition A Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. It helps identify the availability of liquid funds with the organization in a particular accounting period. read more.

The New York Times: Banking

JULY 27, 2024

Here is what experts say are the costliest stumbles people make with their retirement savings accounts — and how to get back on course.

The New York Times: Banking

NOVEMBER 22, 2024

Interest rates have been falling, but deposits are earning more than inflation.

Peak Frameworks

JUNE 27, 2023

In this article, we delve deeper into the critical leadership traits that define top-performing finance professionals and drive forward organizations on the path of growth and success. Emotional Intelligence Emotional intelligence is a crucial leadership trait in finance that often goes overlooked.

The New York Times: Banking

MARCH 23, 2024

A financial firm told an account owner that it had turned over her money to the state. When she filed a claim, something strange happened.

Global Banking & Finance

OCTOBER 7, 2024

Furqan Siddiqui, SOC Operations Officer at Obrela As custodians of sensitive financial data, banks and financial institutions face several cloud security threats that demand security controls and mitigation strategies.

The New York Times: Banking

JUNE 6, 2024

Then it reviewed his account activity. Last year, JPMorgan Chase wanted to pay Mansoor Shams a low-six-figure salary to work in a marketing role.

Peak Frameworks

SEPTEMBER 11, 2023

Case in point: JP Morgan Chase utilized an OD strategy to manage the tumultuous transition during the 2008 financial crisis, demonstrating the potential of OD in the face of adversity. Change Management The financial sector is subject to constant change due to evolving regulations, market dynamics, and technological advancements.

Business Standard - FInance

JUNE 22, 2023

The RBI circular permitting banks to enter into a one-time settlement with wilful defaulters poses a significant risk to the stability of financial institutions in the country, the CPI MP Binoy Viswam has said. This circular poses significant risks to the stability of our financial system," he said.

Razorpay

JANUARY 15, 2025

Debit Card EMI is a financial service offered by banks and financial institutions that allows debit cardholders to split high-value purchases into manageable monthly instalments. Unlike traditional credit-based financing options, Debit Card EMI requires no credit card. What is Debit Card EMI?

FineMark

SEPTEMBER 20, 2023

If you’ve discovered your identity has been stolen, there are steps you should take immediately to minimize the damage and protect your identity, finances, and credit score. You may want to start by calling your bank and other financial institutions to let them know what’s happening.

Razorpay

JUNE 8, 2023

A bank is any financial institution that helps people and businesses store, invest and borrow money. Apart from being a safe place to keep money, banks also provide savings accounts that give the account owner interest on their deposit so that the money is not sitting idle. What is Banking? How do Banks Work?

Razorpay

MAY 17, 2023

Bank reconciliation refers to the process by which the bank account balance of a business entity is reconciled with the amount recorded by financial institutions in the latest bank statement. A bank reconciliation statement ensures that all payments are processed and the required cash is deposited in the bank account.

Razorpay

JULY 20, 2023

Cooperative banking refers to a small financial institution started by a group of individuals to address the capital needs of their specific community. Such financial institutions are owned and controlled by their members, and the board members are democratically selected to oversee the operations. 4 in Assam to Rs.

Razorpay

MARCH 21, 2024

A mandate is a standard instruction that you provide to your issuing bank and other institutions allowing them to automatically debit the mentioned amount from your bank account. This ensures that the payer is the owner of the bank account and agrees to the terms and conditions of the e-mandate.

Wall Street Mojo

JANUARY 18, 2024

Certificate of Deposit Explained A certificate of deposit account is a kind of fixed tenure investment instrument offered by banks, credit unions, and brokers working for a financial entity. Usually, a CD is understood as a kind of savings account that offers a higher interest rate than an ordinary savings account.

Peak Frameworks

MAY 23, 2023

The 2008 financial crisis was a significant threat to many financial institutions in the U.S. Practical Application of SWOT Analysis in Finance SWOT Analysis is a versatile tool, equally applicable in Investment Banking, Private Equity, and Corporate Finance.

Razorpay

NOVEMBER 30, 2023

Besides, electronic payment systems have revolutionized the way we handle our finances, making transactions quicker, more efficient, and accessible to anyone with a bank account. Online Bank Transfers Online bank transfers allow individuals to move money directly from their bank accounts to another party’s account.

Peak Frameworks

JUNE 21, 2023

A well-known example of this type of customer behavior is a consumer who selects a bank solely based on the interest rates offered on savings accounts or term deposits. Need-Based Customers Need-based customers engage with financial institutions to fulfill specific requirements or goals.

Peak Frameworks

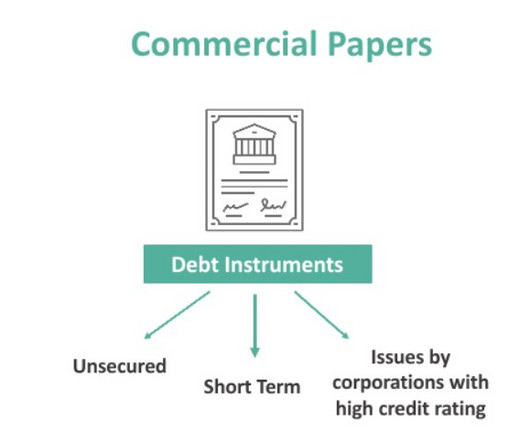

OCTOBER 17, 2023

Commercial paper is a financial instrument that helps corporations with short-term funding and liquidity needs, such as payroll or accounts payable. For instance, a company might issue commercial paper to finance inventory ahead of a peak selling season, repaying it once sales are realized.

Bronte Capital

MAY 21, 2021

The words of the release outlined what the key issue was - trust in a financial institution. In this situation it is particularly important that the judgements required for accounting and measurement purposes are not influenced by considerations that are not appropriate. The stock rose sharply. Lease receivables’.

Midaxo

OCTOBER 12, 2023

The systems could include a CRM for sales to capture all client contacts, HRM systems help human resources to manage vacations and salaries, and accounting systems automate bulk of finance-related tasks. Industry Different industries have varying technology requirements.

How2Exit

FEBRUARY 23, 2023

When considering buying an existing business, it is important to take into account the size of the business. There are a number of organizations and programs that exist to support SMBs, including business associations, government agencies, and financial institutions.

Wall Street Mojo

JANUARY 17, 2024

Financial institutions with good credit ratings offer swap facilities to clients and charge fees from brokers. Usually, financial institutions with very high credit worthiness are the ones that offer the swap market to clients who may be investors or other financial institutions. read more of the risk.

Razorpay

AUGUST 10, 2023

Fintechs, or financial technology companies, offer software solutions to help businesses with their money. There are many types of fintechs: lending fintechs, insuretech, payments – but they all centre around one thing: Finance made easier with technology. Automation and integrations Big businesses and MNCs have huge finance teams.

The New York Times: Banking

DECEMBER 9, 2023

One reason this fraud is rampant: Open forums where anyone can buy checks that thieves have taken from the mail.

Peak Frameworks

SEPTEMBER 12, 2023

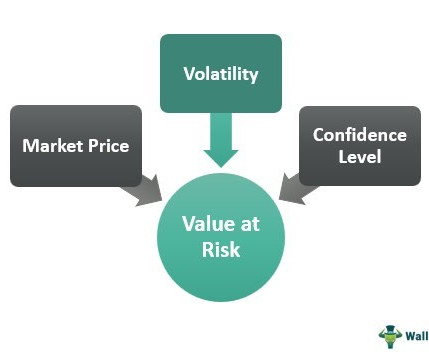

If you're interested in breaking into finance, check out our , Private Equity Course and , Investment Banking Course , which help thousands of candidates land top jobs every year. For Capital Allocation: Banks and financial institutions use VaR to determine the amount of capital they need to hold to cover potential losses.

Razorpay

DECEMBER 15, 2024

Unlike traditional banking, which serves the general public with standard products and services, private banking offers bespoke, customized solutions tailored to the unique financial needs and goals of each client. The private banker handles all financial matters pertaining to the client from loans and credit to bills.

The New York Times: Banking

DECEMBER 9, 2023

Although check usage has declined in the last couple of decades, check fraud has risen sharply, creating a problem for banks — and customers trying to pay their bills.

Peak Frameworks

SEPTEMBER 19, 2023

Types of collateral: Real estate, machinery, accounts receivable, and even stocks. Understanding Credit Risk for Finance Professionals Building upon the 5 Cs of Credit, finance professionals should also deeply understand credit risk , as it plays a central role in financial decisions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content