Negotiating Transition Services Agreements in Carve-Out M&A Deals

JD Supra: Mergers

OCTOBER 24, 2024

By: Mayer Brown

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

OCTOBER 24, 2024

By: Mayer Brown

JD Supra: Mergers

OCTOBER 12, 2023

As part of our ongoing series on tax issues for accounting firms, this article provides information on retirement or deferred compensation arrangements, the related rules of Section 409A of the Internal Revenue Code, and how these issues may impact M&A deal structures and negotiations. By: Levenfeld Pearlstein, LLC

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How2Exit

OCTOBER 23, 2023

Ron rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. rn rn Summary: Patrick Dichter, owner of Appletree Business Services, shares his journey from sales and marketing to acquiring and growing a small business accounting firm.

Lake Country Advisors

APRIL 15, 2024

A successful business sale hinges on solid negotiation skills. Use it to make informed decisions to secure a deal that honors the value of your legacy. Best Practices for Negotiation of the Sale of Your Business Negotiating the sale of your business will impact your financial future and your company’s legacy.

Sun Acquisitions

FEBRUARY 23, 2024

Accountants, lawyers, and brokers are pivotal in helping buyers and sellers make informed decisions that safeguard their economic interests. Accountants: The Financial Architects Accountants are the financial architects of any transaction. They bring market expertise, networks, and negotiation skills to the table.

How2Exit

FEBRUARY 23, 2023

When considering buying an existing business, it is important to take into account the size of the business. However, it is important to take into account the size of the business and to understand the process of buying an existing business. It is also important to be proactive and persistent in the negotiation process.

Sun Acquisitions

JULY 10, 2023

To achieve this, there are several key negotiation points you will need to consider in the process. This post will explore key negotiation points that will help you navigate the sales process and achieve the best outcome. Valuation One of the key negotiation points you should consider when selling your business is the valuation.

How2Exit

OCTOBER 14, 2024

The episode serves as an invaluable guide for entrepreneurs and potential sellers, emphasizing preparation, informed decision-making, and the nuances of successfully negotiating M&A deals. The key is to make sure you have good information, hiring the right advisors, and picking the right partner."

How2Exit

MARCH 21, 2023

This process involves researching the business’s financials, legal documents, and other relevant information. It is a process of researching and verifying the financials, legal documents, and other relevant information of the business. This is especially true for small businesses, as their financial information is often limited.

Devensoft

JUNE 13, 2023

Purchasing a business is a significant decision that requires careful planning and negotiation. One of the most critical steps in the acquisition process is negotiating the letter of intent (LOI). Key terms to negotiate in a LOI to purchase a Business When negotiating the terms of a LOI, there are several key factors to consider.

Razorpay

OCTOBER 7, 2024

Many business owners and financial professionals get confused between proforma invoices and account sales. Understanding the difference between proforma invoices and account sales is essential to ensuring you handle your transactions correctly. What Is Account Sales? How Does Account Sales Work?

Midaxo

APRIL 25, 2023

How to outline the process for negotiating deal terms and determining valuation? It provides a strategic roadmap for identifying, evaluating, negotiating, and integrating potential M&A transactions. Engage with targets : Reach out to potential targets to gauge their interest in an acquisition and gather preliminary information.

How2Exit

APRIL 4, 2023

This includes making sure that the financial statements match the tax return, and that all necessary expenses are accounted for. It is also important to make sure that any gray money or questionable expenses are accounted for, as these can raise flags for buyers. In addition, it is important to assess the business itself.

Lake Country Advisors

JULY 25, 2024

These agreements must be put in place to protect sensitive information. This step involves gathering preliminary information and sets the stage for more detailed due diligence. Verify accounts receivables and payables. These steps ensure that all stakeholders are informed and that the acquisition is set up for success.

OfficeHours

JUNE 5, 2023

Deal execution encompasses various stages, from sourcing and due diligence to negotiation and closing. Professionals with strong business intuition can anticipate market shifts, identify potential synergies, and make informed decisions on exit strategies. This intuition can drive value creation and maximize returns for investors.

How2Exit

JULY 3, 2023

They act as intermediaries between buyers and sellers, helping to facilitate negotiations, conduct due diligence, and ensure a smooth transition. Whether it is in a specific industry or as a generalist, a skilled advisor can provide valuable insights, facilitate negotiations, and ensure a successful outcome.

Lake Country Advisors

FEBRUARY 16, 2024

We’ll walk you through all the important factors to take into account in this in-depth guide to make sure the transaction goes smoothly and successfully. It is not only prudent but also necessary to be informed of the processes involved in this operation. This information helps in positioning your business competitively.

How2Exit

MARCH 15, 2023

Without it, you will be unable to make informed decisions and you will be unable to capitalize on opportunities. He found that accountants were normally really good at resolving the issues but not so good at holding relationships with people. This means not overvaluing it in order to leave room for negotiation.

How2Exit

SEPTEMBER 26, 2023

These deals offer unique advantages, such as faster transactions, potential tax benefits, and the ability to negotiate favorable terms. This exclusivity can lead to better negotiation opportunities, favorable terms, and the potential for higher returns on investment. rn Why Go Off-Market?

Sun Acquisitions

MARCH 8, 2022

Accounts Payable Reports. Selling a business requires the seller to work with a team of experienced M&A professionals including an M&A accountant, an M&A attorney, an M&A business broker just to mention a few. They will ask for more information on gray areas. Seller’s Discretionary Cash Flow. Escrow Agreements.

Francine Way

JULY 10, 2017

Although the analysis will always be wrong when viewed from dollar and cents perspective, it is useful in narrowing the error range and making informed decisions about the prospective transaction. There are also structural differences of past acquisitions to take into account. Valuation focuses on two questions: 1.

How2Exit

AUGUST 22, 2023

Ron rn rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. It requires thorough due diligence, negotiations, and building relationships with sellers. Their team is experienced in M&A, and they hire the best talent available.

Lake Country Advisors

OCTOBER 31, 2024

A local business broker can be invaluable in identifying opportunities, assessing the business’s financial health, and negotiating on your behalf to ensure a smooth transaction. This guide will help you navigate the process and make informed decisions to protect your investment. Are you looking for rapid returns or long-term stability?

How2Exit

FEBRUARY 27, 2023

This is because small businesses tend to have very little information available on the internet. The platform also offers resources to help buyers with financing, such as loan calculators and information about loan programs. This can help you to make an informed decision about who to work with.

How2Exit

MARCH 1, 2023

Joel believes that a lot of the stuff that people uncover during the negotiation process should have been known before the negotiations process. Knowing the environmental risks associated with a property can help buyers make informed decisions and protect their investments. Bringing a lawyer in too early can be a mistake.

Sun Acquisitions

AUGUST 12, 2022

You have an implied obligation as a seller to inform buyers of any lawsuits. As can be imagined, the fact that you omitted to inform the buyer of such a critical piece of information can quickly sour the relationship. You’ll also need M&A attorneys and accountants. Issue #5 Factor associated damages to the business.

How2Exit

JUNE 12, 2023

With a track record of success in buying, growing, and exiting e-commerce businesses, Rapid Diligence is a company that buyers can trust to help them make informed decisions about their investments. Many small business owners do not have a background in finance and may not have the resources to hire a full-time accountant. or contract.

The M&A Lawyer

SEPTEMBER 8, 2015

A substantial amount of the time and energy involved in papering and negotiating the deal is usually devoted to reps and warranties. First, they provide important disclosures from one party with an informational advantage to the other about the disclosing party and, in the case of the seller, the target company or assets. Disclosure.

How2Exit

SEPTEMBER 4, 2023

Ron rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. By engaging in conversations and asking the right questions, buyers can gather valuable information that will help them make informed decisions.

Sun Acquisitions

JULY 21, 2023

Due diligence plays a crucial role in evaluating a transaction’s potential risks and rewards, ensuring that both parties are well-informed and can make informed decisions. It involves gathering relevant information, examining records, and assessing potential risks and opportunities.

Sun Acquisitions

JANUARY 24, 2022

Two must-have professionals are an expert accountant and an experienced attorney. People omit information about deal financing, structure of the purchase price, upfront payment, holdbacks, deadlines, dates, and seller promissory notes. Because the LOI acts as a roadmap, a guide, a framework that sets the pace for future negotiation.

Sun Acquisitions

FEBRUARY 14, 2023

Here are some steps to help ensure you stay on track and make the most of this new opportunity: Communicate With the Buyer It’s essential to establish a clear line of communication from the outset, as both parties will need to be informed of any developments or changes along the way.

Sun Acquisitions

SEPTEMBER 18, 2023

Seek professional assistance from business appraisers, accountants, or business brokers to determine the fair market value of your company. Understanding the value of your business will help you set a realistic asking price and negotiate effectively with potential buyers. Be prepared to compromise while protecting your interests.

OfficeHours

JUNE 6, 2023

They may then negotiate with the company to restructure the debt, provide additional capital, or facilitate a turnaround. The fundraising process typically involves multiple stages, starting with initial discussions and due diligence, followed by formal presentations, negotiation of terms, and ultimately securing commitments from investors.

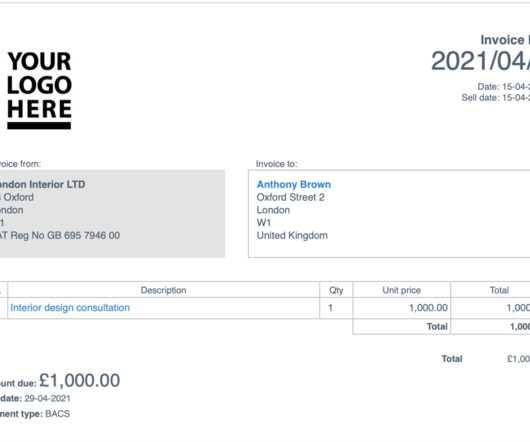

Razorpay

OCTOBER 8, 2024

It acts as a draft bill of sale, outlining the expected goods or services, estimated costs, taxes, shipping expenses, and other information. These invoices offer buyers a clear view of the proposed transaction conditions and allow for negotiations before closing the deal.

Sun Acquisitions

DECEMBER 7, 2023

It involves intricate processes, financial negotiations, and a multitude of considerations. Skillful Negotiations Negotiating a business sale can be daunting, especially for first-time sellers. Business brokers act as impartial mediators during negotiations, skillfully representing your interests while keeping emotions in check.

Chesapeake Corporate Advisors

MAY 24, 2024

By having the company’s financials vetted by a qualified accounting firm early in the process, you gain confidence in your numbers and assurance that they will be less open to scrutiny during negotiations. Credibility A QofE is considered more justifiable than accountant-prepared financials that are only reviewed or compiled.

Lake Country Advisors

AUGUST 9, 2024

Understanding that Wisconsin’s manufacturing sector accounts for 20% of the state’s GDP, it becomes clear that this industry is vital to the local economy. Therefore, it’s crucial to maintain accurate and detailed financial records, including tax returns, audited financial statements, and accounts receivable/payable records.

Focus Investment Banking

MAY 3, 2024

I would think that not having your customers, employees or competitors knowing that a business is for sale would be the most important thing, followed by protecting all of your proprietary and confidential financial information. They don’t want any of their confidential information being disclosed by you also.

The M&A Lawyer

AUGUST 25, 2015

Some, such as “Liabilities,” “Material Adverse Effect” or “Seller’s Knowledge” (or their equivalents) are used throughout the contract and may be the subject of extensive negotiations. accounts receivable and accounts payable. authority and enforceability. absence of conflicts.

How2Exit

MAY 8, 2023

Once the evaluation is complete, the buyer and seller must then negotiate the terms of the transaction. This negotiation process can be complex and may involve the use of lawyers, accountants, and other professionals. This additional information may include financial statements, customer lists, and other relevant information.

Razorpay

JANUARY 2, 2024

Payment processors encrypt sensitive payment information, verify availability, and transfer funds from the customer’s account to the merchant’s account. It facilitates the transfer of funds from the customer’s account to your account. How Does a Payment Processor Work?

The M&A Lawyer

SEPTEMBER 23, 2015

Interestingly, while M&A lawyers often get fairly animated in negotiating whether to include the word “prospects” in the MAE definition, they do not similarly struggle with inclusion of the “could reasonably be expected to have” language, which should be viewed by a court as having the same effect.

How2Exit

OCTOBER 2, 2023

b' rn rn rn rn How2Exit Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. rn Key Takeaways: Knowledge is Power rn David wraps up the episode by emphasizing the importance of being informed and prepared. rn Our Verdict rn David C.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content