Setting Yourself Up for Success: Essential Steps, Tips, and Strategies for a Profitable Exit

How2Exit

OCTOBER 14, 2024

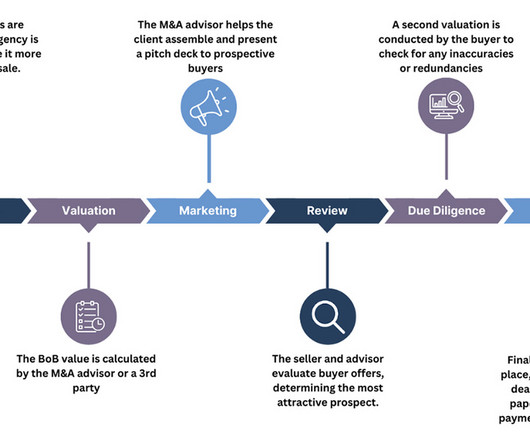

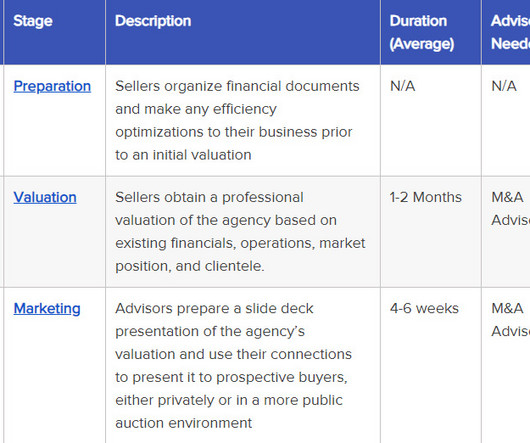

The importance of clean data rooms, strategic earn-out agreements, and the role of rep and warranty insurance in private transactions forms the crux of their discussion. Role of Advisors : Engaging experienced advisors, investment bankers, and accountants can significantly smoothen the M&A process and enhance deal valuation.

Let's personalize your content