Alphabet Reports a 29% Jump in Profit

The New York Times: Mergers, Acquisitions and Dive

JULY 23, 2024

Google’s parent company narrowly topped revenue and profit expectations, driven by its search engine, while growth in YouTube ad sales fell short.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Mergers, Acquisitions and Dive

JULY 23, 2024

Google’s parent company narrowly topped revenue and profit expectations, driven by its search engine, while growth in YouTube ad sales fell short.

Francine Way

JULY 7, 2017

In this post, we will discuss what it takes to set a good acquisition program, best practices on acquisition criteria and sourcing, and challenges with any acquisitions program. It is ABSOLUTELY crucial that a corporate acquisition program is aligned with the corporate strategy. International, national, regional?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How2Exit

OCTOBER 2, 2023

He has a background in mechanical engineering and entrepreneurship, and he joined SaaS Group in 2020. Dirk is responsible for deal origination and works closely with founders of SaaS companies to explore acquisition opportunities. Dirk invites founders to reach out to him via email or LinkedIn for a chat.

How2Exit

MAY 6, 2024

b' E210: Strategic Real Estate: Mergers, Acquisitions, and Business Roll-Ups for Maximum Return - Watch Here rn rn About the Guest(s): rn Dan Taylor is an experienced professional specializing in real estate strategies that set him apart from conventional practices. then reverse engineer that." then reverse engineer that."

Advertisement

Why do some embedded analytics projects succeed while others fail? We surveyed 500+ application teams embedding analytics to find out which analytics features actually move the needle. Read the 6th annual State of Embedded Analytics Report to discover new best practices. Brought to you by Logi Analytics.

How2Exit

APRIL 22, 2024

b' E205: Raising Capital for Acquisitions: Funding Sources to Finance Your Dream Deal w/ Parnell Speed - Watch Here rn rn About the Guest(s): rn Parnell Speed is a seasoned professional with a background in engineering and experience in the real estate sector.

How2Exit

JUNE 16, 2024

E223: The Acquisitions Pilot Project: A Solution For 1st Time Buyers to Buy Lower Markets and Sell A Roll-Up - Watch Here About the Guest(s): Roger Best is a seasoned professional with a diverse background spanning mechanical engineering, law, and private equity.

Global Newswire by Notified: M&A

NOVEMBER 19, 2024

Acquisition of Profitable, Cash Flow-Generating Business Broadens Service Offerings Across Energy Value Chain Acquisition of Profitable, Cash Flow-Generating Business Broadens Service Offerings Across Energy Value Chain

How2Exit

FEBRUARY 10, 2025

His expertise in scaling businesses, combined with his strong belief in long-term ownership and AI-driven efficiencies, makes him a compelling voice in the world of software acquisitions. A way to skip the painful early stages and jump straight to scaling a profitable company? But what if there was another way?

How2Exit

DECEMBER 18, 2023

b' E168: PE Firm Blackbook Investments: Acquiring and Growing Profitable Websites with Mohit Tater - Watch Here rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. Subscribe to The Hub - Acquisitions Hub '

How2Exit

FEBRUARY 18, 2024

b' E188: Valsoft's Investment Partner Costa Tagalakis, Discusses Their Successful Acquisition Strategy - Watch Here rn rn About the Guest(s): rn Costa Tagalakis is an investment partner at Valsoft Corporation, a Canadian company specializing in the acquisition and operation of vertical market software businesses.

TechCrunch: M&A

JULY 3, 2023

In the latest development, HappyFunCorp — a product engineering house that designs and builds apps and more for the likes of Apple, Disney, Amazon and Twitter — is getting acquired by Canadian firm Tiny for $30 million. Similar to the other companies in the Tiny stable, it has up to now been bootstrapped and profitable.

How2Exit

APRIL 18, 2023

In the world of mergers and acquisitions, it is important to have a clear plan of action for integrating a business and to be able to execute it in a timely manner. Tony then moved into the healthcare industry, where he worked for a for-profit healthcare system that was backed by private equity.

How2Exit

MAY 8, 2023

Ron Concept 1: Explore Business Acquisitions and Mergers Business acquisitions and mergers are an increasingly popular way for entrepreneurs to grow their businesses and increase their profits. The process of business acquisitions and mergers begins with an evaluation of the target company.

How2Exit

FEBRUARY 25, 2023

With the right research and understanding of the risks, it’s possible to find great deals and turn them into profitable ventures. Doing this will help to ensure the website is successful and profitable. It is important to use the right tools and sources to ensure the website is successful and profitable.

How2Exit

MAY 20, 2024

b' E212: Unveiling the Secrets of Main Street M&A: Insider Tips from M&A Veteran Carl Allen - Watch Here rn rn About the Guest(s): rn Carl Allen is a seasoned mergers and acquisitions (M&A) professional with over 30 years of experience. He actively invests in and funds student deals through his private equity fund.

How2Exit

FEBRUARY 18, 2024

b' E187: Clint Fiore Discusses the Challenges and Strategies of Buying Businesses - Watch Here rn rn About the Guest(s): rn Clint Fiore is a seasoned entrepreneur with broad experience in the small to medium business acquisitions and mergers sector.

How2Exit

NOVEMBER 12, 2023

Army soldier, engineer, and pilot. rn Summary: Adam Coffey, author and former CEO, shares his expertise in mergers and acquisitions (M&A) and building successful companies. rn Acquisitions can be a fast and effective way to accelerate growth and increase the value of a company.

How2Exit

FEBRUARY 27, 2023

Flippa, has now integrated AI into their matchmaking, the first-ever AI-powered recommendation engine for the M&A industry. The engine will also improve the user experience by offering an easy-to-use interface and seamless search capabilities. Concept 8: Build boring businesses for profit. The blog was sold for $5.2

How2Exit

JANUARY 13, 2024

rn Episode Summary: rn In this episode of the How2Exit Podcast, Ronald Skelton welcomes Marc Andre of Flip My Site to share his wealth of experience in the niche of online business acquisitions, particularly in the realm of websites. He currently operates Flipmysite.com, where he offers insights on buying, fixing, and selling websites.

Sun Acquisitions

JANUARY 10, 2022

Sun Acquisitions is pleased to announce the successful acquisition of an experienced sheet metal fabrication and machining company based in the Greater Chicago area. They are equipped with an experienced team and the engineering and prototyping capabilities to serve any needs of a customer. from its previous ownership.

GillAgency

JULY 30, 2023

With 98% of the revenue as Annual Recurring Revenue (ARR), the monthly recurring support agreements have been instrumental in the company’s consistent profitability. By prioritizing security, compliance, and offering dedicated engineering support, the company provides a holistic approach that ensures prompt resolutions and expert guidance.

How2Exit

OCTOBER 2, 2023

rn Visit [link] rn _ rn About The Guest(s): Damon Pistulka is the founder of Exit Your Way and has extensive experience in mergers and acquisitions, selling businesses, and helping founders build their business legacies. They also discuss the benefits of strategic buyers and the potential for cross-selling and customer acquisition.

How2Exit

JUNE 16, 2024

E222: Paul Neal Discusses Wealth Building by Owning Business Property - Watch Here About the Guest(s): Paul Neal is a seasoned financial strategist and real estate finance expert with a background in engineering. Paul highlights crucial aspects such as autonomy, tax advantages, and the impact on business profitability.

Solganick & Co.

MAY 9, 2024

The most active industry subsectors for mergers and acquisitions in the software and IT services verticals during Q1 2024 were: Software development services , driven by demand for vertical SaaS solutions, a shift to profitability over growth, and consolidation in areas like cloud, analytics, IoT, and AI/ML.

How2Exit

JUNE 12, 2023

Founded by Ahmed Raza, who has a background in acquisition entrepreneurship, Rapid Diligence primarily helps with the buy-side diligence process. Raza's first few acquisitions were distressed and neglected assets, which he grew and exited.

M&A Leadership Council

OCTOBER 30, 2023

Sometimes Complete Integration Isn't the Right Answer By Jeffrey Cartwright, M&A Leadership Council Alum and Managing Partner of Shoreview Advisors If you’ve ever dived into M&A strategy, you’ve undoubtedly read about “Newellization,” the acquisition strategy named for a once-tiny household goods company in Freeport, Illinois.

Growth Business

DECEMBER 1, 2023

Placing a lot of emphasis on their culture of engineering excellence, they’re determined to engineer a seismic shift in the banking industry. Given that it only launched in March 2020, the bank even turned a profit last year – which is unusual in the cash-intensive fintech sector, which burns cash fast.

Solganick & Co.

JANUARY 25, 2024

January 15, 2024 Shifting Gears: Mergers and Acquisitions Reshape the Education, Learning, and Training Technology Landscape in 2023 and Beyond The Education, Learning, and Training Technology sectors went through a transformative dance in 2023. Focus on AI and personalization : The power of AI attracted strategic buyers.

Software Equity Group

MAY 23, 2023

“How profitable is your software business?” Nevertheless, profitability is a critical measure of success that any business owner should understand and be able to communicate. Now more than ever, private equity firms and other buyers prioritize profitability when analyzing potential acquisition targets.

Wizenius

MAY 19, 2023

Growth: The Engine of Progress Growth is the lifeblood of any company, driving its expansion and prosperity. Return on Capital (ROC): Efficiency Meets Profitability Return on Capital evaluates a company's proficiency in generating profits from the capital invested in its operations.

How2Exit

NOVEMBER 6, 2023

Buyers are looking for businesses with a solid foundation and a management team that can continue to drive growth and profitability. By highlighting these strengths, business owners can attract buyers who recognize the value of a well-established sales and marketing engine. Subscribe to The Hub - Acquisitions Hub '

Midaxo

APRIL 25, 2023

Prompt engineering” — figuring out how to ask questions that elicit the desired response — is a crucial skill. How to develop an acquisition strategy? Develop an acquisition strategy : Outline the criteria for target companies, including size, industry, geographic location, technology, and customer base.

Wall Street Mojo

JANUARY 4, 2024

The goal of empire building is to create a larger and more dominant business entity that can achieve significant market share, increased profitability, and a competitive advantage over rivals. Mergers and Acquisitions (M&A) : The merger and acquisition activities are crucial in empire building.

InvestmentBank.com

AUGUST 14, 2019

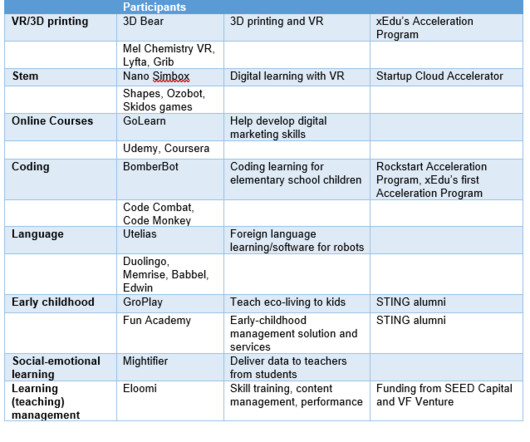

EdTech has enriched education, reaching various industrial categories such as coding, language, Science, Technology, Engineering, Math (STEM), social-emotional learning, early childhood education and learning management tools. A sustainable business model and profit results are major factors in investment decisions. from China with $1.7

Peak Frameworks

OCTOBER 19, 2023

The core idea is that producing more in less time reduces the cost per unit, making products affordable for consumers and profitable for manufacturers. Engineers and designers collaborate to ensure parts are standardized, and the final product can be assembled seamlessly.

The Deal

JULY 18, 2023

Private engineering and technical consulting firm Salas O’Brien Inc. has done quite a few deals over the past two decades, but CEO Darin Anderson refuses to use the word acquisition. The 30-year engineering industry veteran has the same open book mentality when it comes to discussions with the firm’s employee owners.

Focus Investment Banking

JULY 28, 2023

While some companies opt for divestitures in the internal combustion engine (ICE) sector, others see potential for longer-term growth and are willing to sustain those divisions. Companies need to carefully manage these increased costs to maintain profitability and sustainable growth in the industry.

How2Exit

NOVEMBER 8, 2023

rn Building a great company should be the focus, as it leads to better quality, technology, service, and profitability. At great game companies, even if you're remanufacturing internal combustion engines, guess what guys? Subscribe to The Hub - Acquisitions Hub ' And can I do good at the same time? Guess what? There's purpose.

Razorpay

JUNE 16, 2023

Cost of digital acquisition In today’s digital age, the importance of digital marketing in the travel industry cannot be overstated. Digital marketing for travel and tourism encompasses a broad range of tactics and channels to acquire customers, from social media and search engine optimisation (SEO) to email marketing and content marketing.

How2Exit

MARCH 23, 2023

This could include the buyer's desired revenue, growth rate, and profit margins. Ad backs are expenses or benefits that the seller should add back to the profit and loss statement to increase the sale price of the business. The next step is to reverse engineer a pathway to those goals. Subscribe to The Hub - Acquisitions Hub

Lake Country Advisors

JUNE 24, 2024

Optimize Your Business Operations Optimizing your business operations can significantly boost efficiency and profitability. Start optimizing your website for search engines (SEO) to improve your online presence and attract organic traffic. Enhancing these areas makes your business more appealing to potential buyers.

iMerge Advisors

APRIL 9, 2025

A company growing 40%+ annually will often command a premium multiple, particularly if growth is organic and not overly reliant on paid acquisition. Profitability and Margins While some buyers prioritize growth over profits, especially in earlier-stage deals, strong gross and EBITDA margins still matter.

Mergers and Inquisitions

JULY 31, 2024

Morgan’s acquisition of Carnegie Steel in 1901 – was an industrials private equity deal. Growth” was less of a goal than financial engineering and multiple expansion via cost cuts to improve metrics like Return on Invested Capital (ROIC). Industrials PE has been around for a long time and has always been seen as “stable but boring.”

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content