FOCUS Investment Banking Named #1 Lower Middle Market M&A Advisor In Q2 2023?

Focus Investment Banking

JULY 27, 2023

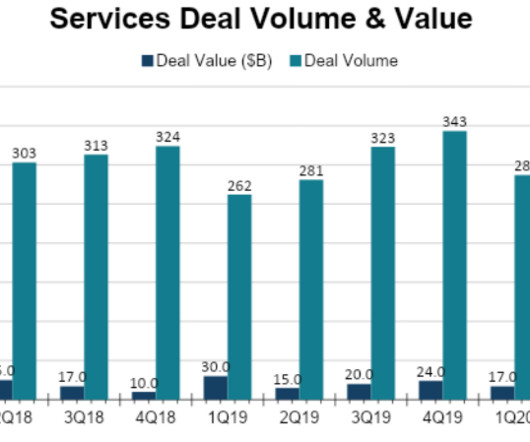

Washington, DC, (July 27, 2023) – FOCUS Investment Banking (“FOCUS”) a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, is thrilled to announce its exceptional achievement of being named #1 on Axial’s second quarter 2023 lower middle market investment bank league table.

Let's personalize your content