Physician Practice Acquisitions: A Primer on Hospital & Private Equity Consolidation

InvestmentBank.com

OCTOBER 24, 2019

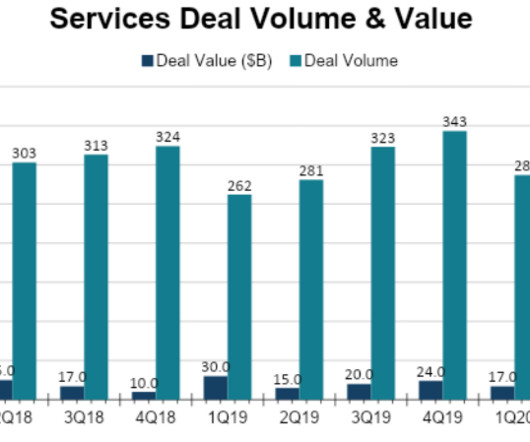

For the better part of the last decade, physician practices have seen a wave of consolidation by hospitals and private equity with 2018 being no exception [1]. In fact, acquisitions by hospitals and private equity in provider services broke records last year according to Bain & Co’s 2019 global healthcare report.

Let's personalize your content