Negotiating Transition Services Agreements in Carve-Out M&A Deals

JD Supra: Mergers

OCTOBER 24, 2024

In mergers and acquisitions (M&A), few transactions are as complex as carve-outs.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

JD Supra: Mergers

OCTOBER 24, 2024

In mergers and acquisitions (M&A), few transactions are as complex as carve-outs.

Sun Acquisitions

APRIL 3, 2024

Mergers and acquisitions (M&A) can be some of the most complex and high-stakes transactions in the business world. Whether you’re looking to expand your company’s reach or considering the sale of your business, effective negotiation is a crucial skill. A well-prepared negotiator is a confident negotiator.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Newswire by Notified: M&A

DECEMBER 14, 2023

14/12/2023 LACROIX and AIAC enter into exclusive negotiations for the sale/acquisition of the Road Signs Business Unit LACROIX announces that it has.

How2Exit

FEBRUARY 25, 2024

b' E190: Brandon Knowlden Shares His Acquisition Strategy and Recent Success - Watch Here rn rn About the Guest(s): rn Brandon Knowlden is an entrepreneur with a rich background in both the advertising industry and the world of manufacturing. rn Building a quiver of private investors is crucial for executing sale leasebacks efficiently.

Sun Acquisitions

FEBRUARY 3, 2023

Negotiating the sale of a manufacturing business can be highly stressful, but it is possible to get through it with minimal stress when armed with the right tips and strategies. To help ensure a better outcome for all parties involved, here are some top tips for negotiating the sale of a manufacturing business.

How2Exit

OCTOBER 16, 2023

b' E149: Bill Snow: From Sales to Mergers and Acquisitions Expert - Watch Here rn rn Here is what my team and I learned from this interview: (These are notes from team members, writers, sometimes AI, and even listeners who submitted what i learned loosely edited and shared here) - If it seems a bit unrefined, you're reading our notes, so.

Sun Acquisitions

JULY 31, 2024

Sun Acquisitions, a prominent mergers and acquisitions firm in Chicago, is thrilled to announce the successful sale of Chain O’ Lakes Transportation, a provider of alternative transportation solutions, to strategic acquirer JW Chicago. JW currently operates similar transportation operations in the northeast.

Sun Acquisitions

FEBRUARY 12, 2023

Contractual negotiations can be a complex process, especially when it comes to selling a manufacturing business. Make Sure Documentation Is in Order Organizing evidence of how you achieved success over time will help potential buyers understand what type of value they stand to gain by entering into negotiations with you.

How2Exit

JUNE 3, 2024

E219: Unlocking True Business Value: Strategies and Insights for Mid-Market Sales w/ Trever Acers - Watch Here About the Guest(s): Trever Acers is an investment banking and valuation expert with over two decades of experience in the industry. And by less risk, that means they're willing to pay more."

Sun Acquisitions

JULY 10, 2024

Chicago, IL — July 10, 2024 — Sun Acquisitions, a prominent mergers and acquisitions firm in Chicago, announced the successful sale of Chain O’ Lakes Transportation, a provider of alternative transportation solutions, to strategic acquirer JW Chicago. Thinking of Buying or Selling a Business?

Sun Acquisitions

MARCH 8, 2022

Sun Acquisitions is pleased to announce the successful acquisition of a profitable residential landscaping business, American Lawn & Landscape Co. Matt is a senior advisor with Sun Acquisitions with significant deal making and negotiation experience. The business is based in the Greater Chicago area.

Sun Acquisitions

JULY 10, 2023

To achieve this, there are several key negotiation points you will need to consider in the process. This post will explore key negotiation points that will help you navigate the sales process and achieve the best outcome. Valuation One of the key negotiation points you should consider when selling your business is the valuation.

MergersCorp M&A International

MAY 3, 2024

MERGERSCORP is a leading American Investment Banking Advisory firm that specializes in facilitating mergers and acquisitions for companies across various industries. The company was founded with the mission of providing strategic and comprehensive advisory services to help businesses navigate the complexities of mergers and acquisitions.

How2Exit

OCTOBER 28, 2024

E252: How Issac Qureshi Built an E-Commerce Empire: Mergers, Acquisitions, and Leveraged Buyouts - Watch Here About the Guest(s): Issac Qureshi : Issac Qureshi is the founder and owner of Bauer, a mergers and acquisitions (M&A) firm specializing in e-commerce.

Sun Acquisitions

JUNE 11, 2024

Whether prompted by strategic decisions, personal reasons, or market trends, navigating the mergers and acquisitions process can be both exhilarating and daunting. However, with the right mindset and strategic approach, entrepreneurs can maximize the profitability of their business sales.

Sun Acquisitions

JUNE 13, 2024

Whether it’s due to retirement, a desire for a new challenge, or seizing a timely opportunity, the sale of a business is a critical decision that requires careful planning and execution. What do you hope to achieve through the sale? Defining your goals will serve as the compass guiding your decisions throughout the process.

Sun Acquisitions

MARCH 1, 2024

In such cases, seller financing emerges as a viable option, enabling buyers to negotiate terms directly with the seller. The most critical aspects of these negotiations are interest rates and repayment periods, which must strike a balance that suits both parties involved. However, this may also lead to higher monthly payments.

JD Supra: Mergers

JUNE 13, 2024

The process of selling can be complex, but taking the time to prepare before listing a business for sale or engaging with potential buyers will make the process smoother. By: Morgan Lewis

Sun Acquisitions

AUGUST 2, 2022

Sun Acquisitions is pleased to announce the closing of three Buy-Side campaigns in the last two months including an industrial pumps distributor, specialty electronics distributor, and a waste management firm. Sun Acquisitions’ clients were both private and publicly held companies which acquired domestic and international targets.

Focus Investment Banking

OCTOBER 7, 2024

Mergers & Acquisitions For Dummies provides useful techniques and real-world advice for anyone involved with – or thinking of becoming involved with – transactional work. If you’re getting involved with a merger or an acquisition, this book will help you gain a thorough understanding of what the heck is going on.

How2Exit

SEPTEMBER 2, 2024

E241: Diving Deep into SME Acquisitions: Essential Insights, Strategies, and Success Secrets - Watch Here About the Guest(s): Danny O'Neill : Danny O'Neill is a seasoned entrepreneur with a rich background in sales and marketing. Due Diligence : Importance of scrutinizing financials to avoid risky acquisitions.

Sun Acquisitions

MAY 3, 2022

Sun Acquisitions is pleased to announce that Ken Cisneros has joined our team as a Senior Advisor. Ken brings over 30 years of experience in executive leadership, sales and operations. After his time as a business intermediary, Ken held several executive leadership positions with expanded sales and operations.

Sun Acquisitions

SEPTEMBER 18, 2023

Whether you’re retiring, moving on to new ventures, or simply seeking a change, finalizing the sale of your business is a crucial step toward achieving your goals. In this blog post, we will explore essential steps to help you complete the sale of your business. Be prepared to compromise while protecting your interests.

Sun Acquisitions

MARCH 6, 2024

However, securing favorable terms in a business acquisition requires more than just financial acumen; it demands the art of persuasion. Negotiating interest rates, equity stakes, and purchase prices is a delicate process that involves convincing the other party that your terms are reasonable and beneficial.

How2Exit

SEPTEMBER 15, 2024

E243: Why SBA Loans Are Key to Small Business Acquisitions – Ray Drew Tells All - Watch Here About the Guest(s): Ray Drew is a distinguished SBA lender with a career spanning over a decade. Throughout his career, he has facilitated millions in financing for small business acquisitions.

Sun Acquisitions

JANUARY 10, 2022

Sun Acquisitions is pleased to announce the successful acquisition of an experienced sheet metal fabrication and machining company based in the Greater Chicago area. Through the confidential marketing of the business, Sun Acquisitions generated over 50 interested buyers which led to two final offers to purchase Mac Ster, Inc.

Sun Acquisitions

APRIL 28, 2022

Sun Acquisitions is pleased to announce that Mike Walton has joined our team as a Senior Advisor. Mike brings 25 years of experience in business ownership that includes start-ups, turnarounds, acquisition and sale of companies, specifically within media and IT industries.

IBG

AUGUST 21, 2023

A powerful tool in negotiating a business’s purchase price, an earnout can bridge the gap between the amount that a buyer is willing to pay and the seller is willing to accept. One of the roadblocks that commonly arise in structuring a business sale stems from differing viewpoints of value. Other benefits are more buyer focused.

How2Exit

OCTOBER 14, 2024

E248: Setting Yourself Up for Success: Essential Steps, Tips, and Strategies for a Profitable Exit - Watch Here About the Guest(s): Kip Wallen is a seasoned M&A attorney with over a decade of experience in live mergers and acquisitions deals, primarily within the lower middle market, involving transactions up to $50 million.

How2Exit

APRIL 2, 2024

b' E201: Trading Treadmills for Acquisitions: Reid Tileston's Journey to Entrepreneurial Success - Watch Here rn rn About the Guest(s): rn Reid Tileston, a seasoned professional with a fascinating background in finance and a passion for fitness, shared his journey on the How2Exit Podcast. at Case Western Reserve University.

Focus Investment Banking

SEPTEMBER 3, 2024

So to match the pace of automotive deals and because we find it more effective, we employ a two-stage sale process. A two-stage sale process involves first getting indications of interest (IOIs) from as many buyers as we can and then narrowing down that buyer pool by inviting the more serious ones to submit formal letters of intent (LOIs).

How2Exit

MAY 16, 2023

Ron Concept 1: Grow Business Through Acquisitions Growing a business through acquisitions is an attractive option for many entrepreneurs. Acquisitions can be an efficient way to quickly expand a business, gain market share, and increase profits. He is an expert in this space and has learned a lot from his own experiences.

Sun Acquisitions

DECEMBER 14, 2023

To ensure a successful and profitable sale, several crucial considerations must be addressed before listing your business on the market. Organize Comprehensive Financial Documentation Before listing your business for sale, it’s essential to have a clear and detailed picture of your financial performance.

Sun Acquisitions

APRIL 29, 2024

This article explores proven methods to enhance the market value of an HVAC business, highlighting the crucial role of Mergers and Acquisitions (M&A) advisors in guiding business owners through this process. These professionals offer invaluable insights into market trends, valuation strategies, and negotiation tactics.

Sun Acquisitions

JUNE 15, 2023

Sun Acquisitions is pleased to announce the acquisition of Redi-Tag Corporation from Identity Group by its Buy-Side client TOPS Products. Sun Acquisitions’ Buy-Side Services clients’ benefit from a targeted, proprietary search which avoids competitive auction processes.

The New York Times: Mergers, Acquisitions and Dive

OCTOBER 27, 2023

BuzzFeed is negotiating a sale of much of Complex Networks for under $140 million, less than half of what it paid to acquire it two years ago.

Lake Country Advisors

MAY 16, 2024

In the context of mergers and acquisitions, the most pertinent impacts of social media are: 1. The ability to respond quickly to customer concerns and celebrate their feedback publicly builds a positive brand image that is crucial during acquisitions or sales. However, the benefits don’t just affect your bottom line.

Sun Acquisitions

APRIL 17, 2023

If so, preparing your company for sale is the best place to start. Another approach involves reviewing customer contracts and adding additional clauses that may benefit a potential buyer regarding revenue streams, change of control provisions or other beneficial terms offered upon acquisition.

Sun Acquisitions

SEPTEMBER 21, 2023

One of the critical hurdles lies in effectively marketing your business for sale. In this blog post, we will explore some common challenges business owners face when marketing their businesses for sale and discuss strategies to overcome them, ultimately ensuring a smooth and successful transition.

Sun Acquisitions

NOVEMBER 30, 2023

Listing your business for sale is a significant milestone that requires strategic planning and execution. In this blog post, we will provide valuable insights into how to list your business for sale and attract potential buyers to maximize your chances of securing a favorable deal.

Benchmark International

OCTOBER 2, 2023

So much hard work goes into negotiating the deal and agreeing the Heads of Terms (Heads) or Letter of Intent (Loi), it’s critical the deal is properly managed, and the legal contracts fairly negotiated to ensure the deal happens!

Sun Acquisitions

AUGUST 2, 2024

Public knowledge of the sale can lead to a drop in sales, loss of key employees, and decreased customer confidence. Here are some strategies to ensure discretion: Confidential Marketing When listing your HVAC business for sale, use confidential marketing techniques.

Sun Acquisitions

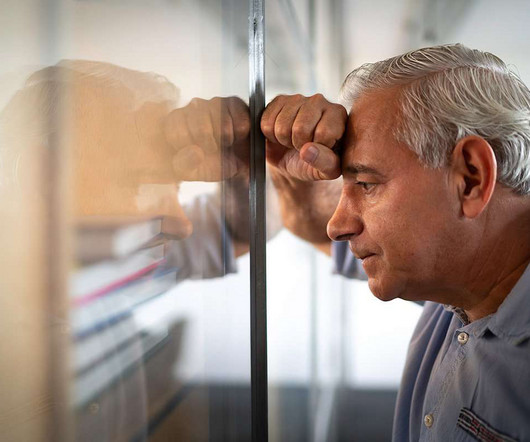

AUGUST 2, 2024

In the world of business, mergers and acquisitions (M&A) are often celebrated as strategic moves that lead to growth, expansion, and increased market share. During the negotiation and due diligence phases of a sale, sellers may experience heightened stress and anxiety as they navigate the complexities of the deal.

IBG

FEBRUARY 6, 2024

Helping the seller anticipate and negotiate issues that can cause deviations from the expected sale proceeds can add unexpected value to involving an experienced M&A intermediary. In a business sale, forewarned is forearmed. From the outset, price is front and center in the negotiations.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content