Common Types of Insurance Agency Sellers

Sica Fletcher

APRIL 11, 2024

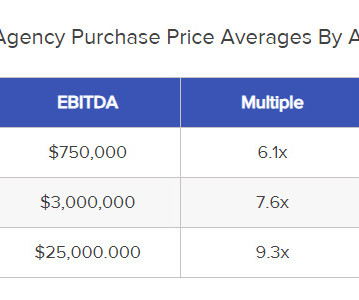

Generally, these fall into two distinct categories of advisory firms or investment banks. M&A Advisory Firms vs. Investment Banks We should emphasize that the comparison information above is generalized , and may not apply to all such firms or banks.

Let's personalize your content