M&A Insights and Outlooks Regarding Financing: A Conversation with Gary Grote of Bridgepoint Investment Banking

JD Supra: Mergers

AUGUST 8, 2024

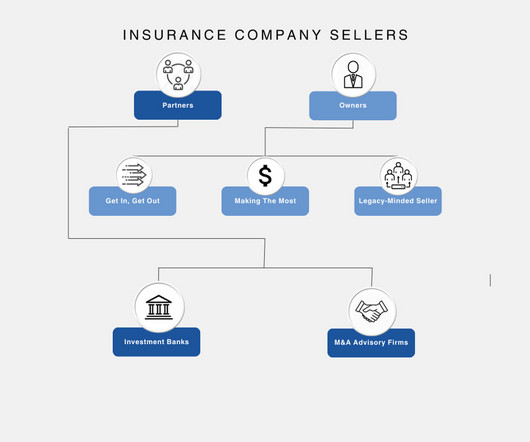

Below is his conversation with Gary Grote, Managing Director at Bridgepoint Investment Banking, which focuses on capital raising and M&A advisory solutions. Gary focuses on deals in the healthcare, leveraged finance, financial services, and real estate industries.

Let's personalize your content