The Intersection of Emerging Trends in M&A/ Private Equity and Reps & Warranty Insurance: The Road Remains Bumpy For Dealmakers

JD Supra: Mergers

JUNE 1, 2023

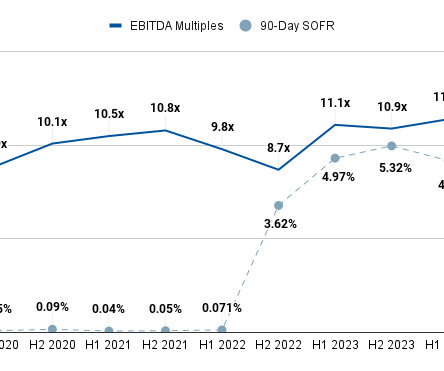

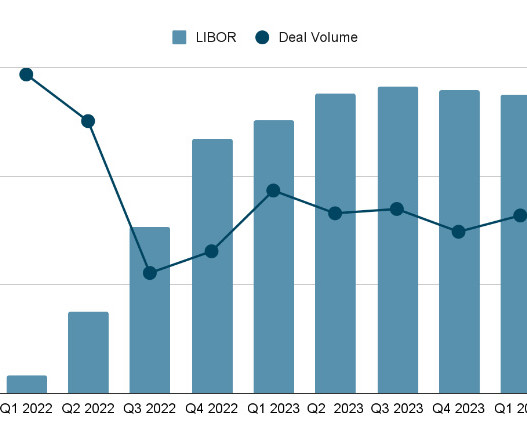

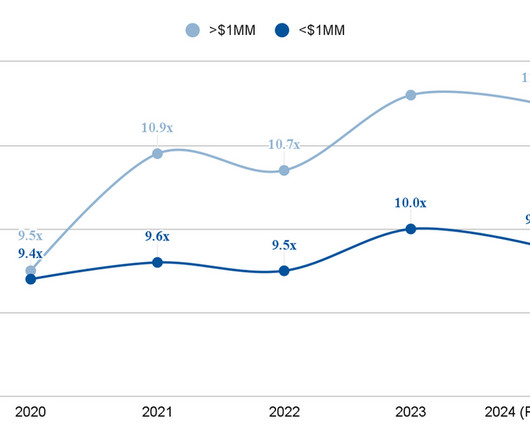

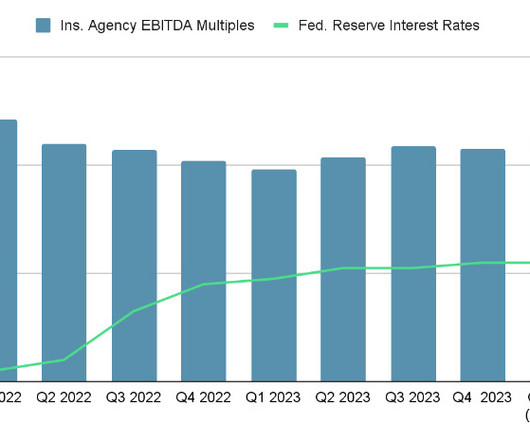

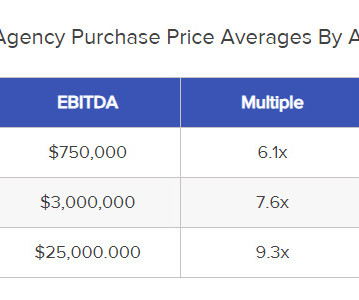

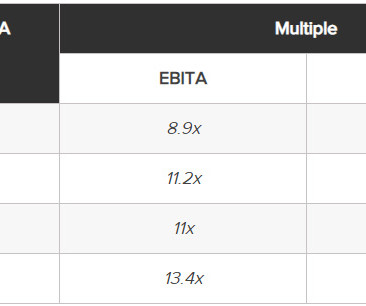

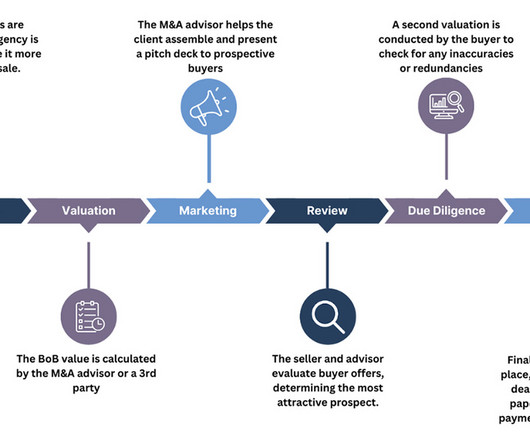

The trio explore current instabilities in the market with respect to deal flow, valuation issues, and emerging risks.

Let's personalize your content