Revolutionizing Finance with Quality Management

Peak Frameworks

SEPTEMBER 11, 2023

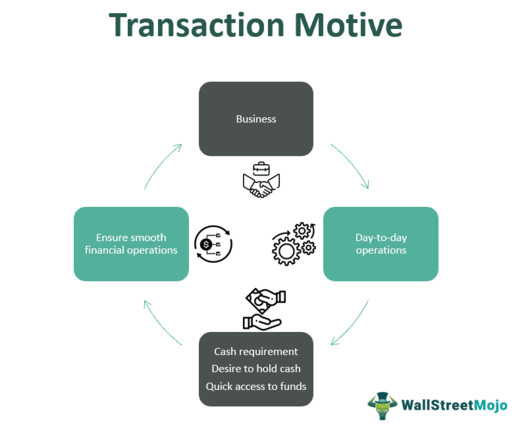

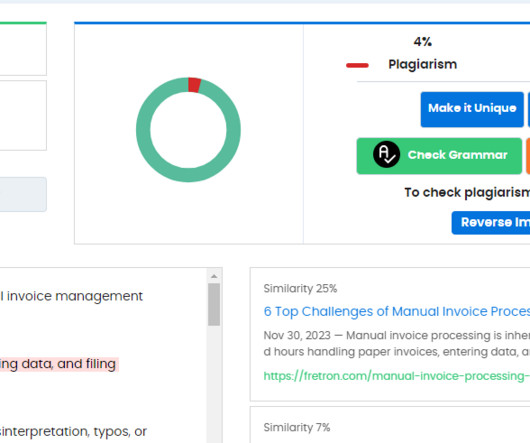

In a finance context, quality assurance could encompass regular audits of financial transactions, comprehensive compliance training for employees, or the implementation of strict controls to prevent fraudulent activities. In 2012, Microsoft made a significant corporate financial decision — the acquisition of Yammer for $1.2

Let's personalize your content