Banks Hit With Service Glitches

The New York Times: Banking

JULY 19, 2024

Trading and some financial transactions were delayed around the world.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

JULY 19, 2024

Trading and some financial transactions were delayed around the world.

Global Banking & Finance

JULY 11, 2024

By Jamie Beckland, Chief Product Officer at APIContext For banks, retailers and enterprise businesses, open banking and application programming interfaces (APIs) are a powerful combination that streamlines how financial data is exchanged.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Razorpay

MAY 27, 2024

What is Core Banking Solution? A core banking solution (CBS) is a software used by banks to manage primary operations. It is a centralized system that allows customers or businesses to carry out transactions from any branch rather than only from the branch where the account was opened.

Razorpay

MAY 23, 2023

Regular retail banks provide financial services to individuals but are not equipped to service businesses. Corporate banking provides businesses financial services like account holding, loans, capital, vendor management, and more. Businesses have other needs that a commercial bank simply cannot anticipate or provide for.

Razorpay

MAY 6, 2024

Payment processing is the backbone of financial transactions in today’s digital world. From credit card payments to digital wallets, comprehending the intricacies of payment processing is vital in safeguarding financial interests and facilitating the smooth flow of commerce. It then accepts or rejects the transaction.

Razorpay

JUNE 8, 2023

What is Banking? A bank is any financial institution that helps people and businesses store, invest and borrow money. Banks provide services like deposits, loans, and investment options. Banks in India are regulated by the Reserve Bank of India (RBI), which is the central banking authority of the country.

Razorpay

JULY 27, 2023

Similarly, businesses with large, complex financial needs go to the country’s biggest banks. These banks are called investment banks. Let’s take an in-depth look at what an investment bank is, and how businesses benefit from them. What is Investment Banking? Let’s understand with an example.

Razorpay

JULY 29, 2023

Do you remember the last time you visited a physical bank branch to change your registered mobile number or personal details? Do you remember the last time you visited a bank for any financial operation? If your answer to these questions is “no”, you have e-banking to thank! What is E-Banking?

Global Banking & Finance

MARCH 22, 2024

Traditional banks that don’t prioritise digital inclusion face being left behind By Laura Rae co-founder of Openbox, a premium digital experience partner to the financial services industry It’s not so long ago that every financial transaction we wanted to make involved leaving the house and physically handing over notes and coins.

Peak Frameworks

MAY 2, 2024

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year. From processing deposits and withdrawals to resolving customer inquiries, tellers play a pivotal role in ensuring a seamless banking experience.

Razorpay

JANUARY 17, 2024

With a RazorpayX Business Banking+ Account, you can add beneficiaries and make payouts with no cooling period. Get Your Own Business Banking+ Account! A beneficiary is a person or organization that benefits from a will , trust , retirement plan , insurance policy , ann uity , financial transaction or another arrangement.

Peak Frameworks

SEPTEMBER 19, 2023

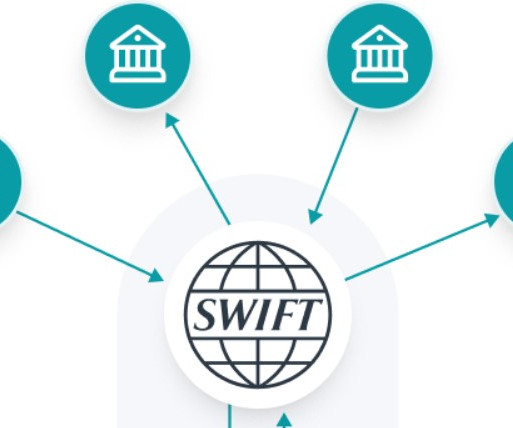

History of SWIFT In the early 1970s, banks predominantly used telex for international communications, which was not just cumbersome but lacked standardization. To address these inefficiencies, 239 banks from 15 countries collaborated in 1973 to form SWIFT , aiming for a standardized global transaction protocol.

Razorpay

SEPTEMBER 22, 2023

The Unified Payments Interface (UPI) is a game-changer technology for digital payments, allowing users to make instant payments, check account balances, and manage multiple bank accounts in a single app. It does away with the time-consuming process of visiting banks or ATMs for transactions.

Razorpay

JULY 11, 2023

This includes services like online banking, wire transfers, and mobile banking apps. This accessibility allows for seamless and efficient management of day-to-day financial transactions, including purchases, bill payments, and withdrawals. What is RazorpayX? Falling below the minimum account balance can have consequences.

Business Standard - FInance

MAY 31, 2023

Banks, foreign exchange dealers and other reporting entities have 'couple of days more' to report high-value transactions done by their clients in 2022-23 by filing SFT returns, the I-T department has said. The last date for filing statement of financial transactions (SFT) for 2022-23 fiscal was May 31.

Razorpay

JULY 25, 2023

Knowing how corporate accounting works and its role in facilitating the growth of a business is important because it plays a fundamental role in the smooth functioning of business financials. Corporate accounting refers to the process of recording a company’s financial transactions. What is Corporate Accounting?

OfficeHours

JUNE 12, 2023

Through a private equity internship, you will be exposed to high-stakes, complex financial transactions and gain valuable experience in investment analysis, deal structuring, and portfolio management. investment banking, private equity , VC, etc.) You can also check our various course curriculums for different careers (i.e.

Razorpay

DECEMBER 16, 2024

Accounting is the process of recording all financial transactions of a business over its lifetime. It doesnt require a set of complex rules or principles for recording transactions, making it accessible for anyone, even without advanced accounting knowledge. There are two major kinds of accounting. Join RazorpayX.

Razorpay

OCTOBER 25, 2024

Offering a broad range of services, from mutual funds to intra-day trading and derivatives, Rupeezy needed a payment partner who could handle the complexities of financial transactions. SEBI requires every transaction initiated by a customer must be made from their registered bank account.

Razorpay

OCTOBER 27, 2023

Payment security refers to the processes and practices used to safeguard financial transactions, funds and personal information of clients from threats like online and offline payment fraud, unauthorized access, and data breaches. As a final confirmation, the bank sends you an OTP on your registered mobile number.

Razorpay

JULY 2, 2024

With these, they observed challenges with chargebacks, transaction failures, and high per-transaction costs for alternative payment methods beyond bank transfers. MoneySaver Export Account allows an Indian business to open an international bank account wherever its customers are, without having a local presence.

Razorpay

JUNE 5, 2023

The double-entry system is a method of bookkeeping that records financial transactions in two accounts. Simply put, the double entry system means that every financial transaction is recorded in at least two different accounts: one account is debited (money going out) and another account is credited (money coming in).

Razorpay

OCTOBER 31, 2023

Export vs Import Payments Export payments are the financial transactions that occur when a country or entity sells goods, services, or assets to foreign customers or buyers. Import payments refer to the financial transactions that occur when a country or entity purchases goods, services, or assets from foreign sources.

MergersCorp M&A International

NOVEMBER 20, 2024

MergersCorp, a leading global investment banking firm specializing in mergers, acquisitions, and corporate advisory services, is excited to announce its official digital expansion in the Principality of Monaco following the successful registration of its new domain, MergersCorp.mc.

Razorpay

FEBRUARY 13, 2024

In India, IMPS and UPI have emerged as widely used electronic funds transfer methods, revolutionising the way people conduct financial transactions. IMPS known for its speed and simplicity, facilitates seamless money transfers between bank accounts. 5 lakhs quickly and securely through mobile banking, NetBanking and ATMs.

Razorpay

MARCH 18, 2024

A corporate account is a bank account one can open in the name of a business. It is used to facilitate transactions, receive income, and store funds. Every small business that is required to pay tax should have a corporate bank account for business banking and its numerous benefits. Explore RazorpayX 2.

Razorpay

NOVEMBER 5, 2023

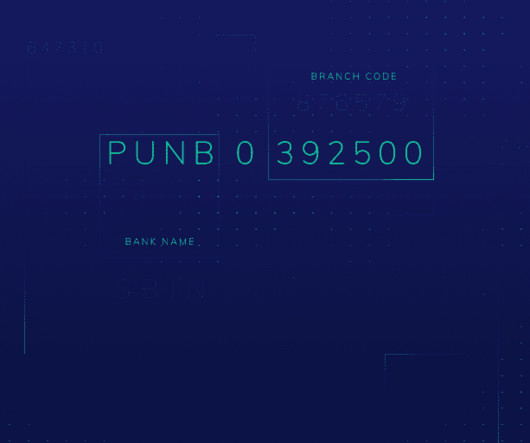

You must be familiar with the term ‘IFSC Code’ if you have transferred funds to another bank account. You may also have noticed the IFSC printed on bank chequebooks. IFSC stands for the Indian Financial System Code. It is an 11-digit alphanumeric code unique to each bank branch in India. What is an IFSC Code?

Peak Frameworks

MAY 2, 2024

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year. This can be particularly useful in situations requiring swift action or in transactions involving multiple parties with varying interests.

Razorpay

MARCH 27, 2024

A checking account is a type of bank account that allows you to deposit and withdraw money, write checks or use a debit card to make purchases or pay bills. This type of account is sometimes called a transactional account, as an individual can draw money from it for day-to-day needs, making it easy to access.

Razorpay

DECEMBER 20, 2023

Payment reconciliation is an accounting process that serves as the bridge between a company’s internal financial records and its bank statements. This reconciliation is essential because it validates account balances and ensures that the company’s financial records accurately reflect its financial transactions.

Razorpay

SEPTEMBER 17, 2023

It is a platform that connects your bank account to the platform where you need to transfer money. A payment gateway authorises you to conduct an online transaction through different payment modes like net banking, credit card, debit card, UPI, or the many online wallets that are available these days. Card Networks (e.g.,

Wall Street Mojo

JANUARY 16, 2024

A reconciliation statement refers to the banking summary prepared by the banks to list down the bank’s account balances and compare the same with their internal records. These further adjustments are made when the data is compared with the account balances depicted in the bank statements.

Peak Frameworks

AUGUST 15, 2023

Double-Entry Accounting System Every financial transaction has two sides - a debit and a credit. These principles play a pivotal role in the Accounting Cycle, setting the rules for how transactions are recorded and reported. But why does this matter to an investment banking professional?

Razorpay

DECEMBER 20, 2023

These methods include cash, credit / debit cards, bank transfers, mobile payments and digital wallets. Debit Card Payments Debit cards allow you to make transactions by deducting funds from your bank account. Limited funds: You can only spend what’s in your bank account. What are Payment Methods?

Wall Street Mojo

JANUARY 15, 2024

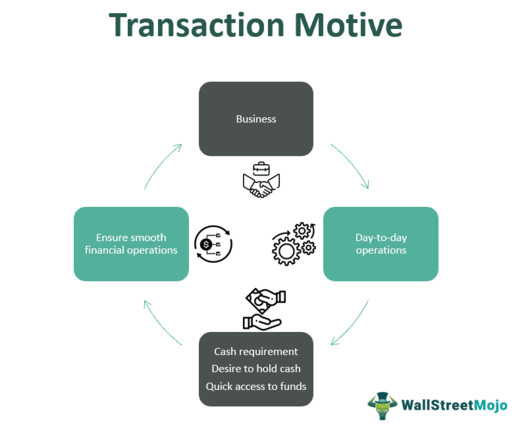

What Is A Transaction Motive? Transaction motive refers to the desire to hold cash to facilitate everyday cash-based financial transactions such as business and personal needs, covering payroll, purchases, and bill payments. Two major factors drive its functioning: the level and frequency of transactions.

How2Exit

FEBRUARY 25, 2024

rn rn Article: rn Leveraging Seller Finance and Creative Deal Structure in M&A rn Acquisitions and mergers are more than just financial transactions; they're about strategic growth, human connections, and seizing opportunities in times of change. It's oftentimes their time or expertise."

Solganick & Co.

SEPTEMBER 30, 2022

You can download the full report here: Solganick HCIT Q2 2022 M&A transactions have remained active in the healthcare IT sector in Q2 2022. We noted a number of strategic and financial transactions even though the public markets continued to remain volatile.

Razorpay

AUGUST 11, 2024

A payment network is a system that processes electronic payments between consumers, businesses, and financial institutions. By connecting merchants, banks, and card issuers, it enables seamless processing of credit, debit, and other electronic transactions. These networks can be specific to a bank or part of interbank networks.

Razorpay

NOVEMBER 19, 2024

Understanding Mandates and e-NACH Cancellation The National Automated Clearing House (NACH) is a centralised payment system established by the Reserve Bank of India (RBI). The mandate is a formal authorisation given to banks and institutions. NACH mandate cancellation is an important process that every account holder should understand.

Razorpay

JULY 26, 2024

Financial Transactions: Banks require an IEC to process international trade payments. This code is essential for facilitating financial transactions related to import-export activities, ensuring smooth and efficient trade operations.

Razorpay

OCTOBER 3, 2024

This includes initiating and processing payments, fraud detection, compliance, handling disputes, resolving issues, managing international transactions, reconciliation, and accounting. It involves integrating various elements to ensure efficient and secure financial transactions.

Razorpay

NOVEMBER 30, 2023

Besides, electronic payment systems have revolutionized the way we handle our finances, making transactions quicker, more efficient, and accessible to anyone with a bank account. NEFT is typically used for smaller transactions, while RTGS is reserved for larger, time-sensitive transfers.

Razorpay

JUNE 10, 2023

Accounting is the process of recording a business’s financial transactions. The objective of accounting is to prepare financial statements like the Balance Sheet, Cash Flow Statement and Income Statement which give detailed insights into the financial performance of a business. What is Accounting? Join RazorpayX.

Razorpay

AUGUST 7, 2024

Features such as user onboarding, balance inquiries, financial transactions, and complaint resolution can all be managed through voice commands. So whether you’re on a flight, in an elevator, or in a basement, UPI Lite X facilitates debit from the sender’s bank and credit to the receiver’s bank entirely offline.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content