Banks Could Weather Even Extreme Economic Tumult, Fed Finds

The New York Times: Banking

JUNE 26, 2024

The Federal Reserve for the first time tested major banks’ ability to withstand crisis scenarios — and the largest U.S. lenders stood tall.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

JUNE 26, 2024

The Federal Reserve for the first time tested major banks’ ability to withstand crisis scenarios — and the largest U.S. lenders stood tall.

Mergers and Inquisitions

DECEMBER 4, 2024

No matter the economic climate, you can always bet on sports fans to show up for their favorite teams. This partially explains why sports investment banking has become a hot field, with JP Morgan and Goldman Sachs launching their own sports coverage groups. What is Sports Investment Banking? Can teams carry debt?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The New York Times: Banking

NOVEMBER 2, 2023

Britain’s central bank said that interest rates would need to remain high for an “extended” period, and that economic growth was expected to be flat over much of the next two years.

The New York Times: Banking

MARCH 29, 2024

Jerome Powell said that strong economic growth gives Federal Reserve officials room to be patient, and he emphasized the institution’s political independence.

The New York Times: Banking

SEPTEMBER 14, 2023

The People’s Bank of China will allow commercial banks to hold less money in reserve, but businesses and households have been cautious about borrowing.

The New York Times: Banking

DECEMBER 14, 2023

percent, the bank said economic growth was expected to remain “subdued” in the short term. Although the inflation rate has fallen to 2.4

The New York Times: Banking

SEPTEMBER 4, 2024

Riad Salameh, once seen as an international financial wizard, is the subject of multiple inquiries and has attracted blame for the country’s economic crisis.

The New York Times: Banking

JULY 30, 2024

The closely watched move by the Bank of Japan could bolster the country’s beleaguered currency.

The New York Times: Banking

FEBRUARY 5, 2024

The Treasury secretary will offer an upbeat assessment of the economy on Tuesday, a year after the nation’s banking system faced turmoil.

The New York Times: Banking

APRIL 11, 2024

Stubborn inflation and strong growth could keep the Federal Reserve wary about interest rate cuts, eager to avoid adding vim to the economy.

The New York Times: Banking

SEPTEMBER 12, 2024

percent, comes as inflation has slowed and the bank faces pressure to bolster the region’s flagging economy. The reduction, to 3.5 percent from 3.75

The New York Times: Banking

JANUARY 16, 2024

Gross domestic product expanded 5.2 percent, as China worked to export more to make up for weak demand, high debt and a steep property contraction at home.

The New York Times: Banking

JULY 31, 2023

The economic strength has helped to maintain popular support for Vladimir Putin’s war, but some have warned the state-led spending is threatening the country’s financial stability.

The New York Times: Banking

OCTOBER 19, 2023

The Federal Reserve may need to do more if growth remains hot or if the labor market stops cooling, Jerome H. Powell said in a speech.

The New York Times: Banking

DECEMBER 15, 2023

The bank warned that its tight monetary policy would continue “for a long period” as it attempts to slow an economy in danger of overheating.

The New York Times: Banking

SEPTEMBER 14, 2023

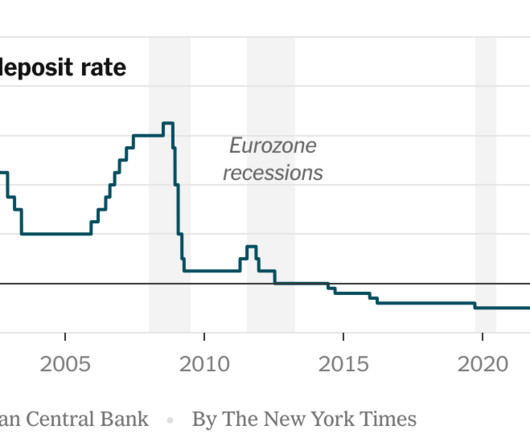

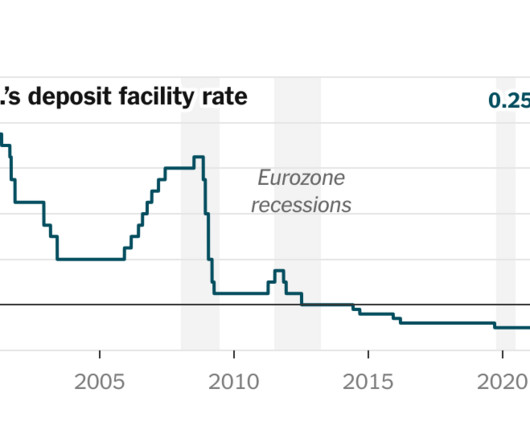

In its battle to control inflation, the bank raised its key interest rate to the highest level on record but suggested that rates have reached their peak.

The New York Times: Banking

SEPTEMBER 28, 2023

Artificial intelligence may help policymakers understand inflation and regulate big lenders, the central bank said.

Global Banking & Finance

DECEMBER 2, 2024

By Sebastian Leape, CEO of Natcap Financial institutions have mastered climate risk assessment, they must now urgently expand their risk management capabilities to address nature risk (the financial exposure from degradation of ecosystems, biodiversity loss, and depletion of natural resources), which impact over $44 trillion in global economic value (..)

The New York Times: Banking

AUGUST 10, 2023

The central bank in Moscow took steps to counter the currency’s slide, but the war and resulting sanctions have put intense pressure on the economy.

The New York Times: Banking

JANUARY 17, 2024

The Great Recession changed how the Fed steers the economy, but textbooks are still catching up.

The New York Times: Banking

OCTOBER 27, 2023

The jump, from 13 percent, would bring a long period of “tight monetary conditions” in order to ease price pressures, the bank said.

The New York Times: Banking

AUGUST 22, 2024

Jerome Powell, the Federal Reserve chair, will deliver remarks as inflation cools and growth holds up — but as labor market weakening threatens to interrupt the soft landing.

The New York Times: Banking

SEPTEMBER 19, 2024

The British central bank has emphasized its intention to move steadily to ensure that inflation continues to slow.

The New York Times: Banking

JUNE 6, 2023

A new report projects that economic growth will slow this year and remain weak in 2024.

The New York Times: Banking

OCTOBER 31, 2023

The Bank of Japan said it would be more flexible in how it managed government bond yields, citing rising inflation.

The New York Times: Banking

SEPTEMBER 18, 2024

Inflation has fallen in most developed nations, and central bank officials are now trying to steer their economies toward a so-called soft landing.

The New York Times: Banking

OCTOBER 14, 2024

Assurances from government officials on plans to strengthen the private sector offset a lack of specifics about economic stimulus.

The New York Times: Banking

DECEMBER 5, 2024

Even before a short-lived declaration of martial law thrust the country into crisis, the economy faced grim prospects.

The New York Times: Banking

DECEMBER 14, 2023

The British economy has showed signs of slowing down, with inflation dropping below 5 percent in October, but the bank gave no sign of a rate cut anytime soon.

The New York Times: Banking

NOVEMBER 4, 2024

When the housing market was flying high, mortgage defaults were almost nonexistent. But now the legal system is struggling to keep up with evictions.

The New York Times: Banking

AUGUST 24, 2023

Investors and economists are watching the event this week closely. How did a remote Wyoming conference become so central?

The New York Times: Banking

OCTOBER 23, 2024

The economic lifeline is expected to be disbursed by the end of the year.

The New York Times: Banking

JUNE 6, 2024

The reduction comes as inflation in the eurozone cools, prompting the E.C.B. to move before the Federal Reserve in the United States, where rates remain high.

The New York Times: Banking

AUGUST 15, 2023

With the third-largest interest rate increase in a decade to shore up the ruble, Moscow’s policymakers are pursuing the conflicting goals of paying for the war against Ukraine and taming inflation.

The New York Times: Banking

JULY 26, 2023

Analysts warn that bankruptcies and defaults could jump as the world adjusts to higher interest rates.

The New York Times: Banking

AUGUST 16, 2023

A string of worrying data has taken the fizz out of markets.

The New York Times: Banking

JUNE 20, 2024

Portfolio managers have conflicting incentives as the economic and financial risks from climate change become more apparent but remain imprecise.

The New York Times: Banking

APRIL 11, 2024

Truong My Lan received the death penalty as Vietnam’s Communist Party cracks down on corruption in the fast-growing Southeast Asian economic hub.

The New York Times: Banking

OCTOBER 16, 2023

After relying on a borrow-to-build model for decades, Beijing must make difficult choices about the country’s housing market and economic future.

The New York Times: Banking

NOVEMBER 28, 2023

Chinese families are sending money overseas, a sign of worry about the country’s economic and political future. But a cheaper currency is also helping exports.

The New York Times: Banking

NOVEMBER 27, 2023

Chinese families are sending money overseas, a sign of worry about the country’s economic and political future. But a cheaper currency is also helping exports.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content