How China Censors Critics of the Economy

The New York Times: Banking

JANUARY 30, 2024

As Beijing struggles with a slumping stock market and a collapsing real estate sector, commentary and even financial analysis it deems negative are blocked.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The New York Times: Banking

JANUARY 30, 2024

As Beijing struggles with a slumping stock market and a collapsing real estate sector, commentary and even financial analysis it deems negative are blocked.

Mergers and Inquisitions

OCTOBER 16, 2024

“Why investment banking?” But most coverage suggests generic answers about wanting to learn a lot, liking financial analysis or valuation, or wanting to “understand different industries.” and there’s now an overwhelming amount of information online about investment banking. Why Investment Banking?”

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

OfficeHours

MAY 24, 2023

Investment banking is one of the most sought-after careers in the finance world. Investment banking is highly desirable due to its potential for high lifetime earnings, its interesting and impactful work, and it serves as a springboard for a career in finance. Maybe even more important than your major is your GPA.

OfficeHours

JUNE 6, 2023

If you are already out of college, unfortunately, there is nothing that you can do regarding whether or not you attended a target school, but for those who are not currently in investment banking or MBB (i.e., Seek staffing that is related to M&A deals that employ intense financial analysis and due diligence.

Wizenius

OCTOBER 6, 2024

Investment banking analysts are responsible for working on pitches and deal execution in healthcare investment banking groups. Vice President refines pitch ideas: The VP translates broad ideas into specific pitchbook content, such as detailed analysis and strategic rationale for each target.

Wizenius

JULY 26, 2023

In the past, before foreign banks entered India and the rise of MBA programs, Chartered Accountants (CAs) dominated the financial services sector and finance jobs. With the expansion of investment banking in India, CAs have been presented with new opportunities and challenges. Key areas to focus on include: a.

MergersCorp M&A International

NOVEMBER 16, 2024

MergersCorp M&A International, a leading investment banking advisory firm specializing in mergers and acquisitions, is proud to announce the acquisition of the official sell side mandate for one of Italy’s most prestigious Serie A soccer clubs.

Wizenius

JULY 12, 2023

Congratulations, pursuing investment banking wouldn’t be a job instead it would be a passion for you. Academics: Not a deal breaker, but definitely opens up many doors for interviews if you are an Ivy league pass out or from a recognized university/course Financial Modelling: Knowledge of financial modelling, valuation techniques is a must.

Wizenius

JUNE 5, 2023

In the highly competitive field of investment banking, a well-crafted resume can be the key to landing coveted interview opportunities. In this blog post, we will highlight five essential keywords that you should incorporate into your resume to increase your chances of getting those sought-after investment banking interview calls.

Wizenius

JULY 18, 2023

If you want to enhance your skills further, consider enrolling in the best investment banking course in Mumbai, which offers placement assistance and a certification upon completion. It's an excellent way to showcase your knowledge during interviews after completing an investment banking certification course.

Wizenius

JULY 17, 2023

Here are key skills to target an investment banking career: 1. Financial Statements: Master the concepts of Balance Sheet, P&L, and Cash Flow statement. Financial Modelling: Practice financial statements in Excel to build comfort and eventually transition to financial modelling.

Wizenius

JULY 25, 2023

Are you looking to excel in financial modeling for Investment Banking? 1) Blueprint: Plan Ahead Before diving into your financial model, create a blueprint of the entire structure. Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modelling - Enroll in Wizenius Investment Banking Course Today!

Wizenius

AUGUST 7, 2023

Even the banks where you deposit your money are legally required to retain only 3-10% of their funds, allowing the remaining to be invested or lent out. Valuation and a company's balance sheet lie at opposite ends of the financial spectrum. Remarkably, about 90% of the world's money is essentially a bet on the future.

Wizenius

JULY 14, 2023

Thanks, Pratik Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

Razorpay

JULY 25, 2023

As per the corporate banking guidelines, the staff payroll checks or direct deposits are given out to bank accountants. Common instances of accounts payables are credit card payments, electronic payments, bank transfers etc. Processing Payroll for Staff Computing staff salaries is an integral part of corporate accounting.

OfficeHours

JUNE 5, 2023

Despite the intensity of the field’s enhanced deal execution capabilities, private equity firms often do not provide the intense associate-level training programs that are commonly seen for investment banking analysts. investment banking, private equity , VC, etc.) Talk about a great head start! and how our process works.

OfficeHours

JUNE 6, 2023

Private debt investments involve providing loans or credit facilities to companies that may not have access to traditional bank financing. investment banking, private equity , VC, etc.) They may then negotiate with the company to restructure the debt, provide additional capital, or facilitate a turnaround. and how our process works.

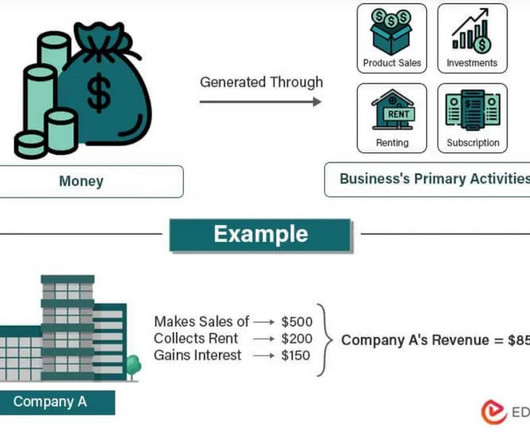

Peak Frameworks

JUNE 7, 2023

And if you are interested in learning more about essential finance concepts, you should check out our , Investment Banking Course. However, a look at the CFO shows a different story, mainly due to changes in their working capital, signaling potential financial stress. For instance, in 2020, IBM reported solid net income.

Wizenius

JULY 9, 2023

The choice between working in a bulge bracket investment bank or a boutique investment bank depends on individual preferences and career goals. Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today!

Wizenius

JULY 2, 2023

As with any financial venture, the success of Private Equity relies on prudent analysis and calculated moves. Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Take your career to new heights in the dynamic world of finance.

Wizenius

JULY 30, 2023

Lets see how this works Most of the variations of Financial models in investment banking mostly revolve around 1) DCF 2) M&A 3) LBO 4) Comparable & Transaction Comps Idea Bank - From Scratch to Template: Build a comprehensive version of each of the above varieties of financial models from scratch.

Peak Frameworks

MAY 2, 2024

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year. Valuation Techniques: Employing discounted cash flow (DCF) and comparative analysis to ascertain the target’s value.

Wizenius

JUNE 25, 2023

As an investment banking analyst, the selection of comparable companies for a valuation analysis is a crucial task that requires careful consideration and justification. Analysts must exercise judgment and consider multiple factors to ensure the chosen companies provide meaningful and relevant benchmarks for the valuation analysis.

Wizenius

AUGUST 16, 2023

Transitioning from investment banking to PE presents the opportunity for deeper involvement in strategic decision-making and operational intricacies, along with an extended investment horizon. For those seeking flexibility, an investment banking course online provides accessible insights. Don't miss out on this opportunity!

Wizenius

JUNE 23, 2023

This approach provides a more accurate valuation by considering the capital needed to support ongoing business activities and maintaining a balanced financial projection. Thanks, Pratik S , Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today!

Wizenius

JUNE 25, 2023

Additionally, consulting with industry experts, financial advisors, or utilizing established valuation methodologies can provide further insights into determining an appropriate discount rate. Thanks, Pratik S , Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today!

OfficeHours

JUNE 6, 2023

Through extensive due diligence and financial analysis, they identify investment opportunities with favorable risk-return profiles. investment banking, private equity , VC, etc.) By actively monitoring and managing their investments, private equity firms mitigate risks and strive to create value for their investors.

MergersCorp M&A International

JANUARY 18, 2024

With years of experience in the investment banking and finance industry, the firm has built a formidable reputation for its expertise and ability to guide businesses through the intricate process of M&A. When it comes to M&A, international finance plays a crucial role in ensuring the success of the transaction.

Solganick & Co.

MARCH 11, 2024

With a long and distinguished career in investment banking, Alexei has a proven track record of leading deal execution and origination efforts. He brings over two decades of experience including managing the client M&A transaction process from start to finish at Morgan Stanley’s Financial Institutions Group in London.

Peak Frameworks

MAY 17, 2023

Understanding these financial intricacies is crucial in the world of corporate finance. If you're interested in breaking into investment banking, check out our , Investment Banking Course. This course offers in-depth insights into financial metrics and is designed to help you break into investment banking.

Wizenius

JUNE 28, 2023

Thanks, Pratik S , Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

MergersCorp M&A International

FEBRUARY 22, 2024

MergersCorp M&A International is a prominent global investment banking firm that offers a wide range of services to businesses looking to expand through mergers and acquisitions (M&A). One of the key services provided by MergersCorp is corporate restructuring, which plays a crucial role in ensuring the success of M&A transactions.

MergersCorp M&A International

JANUARY 25, 2024

The firm conducts detailed financial analysis, assessing key financial metrics such as revenue, profitability, and cash flow. In addition to financial analysis, MergersCorp’s analysts also evaluate factors such as the target’s competitive positioning, market share, and growth potential.

Successful Acquisitions

FEBRUARY 7, 2023

. “ Brian’s career in finance began in the “ com” era working with several venture-backed firms before spending several years with The Vanguard Group where he led a team of financial analysts managing the budgeting process and conducting financial analysis on a variety of technology initiatives.

Wizenius

JULY 9, 2023

Thanks, Pratik S Unlock the Secrets of Investment Banking and Financial Modeling - Enroll in Wizenius Investment Banking Course Today! Master the art of investment banking and financial modeling with our comprehensive online course. Take your career to new heights in the dynamic world of finance.

MergersCorp M&A International

FEBRUARY 13, 2024

However, navigating the intricacies of M&A requires significant expertise and knowledge in areas such as financial analysis, strategic planning, and negotiation tactics. This is where MergersCorp M&A International comes into play.

Razorpay

DECEMBER 16, 2024

In contrast, double-entry records the impact of each transaction in at least two accounts, offering a more comprehensive financial overview. This system is preferred by investors, banks, and buyers because it gives a fuller picture of an organization’s financial health. Join RazorpayX.

Razorpay

JUNE 5, 2023

This ensures that the total debits and credits always balance and helps to maintain accurate financial records. The single entry system is a simplified method of bookkeeping that records only one side of a transaction, typically the cash or bank account, without considering the corresponding entry for the other account.

Peak Frameworks

SEPTEMBER 12, 2023

While they're seen in numerous sectors, their significance shines particularly in investment banking , private equity, and corporate finance. In modern times, their usage has expanded, notably in sectors like investment banking and private equity , adapting to the dynamic needs of the financial industry. Why Retainer Fees?

Mergers and Inquisitions

DECEMBER 4, 2024

This partially explains why sports investment banking has become a hot field, with JP Morgan and Goldman Sachs launching their own sports coverage groups. For a long time, sports teams and franchises were not worth that much, so banks rarely put their “A-Teams” on these deals. What is Sports Investment Banking?

MergersCorp M&A International

JANUARY 16, 2024

MergersCorp M&A International provides comprehensive financial reporting services, assisting businesses in preparing accurate and transparent financial statements that comply with accounting principles and regulatory frameworks.

Sun Acquisitions

JANUARY 26, 2024

This involves an in-depth financial analysis, assessment of potential risks, and evaluation of cultural fit between the entities. It is crucial to examine the financial health of the target company, including its revenue streams, debt levels, and profitability margins.

Razorpay

AUGUST 7, 2024

Payment Informations The payment details include payment methods and bank details such as bank name, account holder name, account number and IFSC code. Include All Payment Details Provide clear payment instructions, including bank details and accepted payment methods, to avoid confusion.

Peak Frameworks

JULY 19, 2023

If you are interested in learning more about financial analysis and pursuing a career in finance, you should check out our Private Equity Course and Investment Banking Course.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content