Eyes on the exit: Selling PE portfolio companies in complex markets

JD Supra: Mergers

MARCH 19, 2025

By: White & Case LLP

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MARCH 19, 2025

By: White & Case LLP

How2Exit

NOVEMBER 12, 2023

b' E159: Building an Empire - Businesses, Private Equity, And M&A - With Adam Coffey - Watch Here rn rn _ rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

TechCrunch: M&A

MAY 8, 2023

First, it is snapping up Blinkist , a startup out of Berlin that had built a platform to discover and read abbreviated versions of longer non-fiction books — “Blinks” that typically take no more than 15 minutes to read or listen to. Seim is far from concerned about this, though. Key insights have always been a commodity.”

The TRADE

APRIL 25, 2025

The service applies to all Xetra trading in equities, ETFs and ETPs. The new retail data offering also includes real-time order book depth data of all ETFs and ETPs traded on Xetra. The new ETF retail trading offering builds on the equities service launched by Xetra last year.

Francine Way

JULY 13, 2017

Building the proforma income statement, proforma balance sheet, and Free Cash Flow to Firm (FCFF). Calculating cost of debt, cost of equity, and weighted average cost of capital (WACC). Calculating the Equity Value and the per-share Equity Value - this number would serve as the base case share price valuation.

The TRADE

MAY 14, 2024

Nasdaq’s Nordic and Baltic equity offering, QuoteView, will be made available through Nasdaq Data Link this month, covering primary venues and MTFs in the region across equities, mutual funds and ETFs. The offering, which is powered by BMLL, provides T+1 consolidated best bid and offer (CBBO) data for Nordic and Baltic equity markets.

The TRADE

DECEMBER 19, 2024

The new offering combines LSEGs pricing services with Yield Book analytics to create pricing information for around 2.9 The combination of Yield Books trusted, in-depth analytics and LSEGs expertise in evaluated pricing delivers a robust and comprehensive suite of tools to empower clients, said Emily Prince, group head of analytics at LSEG.

The TRADE

APRIL 16, 2025

The firm announced the launch of the US options exchange in September 2024, and efforts have already been made to expand IEXs options team, file the proposed rule book with the US Securities and Exchange Commission (SEC) and maintain engagement with regulatory authorities and industry stakeholders.

How2Exit

MAY 20, 2024

Barnett is also an accomplished author with multiple books on topics related to investing in local businesses, franchising, and buy-sell strategies, with his latest book set to release in the fall. rn rn rn Minority equity holders in small businesses may face significant risks without majority control.

OfficeHours

FEBRUARY 9, 2024

Having spent time in technology growth equity and VC in college, I realized quickly that my passions and career goals didn’t align with RX or the exit opps from MM banking to MM private equity. The Lateral Process The biggest piece of advice I have for current banking analysts looking to lateral is to actively build your network.

Francine Way

JULY 17, 2017

This current post about Leveraged Buy Out (LBO) is about a valuation method used by a very specific type of financial acquirer: private equity (PE) firms. The major steps of LBO are: Building the Sources and Uses tables. Building a proforma balance sheet. Building a historical 3-statement model and a debt-interest schedule.

Beyond M&A

SEPTEMBER 15, 2023

A Distinctive Voice in the Startup Literature Having had the privilege of delving into countless books on technology, startups, and the philosophy of problem-solving, it’s rare that one resonates deeply and prompts changes to the way you think about product development.

How2Exit

JUNE 16, 2024

E222: Paul Neal Discusses Wealth Building by Owning Business Property - Watch Here About the Guest(s): Paul Neal is a seasoned financial strategist and real estate finance expert with a background in engineering. He is the author of "Unleash Your Business: Unlock Wealth, Autonomy, and Control by Buying Your Building and Firing Your Landlords."

How2Exit

OCTOBER 2, 2023

With a background in finance and private equity, Codie has closed hundreds of deals and built a portfolio of 26 businesses. She highlights the ease of buying profits compared to building them and encourages listeners to work smarter, not harder. rn rn Quotes: rn rn "Easier to buy profits than it is to build them."

Francine Way

JULY 12, 2017

Build proforma income statement and balance sheet. Calculate cost of debt, cost of equity, and weighted average cost of capital (WACC). Determine the year-by-year future non-equity claims from the latest 10-K, especially those that will occur during the forecast horizon, and their combined present value.

How2Exit

MAY 22, 2023

Walker Diebold, bestselling author of “Buy Then Build: How to Acquisitions Entrepreneurs Outsmart the Startup Game,” experienced the stock market firsthand as a stockbroker and learned valuable lessons from his experiences. In 2018, Walker released his book “By Then Build” which was inspired by this idea.

How2Exit

JUNE 20, 2023

Mentor Nick Bradley Nick Doesn't Tweet Nick Bradley @TheNickBradley Nick Bradley is a world-renowned author, speaker, and business growth expert, who works with entrepreneurs, business leaders, and investors to build, scale and sell high-value companies. Host of the #1 Business Podcast in the UK "Scale Up With Nick Bradley".

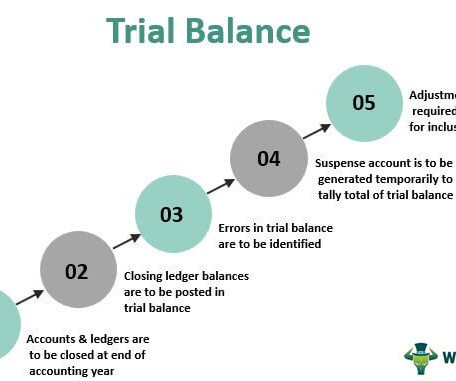

Wall Street Mojo

JANUARY 18, 2024

It may also be stated as a statement of the total debit and credit balances extracted from the various accounts in the ledger to examine the mathematical exactness of the books. At the end of every accounting period the accounting books are to be closed and preparing the trial balance is the first step towards it.

The TRADE

FEBRUARY 29, 2024

Our post-trade business is in the early phase of its next stage of growth, helping financial institutions manage risk and improve capital efficiency across the whole trading book.” LSEG labelled 2023 an “outstanding” year for post-trade, having seen significant strategic progress. In capital markets, the 6.1% respectively.

How2Exit

MAY 20, 2024

Carl has a storied background, including work with giants like GE and Hewlett Packard, and an impressive stint in private equity. He actively invests in and funds student deals through his private equity fund. He has bought and currently owns roughly 30 companies and has coached nearly 30,000 students worldwide.

The TRADE

AUGUST 1, 2023

The players that now dominate in the EMEA equities space are typically larger and have roots that stretch across the Atlantic due to tricky market conditions that have made economies of scale and the ability to internalise risk increasingly essential. “If Goldman Sachs’ equities revenues globally had fallen from $3.24

How2Exit

JULY 23, 2023

He emphasizes the need to avoid spreading oneself too thin and instead concentrate on building expertise in a specific area. This approach builds trust and fosters a positive relationship between the buyer and seller, increasing the likelihood of a successful transaction.

How2Exit

APRIL 2, 2024

He is an alumnus of UC Berkeley and previously worked at Industry Ventures, a venture capital and private equity firm. He also authored a book, "Grit It Done," and is committed to helping others achieve their American dream of business ownership. rn rn rn "What gets focused gets done."

The TRADE

AUGUST 21, 2023

The four separate rulemakings put forward by the US Securities and Exchange Commission (SEC) in December last year represent the most significant attempt to revamp market structure for US equities in recent memory. While evolution of equities market structure in the US is long overdue, what form it should come in is up for debate.

How2Exit

MARCH 22, 2023

His advice is to start small and build up to bigger returns. This way, entrepreneurs can build up their resources and make sure they have the financial security they need before jumping into bigger deals. By starting small and building up to bigger returns, entrepreneurs can get the experience they need to succeed in the long run.

The TRADE

JANUARY 16, 2024

Currently, Mifir foresees three consolidated tapes for Europe, a bond CT – set to be operational by mid-2025, an equities tape set to be operational in early 2026, and a derivatives CT planned for later the same year. Read more: If you build it, will they come?

The Deal

SEPTEMBER 7, 2023

In his time at Bain, a Boston-based private equity sponsor, he had seen the evolution of multistrategy credit businesses at sponsors, and he believed there was an opportunity to provide outside counsel on credit deals, which often evolve quickly. A transaction may start as a debt deal and end up as a hybrid or equity deal, Ramanathan said.

How2Exit

MAY 2, 2023

This means that businesses have to rely on other sources of financing, such as equity or debt, in order to finance an acquisition. Additionally, offering employees equity in the new business can be a great incentive to stay with the company. This will help to build trust between the employees and the new owner.

The TRADE

AUGUST 29, 2024

Buy-side book-building platform Appital has moved to expand its pre-trade price discovery capabilities to allow for greater natural liquidity amongst its buy-side clients. Traders and portfolio managers can also access exposure to liquidity events in relevant equities meeting their minimum ADC or pricing thresholds.

Growth Business

SEPTEMBER 13, 2023

Most exciting tech companies in Manchester This list collates the best in the city based on equity raised, turnover growth year-on-year and impact in their respective fields. #1 The start-up has developed a free app containing a user’s health records and DNA genetic reports, from which you can book GP appointments and order NHS prescriptions.

The TRADE

OCTOBER 9, 2023

Mortimore previously worked for Citi for almost 15 years (before departing in 2016), where he worked on building out the first iteration of the rates algo trading offering both in North America and EMEA. Zain Nizami, global head of cash equity trading, will also join ESMF as well as having oversight of CRB risk.

Presser & Co

MAY 8, 2023

What’s more, sellers: who delayed the preparation of a 3-way model, who didn’t get it quite right, whose model didn’t balance (remember assets = liabilities + shareholders equity), whose model broke when attempting to update it with new trading data, received lower bids. BeeReadi In response, Presser & Co launched BeeReadi.

The TRADE

AUGUST 4, 2023

These were offset partially by declines in North American equities, Europe and Asia Pacific and futures business segments. Cboe Global Markets did, however, experience declines in revenues among its North American equities, Europe and Asia Pacific, and futures business segments, albeit by single digit percentages.

Growth Business

FEBRUARY 28, 2024

In May 2023, engineering firm Dyson also announced plans to build a £100 million R&D hub in the city to be home to hundreds of software and AI engineers. The company was founded in 2016 and has raised over £30 million in equity investment since then. #2 million in equity investment to date. #6 million to date. #7

Mergers and Inquisitions

MAY 10, 2023

The basic difference is that the international bulge bracket banks tend to be stronger in M&A advisory and weaker in equity and debt capital markets. The deal types span a wide range, but equity and debt deals are more common than M&A since many companies in emerging markets are in “growth mode.” 7,200 | U.K.: 3,200 | U.K.: ~500

How2Exit

FEBRUARY 23, 2023

You must be willing to explore different sources for deals, build relationships within your industry or niche, and reach out directly to business owners. Empathy involves understanding the other party’s perspective, building rapport, and using effective communication. Using effective communication is also important.

Peak Frameworks

MAY 17, 2023

Additionally, if you’re interested in refining your Excel skills and recruiting for private equity, you should check out our , Private Equity Course. For example, in 2013, JPMorgan used VBA to build a custom model to forecast loan losses, which helped them save time and improve accuracy.

Presser & Co

MAY 8, 2023

What’s more, sellers: who delayed the preparation of a 3-way model, who didn’t get it quite right, whose model didn’t balance (remember assets = liabilities + shareholders equity), whose model broke when attempting to update it with new trading data, received lower bids. BeeReadi In response, Presser & Co launched BeeReadi.

The Deal

JULY 18, 2023

.” It’s not completely philosophical, of course — Salas O’Brien’s targets almost always roll equity into the deal to join the company’s thousands of other employee owners. “Companies were looking to join us, but they couldn’t roll equity,” Anderson explained.

The TRADE

OCTOBER 26, 2023

The move has opened up swathes of synergy opportunities for the pure fixed income asset manager, with its traders now working directly alongside RBC BlueBay Asset Management’s equities desk. It’s not building up over weeks and weeks. Convertible bonds are a hybrid of bonds and equities. We have to act quickly on them.

How2Exit

OCTOBER 3, 2022

They join cloud services, mobile, SaaS, and data as the most sought among private equity and strategic buyers. For all buyers, they have three choices relating to IP: Buy, build, or partner. While it takes years to build a strong brand, any damage to your MSP’s brand lives ad infinitum on the internet. (PS:

Mergers and Inquisitions

SEPTEMBER 25, 2024

OK Reasons” to Do It 1) You Get Forced Out of Your Company But Want to Remain in the Industry 2) You Need to Gain Credibility or Build a Wider Network 3) You May Not “Need” an MBA to Change Careers, But It Could Improve Your Odds Is an MBA Worth It? no pre-MBA finance experience to private equity ).

How2Exit

MARCH 27, 2023

He was also able to draw on his experience and the experiences of his colleagues to help guide Mert Deshery, his co-author of the book Exit Right, through the exit process. This conversation is important because it helps build alignment among the parties involved and allows everyone to understand what the company is trying to optimize for.

IBG

SEPTEMBER 11, 2024

That is especially true when the buyer is a private equity group or other type of “financial” buyer, which is the case in seven out of 10 deals that we have closed over the last several years. Strengthen your ratios: working capital, debt-to-equity, “quick,” price-to-earnings, return on equity, etc.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content